Revenue

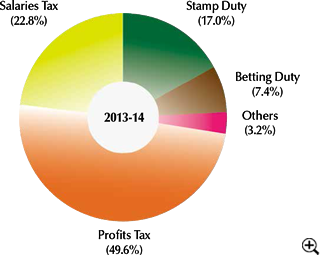

In 2013-14, the Inland Revenue Department collected $243.5 billion. It represents a slight increase of $1.4 billion or 0.6% over the amount collected in the previous year. The increase mainly came from salaries tax and betting duty. Salaries tax collections increased by 10% to $55.6 billion while betting duty climbed 9% to $18.1 billion. Total profits tax collections, on the other hand, fell by 4% to $120.9 billion. An analysis of the revenue collected by tax type is provided in Figure 1.

| Type of tax | 2010-11 ($m) |

2011-12 ($m) |

2012-13 ($m) |

2013-14 ($m) |

|---|---|---|---|---|

| Profits tax - | ||||

| Corporations | 88,191.4 | 113,798.6 | 120,727.2 | 116,097.5 |

| Unincorporated businesses | 4,991.7 | 4,801.3 | 4,911.2 | 4,784.3 |

| Salaries tax | 44,254.7 | 51,761.3 | 50,467.0 | 55,620.3 |

| Property tax | 1,647.1 | 1,948.4 | 2,258.2 | 2,583.8 |

| Personal assessment | 3,921.8 | 4,512.2 | 4,078.2 | 4,420.0 |

| Total earnings & profits tax | 143,006.7 | 176,821.8 | 182,441.8 | 183,505.9 |

| Estate duty | 212.8 | 94.2 | 137.6 | 388.4 |

| Stamp duty | 51,005.1 | 44,355.9 | 42,879.7 | 41,514.7 |

| Betting duty | 14,759.1 | 15,760.6 | 16,564.8 | 18,066.4 |

| Business registration fees | 35.7 | 1,292.9 | 122.9 | 73.5 |

| Total revenue collected | 209,019.4 | 238,325.4 | 242,146.8 | 243,548.9 |

| % change over previous year | 16.7% | 14.0% | 1.6% | 0.6% |

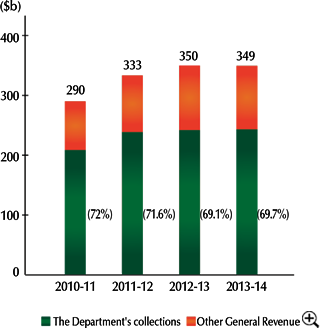

The revenue collected by the Department during 2013-14 accounted for 69.7% of the Government General Revenue (Figure 2). Profits tax contributed the largest part of the total revenue collected, followed by salaries tax. Together they made up 72.4% of the total revenue collected (Figure 3).

-

Figure 2Government General Revenue

-

Figure 3Composition of the revenue

collections

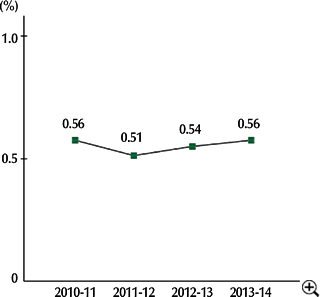

In 2013-14, the cost of collection of revenue rose from 0.54% to 0.56% (Figure 4).