|

|

|

|

|

|

|

Online Demo on Uploading of Data Files for Supplementary Forms and Supporting Documents to Profits Tax Return – Corporations |

|

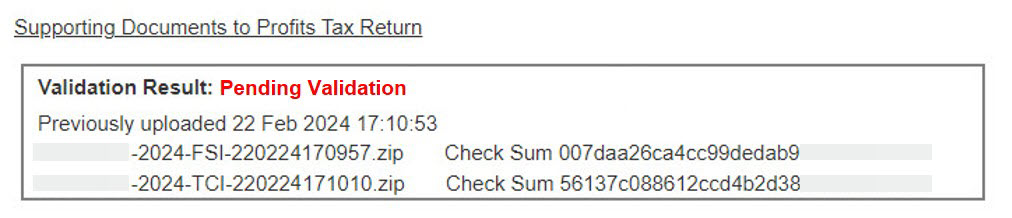

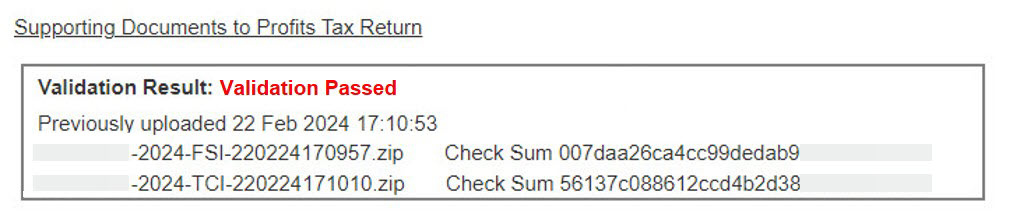

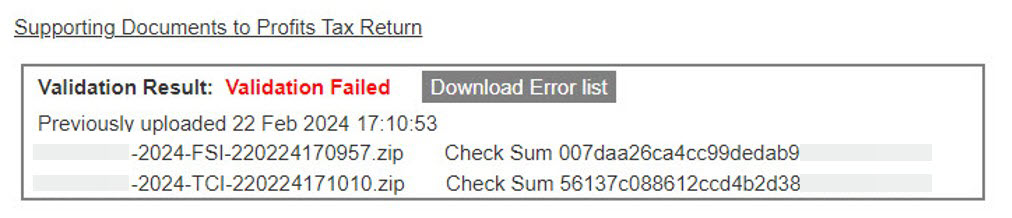

Step 4: Zip / Upload / Delete Data File – Check Validation Result

|

|

You can access the screen "Step 4 – Upload Zip File for Supporting Documents to Profits Tax Return" to check the validation result. There are three types of validation result: Pending Validation / Validation Passed / Validation Failed. |

|

(i) If "Pending Validation" is shown, iXBRL data file validation is still in progress and you will be notified by e-mail once the result has been released.

|

|

|

(ii) If "Validation Passed" is shown, the iXBRL data files uploaded have passed the validation.

|

|

|

(iii) If "Validation Failed" is shown, the iXBRL data files uploaded could not pass the validation. There are two stages of validation: schema and business validations. The uploaded data files must pass through the schema validation (which ensure that the data files are prepared on the basis of taxonomies published on the Inland Revenue Department’s web site) before proceeding to business validation (which ensure that the data files conform with the business logic). You may download the CSV file listing the error messages and rectify the data file(s) accordingly.

|

|

|

After rectification of error for "Validation Failed" data file(s), you may repeat the steps to zip data file(s), re-upload Zip files and check the validation result.

|