|

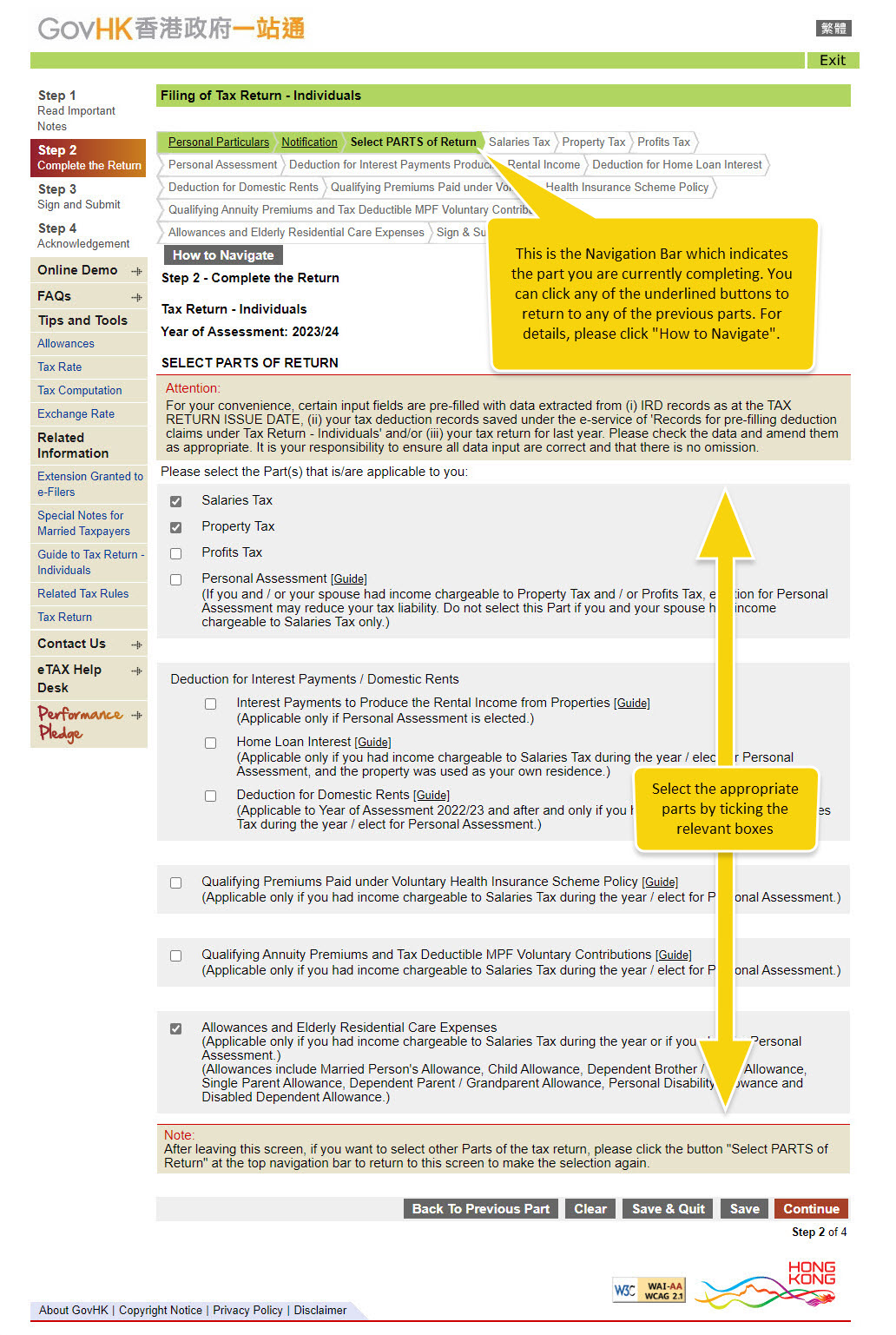

Note the conditions for the relevant parts of the tax return:

Salaries Tax -

Applicable if you have income chargeable to Salaries Tax during the year. You can report up to 10 employers and 4 places of residence provided by employer or associated corporation.

Property Tax -

Applicable if you have any solely-owned properties which were let during the year. You can report up to 3 properties.

Profits Tax -

Applicable if you have any sole proprietorship businesses during the year. You can report up to 2 businesses.

Personal Assessment -

Need not select this part if you and your spouse had income chargeable to Salaries Tax only.

Deduction for Interest Payments -

Applicable if you paid interest during the year in respect of a loan obtained for the purpose of acquiring a property in Hong Kong: -

* Interest Payments to Produce Rental Income from Properties

Deductible only if the property was let and Personal Assessment is elected.

* Home Loan Interest

Deductible only if the property was used by you as your own residence.

Deduction for Domestic Rents -

Applicable if you had income chargeable to Salaries Tax during the year / elect for Personal Assessment.

Election for using the Home Loan Interest / Domestic Rents Additional Deduction Ceiling Amount -

Applicable to Year of Assessment 2024/25 and after and only if you and / or your spouse reside(s) with the child born on or after 25 October 2023.

Qualifying Premiums Paid under Voluntary Health Insurance Scheme Policy -

Applicable if you had income chargeable to Salaries Tax during the year or if you elect Personal Assessment and you intend to claim qualifying premiums paid under Voluntary Health Insurance Scheme policy.

Deduction for Expenses on Assisted Reproductive Services -

Applicable to Year of Assessment 2024/25 and after and only if you had income chargeable to Salaries Tax during the year / elect for Personal Assessment and you intend to claim deduction for Expenses on Assisted Reproductive Services.

Qualifying Annuity Premiums and Tax Deductible MPF Voluntary Contributions ("TVC") -

Applicable if you had income chargeable to Salaries Tax during the year or if you elect Personal Assessment and you intend to claim qualifying annuity premiums and / or tax deductible MPF voluntary contributions.

Allowance and Elderly Residential Care Expenses -

Applicable if you had income chargeable to Salaries Tax during the year or if you elect Personal Assessment and you intend to claim the allowances or deductions for Elderly Residential Care Expenses.

|