Collection

Revenue collected by the Department includes tax, additional tax, surcharge and fines.

Schedules 13 and

14 provide details of additional tax, surcharge and fines imposed by the Department in respect of earnings and profits tax during 2011-12.

Collection of Tax

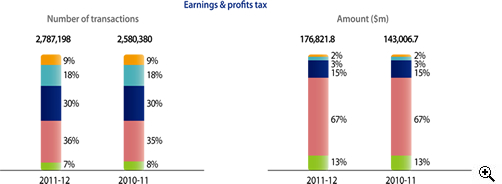

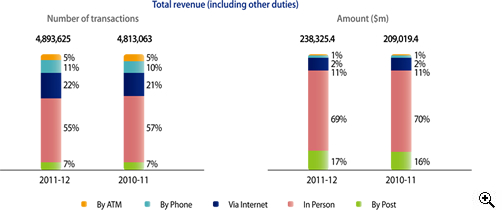

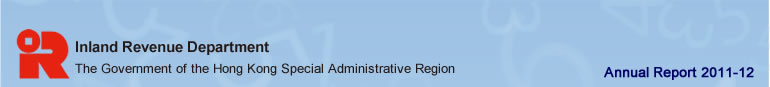

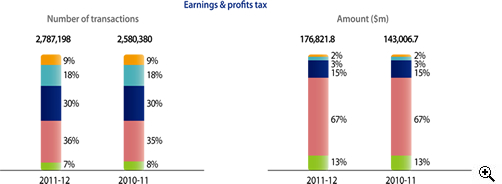

A taxpayer can choose to settle his tax liability by various payment methods, including electronic payments (by phone, bank ATM or the Internet), payment in person or payment by post. Paying tax by electronic means has been well received by the public. For earnings and profits tax, 57% of the payment transactions in 2011-12 were made through electronic means, representing an increase of about 107,000 cases or 7% over last year. Figure 25 shows the respective percentages of the different payment methods used by taxpayers under earnings and profits tax and total revenue.

Figure 25 Payment methods

Refund of Tax

Tax refunds were made mainly due to overpayment of tax by taxpayers and revision of assessments. 491,536 refund cases were made in 2011-12, representing a decrease of 6%. The total amount of refunds was $9.3 billion, representing a decrease of

$1.5 billion or 13.7% compared with the previous year (Figure 26).

Figure 26 Tax refunds

| |

|

2011-12 |

|

2010-11 |

|

| |

Type of tax |

Number |

|

Amount ($m) |

|

Number |

|

Amount ($m) |

|

| |

Profits tax |

32,899 |

|

5,257.6 |

|

35,606 |

|

6,672.1 |

|

| |

Salaries tax |

398,986 |

|

2,355.7 |

|

420,915 |

|

2,438.9 |

|

| |

Property tax |

17,212 |

|

127.1 |

|

16,742 |

|

128.7 |

|

| |

Personal assessment |

25,484 |

|

245.4 |

|

24,499 |

|

247.9 |

|

| |

Others |

| 16,955 |

|

|

|

| 1,264.9 |

|

|

|

| 25,402 |

|

|

|

| 1,225.9 |

|

|

|

| |

Total |

|

|

|

|

|

|

|

|

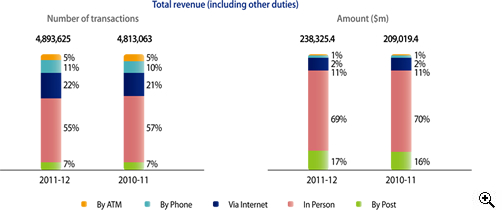

Recovery of Tax in Default

Taxpayers should pay tax on or before the due date shown on the demand notes issued to them. The vast majority of taxpayers settle their tax liabilities in a timely manner.

A late payment surcharge of 5% will generally be imposed where tax is in default. If tax debts remain outstanding for more than six months after the due date, the Department may impose a further surcharge of 10% on the total unpaid amount.

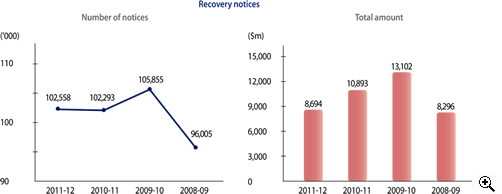

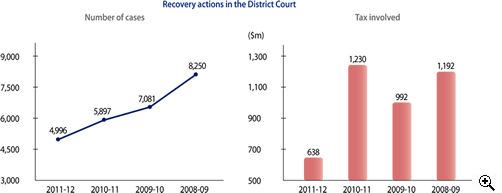

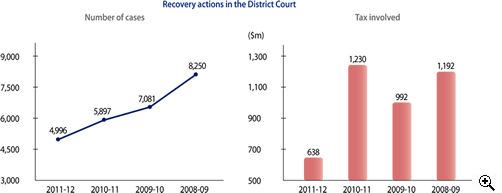

Any tax in default is immediately recoverable. Recovery notices can be issued to employers, bankers, debtors and persons holding money on behalf of the defaulting taxpayers to effect collection. Actions may also be commenced in the District Court. Figure 27 summarises the recovery actions taken by the Department. Upon entry of judgment, a defaulting taxpayer becomes liable to legal costs and interest on judgment debt for the period from the date of commencement of proceedings to the date of full settlement in addition to the outstanding tax. Figure 28 shows the legal costs and judgment interest collected during

2011-12.

Figure 27 Recovery action

Figure 28 Legal costs and judgment interest collected in 2011-12

| |

|

$ |

|

$ |

|

| |

Court cost |

|

|

|

|

| |

|

1,754,264 |

|

|

|

| |

|

| 36,389 |

|

|

|

1,790,653 |

|

| |

Fixed cost |

|

|

757,721 |

|

| |

Judgment interest |

|

|

|

|

| |

|

2,719,230 |

|

|

|

| |

|

| 18,851,927 |

|

|

|

| 21,571,157 |

|

|

|

| |

Total costs and interest collected |

|

|

|

|

Furthermore, the Commissioner may apply to a District Judge to prevent a person with tax in default from leaving Hong Kong. If the District Judge is satisfied that it is in the public interest to ensure that the person does not depart from Hong Kong, or if he returns, does not depart again, without first paying the tax or furnishing security to the satisfaction of the Inland Revenue Department for payment of that tax, he shall issue the “departure prevention direction”. The person concerned has the right to appeal to the Court of First Instance of the High Court against the District Judge's decision.