Taxpayer Services

IRD Homepage

www.ird.gov.hk

A wide range of updated information on Hong Kong taxation and the Department are made readily available to the public through the IRD Homepage, including:

- information on tax law, tax returns, tax obligations and other hot topics;

- answers to frequently asked questions;

- IRD software and tax forms;

- interactive programs to calculate salaries tax and tax under personal assessment

Electronic Enquiry Service

Instant electronic enquiry service is provided to eTAX users at <www.gov.hk/etax>. They can view their position in relation to their returns, assessments and payments, etc.

Enquiry Service Centre

The Department's Enquiry Service Centre handles telephone and counter enquiries. The Centre is equipped with a computer network linked to the Department's Knowledge Database to enable it to provide, as far as possible, an immediate “one-stop” service.

Telephone Enquiry Service

The Centre operates an Interactive Telephone Enquiry System (ITES) with 144 telephone lines. Callers can have access on a 24-hour basis to a wide range of tax information by listening to recorded messages and obtaining facsimile copies of information sheets and forms. A “Leave-and-call-back” facility, for recording information requests, and a “Fax-in enquiry” service are also available. The telephones are manned by staff during office hours. Callers can choose to speak to them. The Centre also provides an eTAX help desk hotline to handle enquiries on eTAX services.

The statistics of services provided through ITES are shown in Figure 32.

Figure 32 Statistics of services provided through ITES

| 2011-12 Number | 2010-11

Number |

Increase / Decrease | |||||

| Calls answered by staff | 736,986 | 678,702 | +8.6% | ||||

| Calls answered by system | 463,082 | 486,918 | -4.9% | ||||

| Leave-and-call-back messages | 34,099 | 34,963 | -2.5% | ||||

| Documents supplied by fax | 4,723 | 5,085 | -7.1% |

Counter Enquiry Service

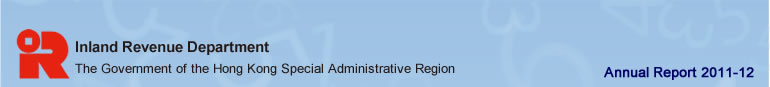

Generally, the counter staff of the Centre is able to handle enquiries, collect mail items and issue forms all by themselves without the need of referring callers to other officers in the Department for assistance. The number of counter enquiries handled during 2011-12 was about 0.53 million (Figure 33).

Information leaflets on topics of general interest are available for collection at the two form stands located on the ground floor and first floor of Revenue Tower. The public may also obtain general tax information and download forms from the Department's website <www.ird.gov.hk>

and GovHK's website <www.gov.hk>.

Figure 33 Counter enquiries

Tax-help Services for Completion of Tax Returns

On the IRD Homepage, e-Seminars are provided for employers, property owners and individual taxpayers. Information on how to complete tax returns, fulfill tax obligations and overcome difficulties in compliance are uploaded to the website. After reading the information, taxpayers can raise enquiries electronically at the “Q&A Column”. The Department will reply the questions on a regular basis.

The Department issued 2.05 million Individuals Tax Returns for the year of assessment 2010-11 on 3 May 2011. To cope with taxpayers' enquiries during the peak season for tax filing, the Department extended the service hours for answering telephone enquiries from that date for one month, up to 7 p.m. from Mondays to Fridays, and 9 a.m. to 1 p.m. on Saturdays.

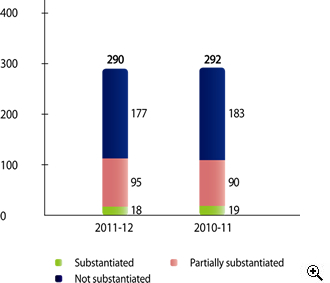

Complaints and Compliments

If taxpayers are dissatisfied with the services provided by the Department or their problems cannot be solved satisfactorily through normal channels, the Complaints Officer may be approached for assistance. The complaint channel provides taxpayers with the means of having individual grievances dealt with independently at a senior level. This ensures that such cases are properly handled in a fair and unbiased manner. During 2011-12, 290 complaints cases were received (Figure 34). This represents a decrease of 1%, as compared with the previous year.

If taxpayers are dissatisfied with any administrative action taken by the Department, they may refer the matter to the Ombudsman. During 2011-12, the Ombudsman sought written comments from the Department in respect of 23 cases. In the light of these cases, the Department has reviewed relevant operations with a view to improving them.

Figure 34 Complaint cases

Taxpayers may compliment the service of the Department. During the year, 159 Letters of Compliments were received.

Performance Pledge

The service standards a taxpayer can expect from the

Department are set out in the performance pledges. The

Department has achieved all the targets of performance

pledges and excelled in some of the

targeted performance with remarkable

results during 2011-12.