Frequently Asked Questions

A:

CbC Reporting Portal is a system designated by the Commissioner of Inland Revenue under Part 9A of the Inland Revenue Ordinance (Cap.112) ("the Ordinance") for Reporting Entities to register a CbC Reporting Account, submit notification and file CbC Return to the Inland Revenue Department ("the Department").

A:

A Reporting Entity can register online on its own. In addition, an authorized service provider or the person managing the Reporting Entity (if the Reporting Entity is not a corporation) can register a CbC Reporting Account on behalf of a Reporting Entity after the Reporting Entity has submitted to the Department an “Authorization Form for Registration / Operation of CbC Reporting Account” (Form IR1465). In the latter case, the Department will send a confirmation letter to the Reporting Entity concerned with a copy sent to the authorized service provider or the person managing the non-corporate Reporting Entity.

Q:

I am a service provider engaged under section 58M of the Ordinance by a Reporting Entity to fulfill the latter’s reporting obligations. Can I register a CbC Reporting Account for the Reporting Entity?

A:

Yes. You can register a CbC Reporting Account for the Reporting Entity provided that you have been duly authorized by that Reporting Entity. In this case, before performing the online registration, you should request the Reporting Entity to submit to the Department an “Authorization Form for Registration / Operation of CbC Reporting Account” (Form IR1465). The Department will send a confirmation letter to the Reporting Entity and a copy to you.

Q:

I am the person acting for a Reporting Entity, which is not a corporation. Can I register a CbC Reporting Account for the non-corporate Reporting Entity?

A:

Yes. You can register a CbC Reporting Account for the non-corporate Reporting Entity. In this case, before performing the online registration, you should request the non-corporate Reporting Entity to submit to the Department an “Authorization Form for Registration / Operation of CbC Reporting Account”(Form IR1465). The Department will send a confirmation letter to the non-corporate Reporting Entity and a copy to you.

Q:

I am the person acting for a Reporting Entity, which is not a corporation. Can I authorize a service provider to register a CbC Reporting Account for the non-corporate Reporting Entity?

A:

If the service provider is engaged by a Reporting Entity to fulfill reporting obligations on the latter’s behalf under section 58M of the Ordinance, it can register a CbC Reporting Account for that Reporting Entity provided that the requirements set out in FAQ 3 above have been met.

A:

The CbC Reporting Account Registration Form must be signed by the authorized person holding a Hongkong Post Certification Authority e-Cert (Organisational) with AEOI Functions of:

- the Reporting Entity;

- the service provider engaged to carry out the Reporting Entity’s obligations under section 58M of the Ordinance; or

- the person who acts for or is responsible for the management of the Reporting Entity (if the Reporting Entity is not a corporation) under section 58N of the Ordinance.

If you are the "authorized person", you must sign the CbC Reporting Account Registration Form in any of the following capacities:

- "director" if you are a director of the corporation (i.e. corporate Reporting Entity, corporate service provider or corporate entity managing the non-corporate Reporting Entity) that completes the Registration; or

- "officer" if you are a manager or company secretary of the corporation (i.e. corporate Reporting Entity, corporate service provider or corporate entity managing the non-corporate Reporting Entity) that completes the Registration; or

- "principal officer" if you are the principal officer of a non-corporate entity (i.e. non-corporate Reporting Entity, non-corporate service provider or non-corporate entity managing a non-corporate Reporting Entity) that completes the Registration; or

- "responsible person" if you are the responsible person of a non-corporate entity (i.e. non-corporate Reporting Entity, non-corporate service provider or non-corporate entity managing a non-corporate Reporting Entity) that completes the Registration. "Responsible person" includes a partner for a partnership and a trustee for a trust.

Q:

What should I do if the Reporting Entity does not have a Business Registration Number ("BRN")?

A:

To register a CbC Reporting Account, the authorized person performing the registration is required to input, among others, the BRN of the Reporting Entity. In general, a Reporting Entity should have a BRN if it carries on business in Hong Kong. If the Reporting Entity currently does not have a BRN but has the obligations to apply for a business registration, it should approach the Business Registration Office of the Department directly to complete business registration procedures before performing any online registration of the CbC Reporting Account. If the Reporting Entity is not carrying on any business in Hong Kong but wishes to register a CbC Reporting Account to fulfill its reporting obligations, it should write to IRD via cbc_reporting@ird.gov.hk to request a Business Registration Number Equivalent (“BRNE”), which will serve the function of the BRN for the purpose of registration with the CbC Reporting Portal, providing full details of the Reporting Entity, in particular the reason why it has not applied for business registration. The Department will issue a reference letter, where appropriate, to the Reporting Entity to facilitate its application for an e-Cert (Organisational) with AEOI Functions. Please refer to FAQ 12 below.

Q:

Can a Reporting Entity authorize a representative for CbC reporting purposes and what matters can the authorized representative handle?

A:

Yes. The Reporting Entity can authorize a representative and should notify the Department of such authorization when the Reporting Entity sets up or updates its profile of the CbC Reporting Account. An authorized representative can send to the Department enquiries relating to the CbC reporting for the Reporting Entity through a designated channel. Please also refer to FAQ 10 below.

Q:

Each of the CbC Reporting Account Registration Form and the Application Form for Hongkong Post e-Cert (Organisational) / (Encipherment) / (Server) Certificate (CPos 798F) ("Application Form for e-Cert") contain a Part "Authorized Representative". What are their respective roles?

A:

The authorized representative as stated in the CbC Reporting Account Registration Form can communicate with the Department in relation to the CbC reporting for the Reporting Entity. For details, please refer to FAQ 10 below.

As regards the Application Form for e-Cert, the authorized representative stated therein is responsible for administering on behalf of the Subscriber Organisation the e-Cert application. For more details, please refer to the e-Cert Certification Practice Statement published at the website of the Hongkong Post Certification Authority.

Q:

A Reporting Entity has authorized me as its authorized representative when it set up its account profile. Can I access the Reporting Entity’s CbC Reporting Account and check the information therein?

A:

An authorized representative, if not engaged as the service provider of the Reporting Entity, is not allowed to access the Reporting Entity's CbC Reporting Account. However, an authorized representative can send to the Department enquiries relating to the CbC reporting for the Reporting Entity through the "Contact Us (For Authorized Representative)" channel provided in the CbC Reporting Portal. The authorized representative is required to authenticate such submission with its own digital certificate, i.e. e-Cert (Personal) or e-Cert (Organisational).

A:

No. A Reporting Entity can register only one account with the CbC Reporting Portal. Each Business Registration Number can link up with one CbC Reporting Account only.

Q:

A:

For access to the CbC Reporting Portal, the Reporting Entity, service provider or person managing the non-corporate Reporting Entity is required to use an e-Cert (Organisational) with AEOI Functions for authentication. For more information about e-Cert (Organisational) with AEOI Functions, please click here to visit the website of the Hongkong Post Certification Authority.

Q:

I am a holder of an e-Cert (Personal). Can I use that digital certificate to register or operate a CbC Reporting Account for the Reporting Entity?

A:

No. An e-Cert (Organisational) with AEOI Functions must be used. The e-Cert (Personal) cannot be used for registering or operating a CbC Reporting Account for the Reporting Entity. Each authorized person (e.g. staff of the Reporting Entity) must hold the relevant organisation’s e-Cert (Organisational) with AEOI Functions issued by the Hongkong Post Certification Authority.

Q:

My organisation is an existing subscriber of an e-Cert (Organisational). Can that digital certificate be used to register or operate a CbC Reporting Account for the Reporting Entity?

A:

No. An e-Cert (Organisational) with AEOI Functions must be used. An e-Cert (Organisational) is not accepted by the CbC Reporting Portal for authentication. Your organisation may choose to add the new feature of AEOI functions when renewing the existing certificate. For further details of the procedures and documents required, please click here to visit the website of the Hongkong Post Certification Authority.

Q:

My organisation has subscribed an e-Cert (Organisational) with AEOI Functions for submitting financial information to the AEOI Portal. Can that digital certificate be used to register or operate a CbC Reporting Account for the Reporting Entity?

A:

Yes. Your organisation can use the same e-Cert (Organisational) with AEOI Functions to register and operate a CbC Reporting Account for the Reporting Entity. Your organisation is not required to apply for the new digital certificate.

Q:

What is the CbC ID Number? Can the Reporting Entity change the CbC ID Number after registration?

A:

After successful registration, a unique CbC ID Number will be issued as the identification number of the Reporting Entity for future access to the CbC Reporting Portal. This identification number cannot be changed once issued.

A:

You can request to retrieve the Reporting Entity’s CbC ID Number by clicking the "Forgot CbC ID Number" link provided in the CbC Reporting Portal. Please input Business Registration Number of the Reporting Entity and use your e-Cert (Organisational) with AEOI Functions for authentication. The Reporting Entity’s CbC ID Number will be sent to the email addresses of the contact persons according to the Department’s records.

A:

In case you forgot your password, you are recommended to revoke your e-Cert (Organisational) with AEOI Functions immediately and apply for a new one. For more details, please contact the Hongkong Post Certification Authority direct.

Q:

What format should data file be prepared for reporting the required information in relation to the country-by-country report for a reportable group?

A:

A data file should be prepared in the Extensible Markup Language (XML) format, which is set out in the Country-by-Country Return XML Schema issued by the Department. For details, please refer to the Country-by-Country Return XML Schema and its User Guide.

A:

The maximum recommended file size is 50MB after being compressed, signed and encrypted with the tools provided by the Department.

A:

The data file containing the required information in relation to the CbC Report must be submitted together with the CbC Return via the CbC Reporting Portal, which supports transfers through HTTPS. Specific operational procedures are documented in "A Guide to Return Filing".

Q:

How can I check whether a data file conforms to the requirements of the Country-by-Country Return XML Schema?

A:

Data file should be prepared in accordance with the requirements of the Country-by-Country Return XML Schema issued by the Department. The Encryption Tool provided by the Department would perform schema validation during the encryption process. Furthermore, if any self-developed software is used to prepare the data file, prior consent has to be obtained from the Department by submitting a test data file to the CbC Reporting Portal for validation.

Q:

What if I have mistakenly submitted my production data file to the CbC Reporting Portal via the "Submit Test Data File" function?

A:

Data file uploaded under the "Submit Test Data File" function will only be used for validation purposes and will not be attached to the CbC Return filed by the Reporting Entity.

A:

An encryption tool has been provided in the CbC Reporting Portal. With your e-Cert (Organisational) with AEOI Functions, you can use the encryption tool to encrypt the data file.

Q:

Is there any information required to be inputted when encrypting a data file with the Encryption Tool provided by the Department?

A:

No. Number of Tax Jurisdictions, Constituent Entities and Additional Information Tables in the data file will be displayed for checking when encrypting a data file with the Encryption Tool. You will not be prompted to input such information.

A:

No. All data files uploaded to the CbC Reporting Portal and the data records contained therein cannot be subsequently downloaded or retrieved via the CbC Reporting Portal. You should keep a copy of the data file for future reference.

Q:

What is the voluntary filing of a CbC Return under section 58E(2) of the Inland Revenue Ordinance?

A:

Some jurisdictions have introduced CbC reporting requirements for accounting periods beginning on or after 1 January 2016. Such a jurisdiction may require a constituent entity resident there to file a CbC Report if the constituent entity is part of a Reportable Group with the ultimate parent entity (UPE) resident in another jurisdiction that does not have a CbC reporting requirement for the same accounting period (Local CbC Filing). As Hong Kong has only implemented CbC reporting for accounting periods beginning from 1 January 2018 under section 58E(1), constituent entities of a Reportable Group with HK UPE (HK Reportable Group) may be subject to Local CbC Filing for an accounting period beginning between 1 January 2016 and 31 December 2017 (Early Reporting Period). To mitigate the Local CbC Filing exposure of HK Reportable Groups, the HK UPE of such a group may voluntarily file a CbC Return for an Early Reporting Period to the Department under section 58E(2) of the Inland Revenue Ordinance such that the CbC Report included therein can be exchanged with relevant jurisdictions.

A HK Reportable Group should take note that whether this voluntary filing of the CbC Return can relieve its Local CbC Filing obligation in a jurisdiction would depend on the CbC reporting requirements of that jurisdiction.

Q:

Can a HK constituent entity of a reportable group that is not the group’s UPE voluntarily file the CbC Return under section 58E(2) of the Inland Revenue Ordinance?

A:

No. Only the HK UPE of a HK Reportable Group may voluntarily file a CbC Return for an Early Reporting Period to the Department such that the CbC Report included therein can be exchanged with relevant jurisdictions.

Q:

How can the HK UPE of a HK Reportable Group voluntarily file a CbC Return for an Early Reporting Period under section 58E(2) of the Inland Revenue Ordinance?

A:

The HK UPE of a HK Reportable Group can request a CbC Return for voluntary filing through the CbC Reporting Portal. For details, please refer to A Guide to Return Filing.

Q:

Can the HK UPE of a HK Reportable Group voluntarily submit the data file of CbC Report for an Early Accounting Period direct to the Department's email account of CbC Reporting?

A:

No. The data file of CbC Report must be submitted together with a CbC Return through the CbC Reporting Portal. For details, please refer to A Guide to Return Filing.

A:

CbC Return must be signed by the authorized person holding a Hongkong Post Certification Authority e-Cert (Organisational) with AEOI Functions of:

- the Reporting Entity (if the Reporting Entity is a corporation); or

- the service provider engaged to carry out the Reporting Entity’s obligations under section 58M of the Ordinance; or

- the person acting for or responsible for the management of the Reporting Entity (if the Reporting Entity is not a corporation) under section 58N of the Ordinance.

If you are the “authorized person”, you must sign the return in any of the following capacities:

- “director” if you are a director of the corporation (i.e. corporate Reporting Entity, corporate service provider or corporate entity managing a non-corporate Reporting Entity) that files the Return; or

- “officer” if you are a manager or company secretary of the corporation (i.e. corporate Reporting Entity, corporate service provider or corporate entity managing a non-corporate Reporting Entity) that files the Return; or

- “principal officer” if you are the principal officer of a non-corporate entity (i.e. non-corporate service provider or non-corporate entity managing a non-corporate Reporting Entity) that files the Return; or

- “responsible person” if you are the responsible person of a non-corporate entity (i.e. non-corporate service provider or non-corporate entity managing a non-corporate Reporting Entity) that files the Return. “Responsible person” includes a partner for a partnership and a trustee for a trust.

A:

No. If you subsequently discern that there are mistakes made in the reported country-by-country information, you should submit a correction data file to rectify the situation. For details, please refer to the Country-by-Country Return XML Schema and its User Guide.

Q:

What is the obligation for a HK UPE of a HK Reportable Group under section 58H of the Inland Revenue Ordinance?

A:

A HK UPE of a HK Reportable Group is required to file a Notification within 3 months after the end of each accounting period beginning on or after 1 January 2018, containing information relevant for determining the obligation for filing a CbC Return.

Q:

What is the obligation for a Hong Kong Entity of a Reportable Group, whose UPE is not resident in Hong Kong, under section 58H of the Inland Revenue Ordinance?

A:

A Hong Kong Entity of a Reportable Group is required to file a Notification within 3 months after the end of each accounting period beginning on or after 1 January 2018, containing information relevant for determining the obligation for filing a CbC Return. For a Reportable Group with more than one Hong Kong Entity, a Hong Kong Entity is not required to make a Notification provided that it is not the entity which is to file a CbC Return and another Hong Kong Entity has already made the Notification.

A:

The Notification should be filed through the CbC Reporting Portal. For details, please refer to A Guide to Notification Filing.

Q:

How can the Reporting Entity provide details of all other Hong Kong Entities of the Reportable Group in the Notification?

A:

In the course of filing Notification on the CbC Reporting Portal, the Reporting Entity can provide details of all other Hong Kong Entities by either online input or upload a CSV file. The CSV file should be prepared in advance, containing business registration numbers of other Hong Kong Entities, and should be saved in UTF-8 ".csv" format. The system will reject the CSV file, which is not UTF-8 encoded. For details, please refer to A Guide to Notification Filing.

A:

The Reporting Entity is only allowed to amend the list of other Hong Kong Entities attached to the Notification filed. For details, please refer to A Guide to Notification Filing. If the Reporting Entity wishes to amend other information in the Notification, it should send an e-message to the Department through the CbC Reporting Portal.

Q:

What is the obligation for a HK UPE of a HK Reportable Group under section 58E(1) of the Inland Revenue Ordinance?

A:

A HK UPE of a HK Reportable Group is required to file a CbC Return for each accounting period beginning on or after 1 January 2018. In general, the CbC Return should be filed within 12 months after the end of the relevant accounting period.

Q:

Under what circumstances a Hong Kong Entity is subject to a secondary obligation of filing a CbC Return?

A:

A Hong Kong Entity of a Reportable Group whose UPE is not resident in Hong Kong is subject to a secondary obligation of filing a CbC Return if any of the following conditions is met:

| (i) | the UPE is not required to file a CbC Report in its jurisdiction of tax residence; |

| (ii) | the jurisdiction has a current international agreement with Hong Kong providing for automatic exchange of tax information but, by the deadline for filing the CbC Return, there is no exchange arrangement in place between the jurisdiction and Hong Kong for CbC Reports; |

| (iii) | there has been a systemic failure to exchange CbC Reports by the jurisdiction, which has been notified to the Hong Kong Entity by the Commissioner. |

Even if one of the above conditions is met, the Hong Kong Entity is not required to file a CbC Return if:

| (i) | a CbC Return for the relevant accounting period is filed by another Hong Kong Entity of the Reportable Group; or |

| (ii) | the Reportable Group has authorized a constituent entity as its surrogate parent entity ("SPE") to file CbC Report on behalf of the Group, and the CbC Report is filed by the SPE in Hong Kong or a jurisdiction which has an exchange arrangement in place with Hong Kong. |

A:

According to the Notification filed, the Department will send an electronic notice to the Message Box of the Reporting Entity, which is either ultimate parent entity, surrogate parent entity or local filing entity, requiring it to file a CbC Return. The Reporting Entity should file the CbC Return including the XML data file in relation to the CbC Report for the accounting period through the CbC Reporting Portal. For details, please refer to A Guide to Return Filing.

A:

For accessing the CbC Reporting Portal, you need to use web browsers with Internet connection. Current versions of major browsers, namely Firefox, Edge, Chrome and Safari are acceptable. The browser settings must be set in the following manner:

(1) JavaScript enabled;

(2) Session cookies enabled;

(3) Web browser encryption enabled (at least TLS v1.2).

The CbC Report should be stored in a data file, which has to be encrypted with an Encryption Tool provided by the Inland Revenue Department, before uploading to the CbC Reporting Portal.

A:

The Encryption Tool can be run on Windows 7 or above and macOS. The workstation should be:

(1) With 4GB free memory;

(2) With Java Standard Edition (Java SE) 17 installed

(3) If the Encryption Tool is used on an Intel-based Mac, Java SE 17 with JavaFX must be installed. For details, please refer to Question 46.

The Encryption Tool can work with

Oracle Java SE 17 or other compatible OpenJDK 17 platforms. If your computer does not have any existing Java SE 17 installed, it is suggested that you can download and install Azul Zulu OpenJDK 17 from the Zulu Community download page* by using one of the following browsers:

- Microsoft Edge

- Google Chrome

- Mozilla Firefox

- Safari

You can refer to the Zulu Installation Guide for instructions on installing the Zulu JDK.

*If the Encryption Tool will be installed on Windows 32-bit platform, please refer to Question 45.

A:

If you need to install Java SE 17 on Windows 32-bit platform, you can download and install Azul Zulu OpenJDK 17 from the Zulu Community download page. Please follow the below steps to install it:

a) Download the installation package for Windows 32-bit in ZIP file format from the Zulu Community (Windows 32-bit) download page;

b) Move the zip file to the same folder as the Encryption Tool;

c) Unzip the file to the same folder;

d) Rename the unzipped folder to "EncryptionToolJre".

A:

For new Encryption Tool users, you can download the installer in DMG file format and install the Java SE 17 with JavaFX from the Zulu Community (macOS JavaFX)) download page.

For existing Encryption Tool users with Azul Zulu OpenJDK 17 installed, please follow the below steps:

a) Follow the guide on the Zulu Community to uninstall Azul Zulu OpenJDK 17;

b) Download the installer in DMG file format and install Java SE 17 with JavaFX from the Zulu Community (macOS JavaFX) download page.

A:

The schema files can be viewed with a web browser, such as Internet Explorer, Firefox and Chrome, and a text editor such as Microsoft Notepad, or an XML tool such as XML Spy or XML Notepad.

Q:

I have prepared an XML data file by using self-developed software. When I encrypt the data file with the Encryption Tool provided by the Inland Revenue Department, it returns error messages "Unrecognized file format" and "Schema validation failed". Can you advise what the possible errors in the data file are?

A:

If you are using self-developed software to prepare the XML data file, you are advised to validate the data file against the Country-by-Country Return XML Schema using XML tools before passing them to the Encryption Tool. It ensures that the data file conforms to the data specifications issued by the Inland Revenue Department.

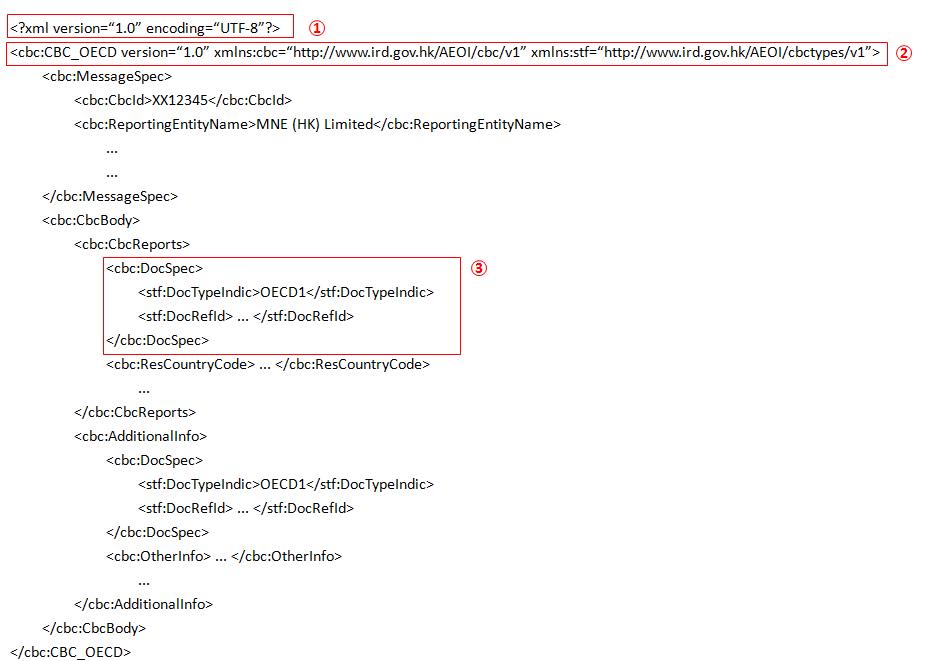

Below are some technical tips in preparing the XML data file:

- Must include the XML Prolog

- Must declare the two namespaces with prefixes "cbc" and "stf" in the root element

- Must use namespace prefix "stf" for all the child elements of the "cbc:DocSpec" element

- For all "Optional" or "Optional (Mandatory)" fields, if no value is provided, the element or attribute should be removed.

As from 1 February 2021, data files must be prepared by using Country-by-Country Return XML Schema (version 2.0), please follow FAQ #49 to update the existing xml data file so that it satisfies the data specification of version 2.0.

47.

Q:

I have prepared an XML data file in accordance with Country-by-Country Return XML Schema (version 1.0). According to the web page of Inland Revenue Department, data file must be prepared using the Country-by-Country Return XML Schema (version 2.0) as from 1 February 2021. Can you advise how to update the existing xml data file to the one which satisfies the data specification of Country-by-Country Return XML Schema (version 2.0)?

A:

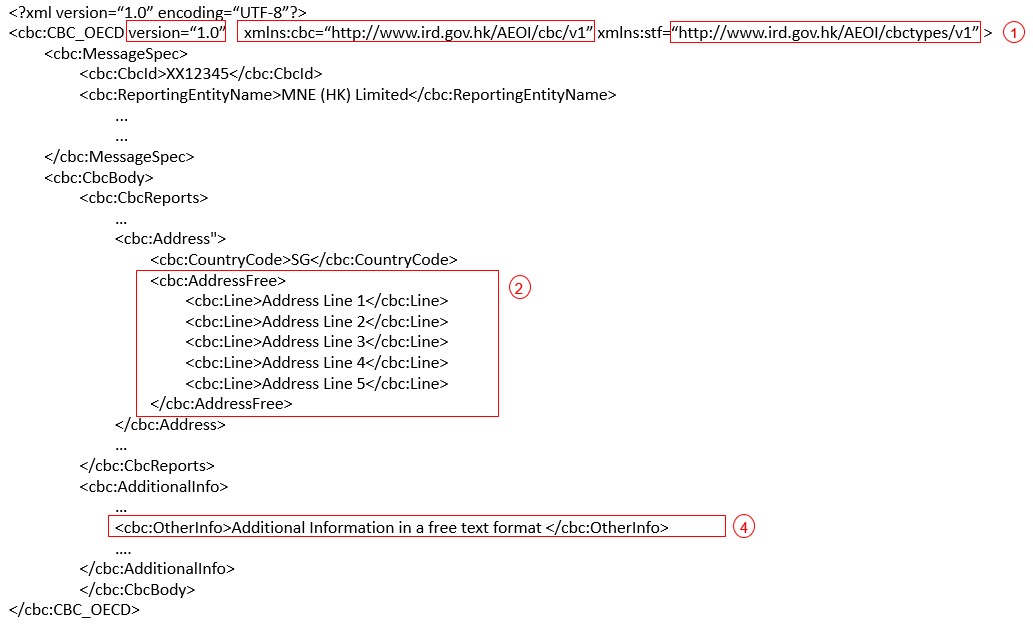

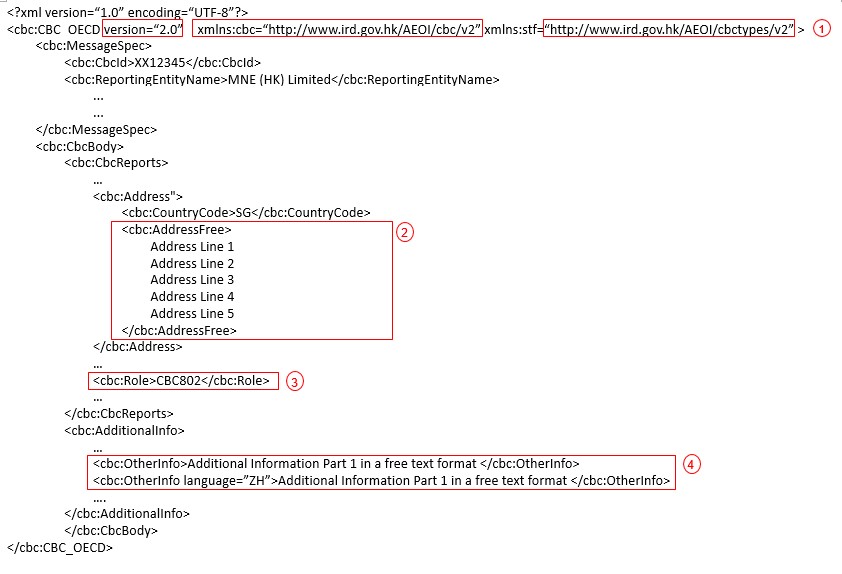

The main technical changes of Country-by-Country Return XML Schema to version 2.0 are summarized below. You can update those code as highlighted.

- Change of Schema version;

- Change of reporting requirement of element "AddressFree";

If an address is input using "AddressFree", all available address details shall be presented as one string of bytes up to a maximum of 4,000 characters instead of presented in multiple lines of a maximum of five.

- Addition of a new data element "Role";

An optional element "Role" indicates the role of the Reporting Entity with respect to the multinational enterprise group (MNE Group) is added.

- Change of element "OtherInfo";

"OtherInfo" is changed to be a repeatable element, but should only be repeated for transliteration purposes. The language attribute, which specifies the language in which the content of the OtherInfo element is written by, must be provided if the OtherInfo is repeated.

Country-by-Country Return XML Schema (version 1.0)

Country-by-Country Return XML Schema (version 2.0)

48.

Q:

The ultimate parent entity (UPE) of our group is tax resident in other jurisdiction. For the purposes of local filing, the UPE has provided us with the CbC XML data file which is prepared in accordance with the latest version of the CbC Reporting XML Schema promulgated by the OECD (OECD XML Schema). However, the data file is rejected during the encryption process when I encrypt it with the Encryption Tool provided by the Inland Revenue Department. Can you advise what the possible errors in the data file are?

A:

According to the system requirements of the CbC Reporting Portal, some data provided by the Reporting Entity for account registration at the Portal (e.g. ResCountryCode, TIN and Address of the Reporting Entity) are not required to be submitted again when filing a Notification or CbC Return. Such data are therefore excluded from the CbC Return XML Schema developed by the Department. If you wish to use the data file provided by the UPE for the purposes of filing a CbC Return, you need to make slight modifications in respect of the message header and reporting entity. You can click here to follow the required steps.

Common errors when submitting a Test Data File / Data File for Country-by-Country (CbC) Return purpose

Q:

I have prepared an XML data file by using self-developed software. When I submit the data file for CbC Return purpose, it returns an error message “Upload of data file is not accepted. For data file prepared by self-developed software, prior consent has to be obtained from the Department by submitting a test data file for validation. [E-0539]”. What is the possible error in the data file?

A:

Reporting Entity can develop their own computer program for preparing a data file for Return submission purposes. Before implementing their own program, Reporting Entity should obtain prior consent from IRD by submitting a test data file for validation. Reporting Entity should submit the test data file to the CbC Reporting Portal through the function “Submission of Test Data File” on the Landing Page to verify whether the data file produced by its program conforms to the specifications in the Country-by-Country Return XML Schema.

Upon receipt of the message in the Message Box of the Reporting Entity’s CbC Reporting Account, informing that the test data file conforms to the data specifications issued by IRD, Reporting Entity can use the self-developed software to prepare a data file and upload the data file to the CbC Reporting Portal.

Q:

I have prepared an XML data file by using self-developed software. When I submit the test data file through the function “Submission of Test Data File”, it returns an error message “File contains production data for test environment. (CbC Code 50011) [E-0607]”. What is the possible error in the data file?

A:

For submission of a test data file containing new information, the value of the MessageTypeIndic element should be CBC401 (i.e. the message contains new information) and the value of the DocTypeIndic element should be OECD11 (i.e. New Test Data).

For submission of a test data file for correction of data, the value of the MessageTypeIndic element should be CBC402 (i.e. the message contains corrections for previously sent information) and the value of the DocTypeIndic element should be OECD12 (i.e. Corrected Test Data) and/or OECD13 (i.e. Deletion of Test Data).

Please note that a test data file can contain either new records (OECD11) or corrections (OECD12 / OECD13), but should not contain a mixture of both.

Q:

I have prepared an XML data file by using self-developed software. When I submit the data file for CbC Return purpose, it returns an error message “File contains test data for production environment. (CbC Code 50010) [E-0608]”. What is the possible error in the data file?

A:

To attach a data file for filing the Country-by-Country Return in CbC Reporting Portal, the value of the MessageTypeIndic element should be CBC401 (i.e. the message contains new information) and the value of the DocTypeIndic element should be OECD1 (i.e. New Data).