|

|

|

|

| |

| With the strong economic rebound in the second

half of 2003 and the implementation of phase I tax increase

measures in the 2003-04 Budget, there was an increase of $7.4

billion in Earnings and Profits Tax collections, representing

a growth of 10.2% as compared with the previous year (Figure

1, Schedules

1 and 2).

The marked revivals in the property and stock markets in the

later part of the year also brought about a substantial increase

of $3.8 billion in stamp duty collections. |

| |

2000-01 |

2001-02 |

2002-03 |

2003-04 |

| Type

of tax |

($m) |

($m) |

($m) |

($m) |

Profits Tax - |

Corporations |

38,960.5 |

39,272.4 |

33,692.9 |

43,666.3 |

| Unincorporated

Businesses |

4,008.9 |

5,103.3 |

5,106.6 |

5,103.7

|

| Salaries Tax |

26,302.9 |

28,634.6 |

29,733.1 |

27,976.9 |

| Property Tax |

1,143.1 |

1,135.7 |

1,180.1 |

983.0 |

| Personal Assessment |

3,454.9 |

3,603.0 |

3,315.9 |

2,744.4 |

| Total Earnings & Profits

Tax |

73,870.3 |

77,749.0 |

73,028.6 |

80,474.3 |

| Estate Duty |

1,502.6 |

1,927.8 |

1,402.7 |

1,455.3 |

| Stamp Duty |

10,911.2 |

8,636.6 |

7,458.2 |

11,245.4 |

| Betting Duty |

12,630.1 |

11,571.3 |

10,920.7 |

11,635.9 |

| Business Registration Fees |

1,300.7 |

1,240.2 |

127.7 |

1,233.3 |

| Hotel Accommodation Tax |

222.5 |

202.9 |

201.0 |

155.6 |

| Total revenue collected |

100,437.4

|

101,327.8

|

93,138.9

|

106,199.8

|

| % change over previous year |

7.2% |

0.9% |

-8.1% |

14.0% |

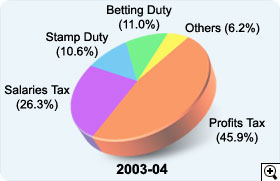

Overall, revenue collected

by the Department during 2003-04 totalled $106.2 billion.

This represents an increase of $13.1 billion or 14%, from

that collected in the previous year. The major part of revenue

collected came from Profits Tax and Salaries Tax, which together

contributed 72% (Figure 2).

The various taxes collected by the Department

contributed 36% of the total Government General Revenue in

2003-04 (Figure 3). The significant drop

in the percentage of contribution is largely attributable

to the transfer of $120 billion from the Land Fund to the

General Revenue Account during the year to meet government

expenditure requirements.

Productivity savings were achieved during

the year. The cost of collection of revenue decreased from

1.38% to 1.14% (Figure 4).

|

|

|

|

|

|

|

|