|

|

|

|

| |

Salaries

Tax

Salaries Tax is charged on all income arising

in or derived from Hong Kong from any office (e.g. a directorship),

employment or pension. The total tax payable is restricted

to an amount not exceeding the standard rate of Salaries Tax

of the net total income (without allowances) of the individual

concerned. For the year of assessment 2003-04, the standard

rate was increased from 15% to 15.5%.

|

|

|

|

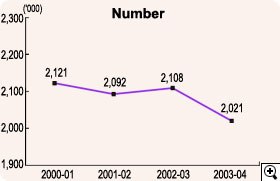

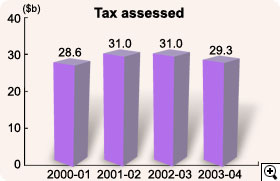

As compared with the previous

year, the number of assessments made during the year has slightly

dropped and 5.5% less tax was assessed (Figure 7).

Analyses of tax assessed and allowances granted in respect

of taxpayers at various income levels are provided in Schedules

5 and 6.

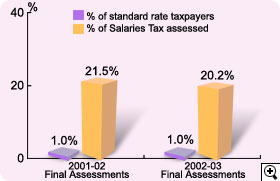

With the drop in the level of salaries,

there was a decrease of 5.1% in the number of standard rate

taxpayers, from 12,328 last year to 11,697 this year. These

taxpayers together contributed 20.2% of the Salaries Tax assessed,

compared to 21.5% last year (Figure 8).

Notification Requirements

of Employers

Apart from reporting commencements and cessations

of employments, employers are required to prepare annual returns

to report the emoluments of each of their employees. During

the year, 218,582 employers filed employer's returns with

the Department. |

|

| The Department firmly believes

that continuous taxpayer education can help promoting voluntary

compliance by employers. Apart from disseminating information

on the IRD Homepage, the Department continues to hold e-Seminar

for employers this year. Information on completion of employer's

return, employer's obligation and answers to frequently asked

questions were uploaded to the IRD website. Employers can also

obtain information and specimens of employer's return through

the Fax-A-Form service. |

|

|

|

|

|

|

|

|

| |

Objections

A taxpayer who is aggrieved by an assessment made under the

Inland Revenue Ordinance may lodge an objection to the Commissioner.

A significant proportion of the objections received each year

arises from estimated assessments issued to taxpayers who

fail to lodge returns in time. An objection of this nature

must be supported by a completed return and, where applicable,

by supporting accounts. Most of these objections are settled

promptly by reference to the returns subsequently submitted.

Most of the other types of objections are also settled by

agreement between the taxpayer and the assessor. Only a small

percentage of objections are ultimately referred to the Commissioner

for determination. During the year, the Department processed

over 67,000 objections (Figure 12).

|

| |

2002-03 |

2003-04 |

| |

|

Number |

|

Number

|

| Awaiting settlement at the beginning of the year |

|

22,598 |

|

24,499 |

| Add: Received during the year |

|

79,548

|

|

68,961

|

| |

|

102,146 |

|

93,460 |

| Less: Disposed of

- |

Settled or withdrawn |

76,723 |

|

66,094 |

|

| Assessment confirmed |

482 |

|

540 |

|

| Assessment

reduced |

265 |

|

253 |

|

| Assessment

increased |

164 |

|

142 |

|

| Assessment

annulled |

13

|

77,647

|

13

|

67,042

|

| Awaiting settlement at the end of the year |

|

24,499

|

|

26,418

|

|

|

|

|

|

|

|

|

| |

Business

Registration

The Department aims to maintain an efficient business registration

system. Every person carrying on business in Hong Kong must

register the business and pay the required fee. Registered

businesses may renew their registration certificates either

annually or once every 3 years. Up to 31 March 2004, 9,200

businesses had taken the 3-year certificates.

As a budgetary measure for 2002-03, the

business registration fee was waived for a year with effect

from 1 April 2002. Following the expiration of the waiver

period on 31 March 2003, collection of business registration

fee was resumed on 1 April 2003 at the original fee scale

i.e. $2,000 for a certificate that is valid for one year and

$5,200 for one that is valid for 3 years. As before, registered

businesses and branches are also required to pay the levy

for the Protection of Wages on Insolvency Fund at $600 for

a 1-year certificate and $1,800 for a 3-year certificate. |

The special refund exercise

for businesses which had already paid registration fees for

2002-03 but were not required to renew their registration

certificates during the year was completed on 30 September

2003 as scheduled. For the whole exercise, the Department

issued 53,942 application forms to eligible businesses, of

which 13,925 had been returned. 12,186 successful applicants

were issued refunds totalling $14.48 million.

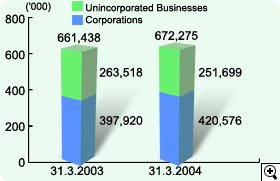

The resumption of business registration

fee collection had brought the number of new registrations

in 2003-04 down by 13,910, whereas the number of cancelled

registrations was 10,356 more than last year (Schedule

8). Although the total number of active registrations

still managed to record a growth of 10,837 for the year (Figure

15), there was a decrease of 4.2% in the number of

certificates issued. Total business registration fees collected

in the year was $1,233 million (Figure 16).

|

|

| |

2002-03 |

2003-04 |

Increase/Decrease |

| Number of certificates issued (Main and Branch) |

743,880 |

712,934 |

-4.2% |

| Fees (inclusive of penalties) ($m) |

127.7 |

1,233.3 |

865.8% |

Under the Business Registration

Ordinance, a small business with sales or receipts below a

specified limit ($10,000 for a business mainly deriving profits

from the sale of services or $30,000 for other businesses)

could apply for exemption from payment of the fee and levy.

The number of total exemptions granted during the year was

13,743, representing a significant increase of 64% from the

previous year.

Where an application for exemption is not

allowed, the business operator may appeal to the Administrative

Appeals Board. 11 appeals were received by the Board in 2003-04,

of which 3 were dismissed and 7 were subsequently withdrawn

by the appellant (Figure 17).

|

| |

|

Number |

| Awaiting hearing as at 1 April 2003 |

|

0 |

| Add : Lodged during the year |

|

11

|

| |

|

11 |

| Less:

Disposed of - |

Appeal dismissed |

3 |

|

| Appeal withdrawn |

7

|

10

|

| Awaiting hearing as at 31 March 2004 |

|

1

|

|

|

|

|

|

|

|

|

| |

| Stamp

Duty

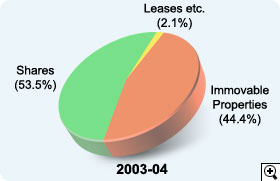

Stamp Duty is charged on instruments effecting property and

stock transactions and leasing of property (Figure

18).

Both the property and stock markets remained

sluggish during the first half of 2003-04. Following the sharp

economic rebound towards the second half of the year, there

have been marked increase in both property and stock transactions.

The stamp duty collections from property and share transactions

increased by 20% and 95% respectively when compared with the

previous year.

Overall, there was a handsome increase of

51% in total stamp duty collections during the year (Figure

19 and Schedule

9). The number of documents stamped also increased

by 7.2% (Schedule

10). |

|

| |

2002-03

($m) |

2003-04

($m) |

Increase |

| Immovable Properties |

4,151 |

4,996 |

+20% |

| Shares |

3,088 |

6,019 |

+95% |

| Leases etc. |

219 |

230 |

+5% |

| Total |

7,458 |

11,245 |

+51% |

|

|

|

|

|

|

|

|

| |

Betting

Duty

Betting Duty is charged on bets made on totalisators at race

meetings conducted by the Hong Kong Jockey Club and on the

proceeds of lotteries conducted by the HKJC Lotteries Limited.

Effective from August 2003, betting duty is also payable on

the net stake receipts from the conduct of authorized betting

on football matches by the HKJC Football Betting Limited.

In 2003-04, the duty rate on Exotic Bets

on horse racing was increased from 19% to 20% (with effect

from 1 August 2003). The other rates of duty remained unchanged

(Figure 22). |

| |

|

Rate |

| Standard Bets |

win, place, double, quinella and

quinella place |

12% |

| Exotic Bets |

six up, treble, tierce,

trio, double trio and triple trio |

20% * |

| Lotteries |

|

25% |

| Football Betting |

|

50% ** |

| Note: |

* |

Rate

increased from 19% to 20% with effect from 1 August 2003. |

| |

** |

Duty rate on the

net stake receipts. |

|

|

|

| During the year, both the

racing attendance and bets on horse racing were on the decline

(Schedule

13), resulting in a drop of 4.8% in the duty

collected from horse racing. However, lotteries duty collection

increased by 13.2%, which, together with the duty from football

betting newly introduced in August 2003, accounted for an

increase of 6.5% in total betting duty collection in 2003-04

over that of the previous year (Figure 23). |

| |

2002-03

($m) |

2003-04

($m) |

Increase/Decrease |

| Horse Racing |

9,725.7 |

9,258.7 |

-4.8% |

| Lotteries |

1,195.0 |

1,352.9 |

+13.2% |

| Football Betting |

- |

1,024.3 |

- |

| Total |

10,920.7 |

11,635.9 |

+6.5% |

|

|

|

|

|

|

|

|

| |

Hotel

Accommodation Tax

Hotel Accommodation Tax is imposed on hotel and guest house

accommodation at the rate of 3% of the accommodation charges

paid by guests and is collected quarterly in arrears.

In 2003-04, the number of hotels, boarding

houses and taxable rooms remained almost unchanged (Figure

24). However, average room occupancy rate dropped

by 16.7% (Figure 25) due to the outbreak

of SARS in early 2003. A decrease in room charges (Schedule

14) was recorded. Total tax collected in the

year was 22.6% less than that of the previous year (Figure

26). |

|

| |

2002-03 |

2003-04 |

Increase |

| Hotels and Boarding Houses |

161 |

162 |

+0.6% |

| Taxable Rooms |

39,101 |

39,135 |

+0.1% |

| Exempted Rooms |

5,315 |

5,484 |

+3.2% |

|

| |

| |

2002-03 |

2003-04 |

Decrease |

| Room Days |

11,057,669 |

8,553,005 |

-22.7% |

| Occupancy Rate |

83.9% |

67.2% |

-16.7% |

|

|

|

|

|

|

|

|

|

| |

Tax

Reserve Certificates

There are two sets of circumstances under which Tax Reserve

Certificates are purchased.

The first applies to taxpayers who wish

to save for the payment of their future tax liabilities. Two

service schemes are offered to these taxpayers: the "Electronic

Tax Reserve Certificates Scheme" for all taxpayers and the

"Save-As-You-Earn" (SAYE) Scheme for civil servants and civil

service pensioners. Under the Electronic Tax Reserve Certificates

Scheme, certificates can be purchased using various electronic

means, i.e. by bank autopay, telephone, the Internet, public

information kiosk and bank ATM. Under the SAYE Scheme, certificates

are purchased by civil servants and civil service pensioners

through monthly deductions from their salaries/pensions. Interest

is payable on the certificates when they are redeemed for

settlement of tax liabilities, based on the interest rate

prevailing at the time of purchase, for a maximum period of

36 months from the date of purchase.

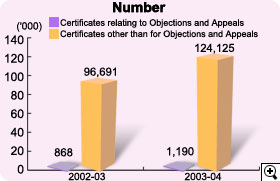

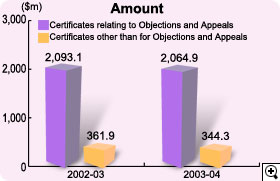

In 2003-04, a promotion campaign launched

by a payment service provider was well received by the public,

resulting in a substantial jump in the number of certificates

sold under the Electronic Tax Reserve Certificates Scheme.

While there was an increase of 76.8% in the number of certificates

sold under the Electronic Tax Reserve Certificates Scheme,

there was a slight drop of 3.6% in the sale of certificate

under the SAYE Scheme (Schedule

15). The total amount involved decreased by 4.9%

(Figure 27). |

|

|

|

|

| The second situation applies to taxpayers

who object to tax assessments and are required to purchase Tax

Reserve Certificates in respect of the tax in dispute. Such

certificates are used to settle any tax found payable upon the

finalization of the objection or appeal. Interest is only payable

on the amount, if any, subsequently required to be repaid to

the taxpayer, and is computed at floating rates ruling over

the tenure of the certificate. |

|

|

|

|

|

|