|

|

|

|

| |

To ensure tax compliance,

the Department pursues its enforcement policy to effectively

detect and punish non-compliance. The Field Audit and Investigation

Unit is responsible for conducting field audits and investigations

on businesses and individuals with a view to combating tax

evasion and avoidance. |

Back tax is assessed and

penalties are generally imposed where discrepancies are detected.

During 2003-04, the Field Audit and Investigation Unit completed

1,863 cases (including avoidance and prosecution cases) and

assessed back tax and penalties of about $2.06 billion (Figure

32). |

|

| |

2000-01 |

2001-02 |

2002-03 |

2003-04 |

| Number of cases completed |

1,920 |

1,921 |

1,862 |

1,863 |

| Understated earnings and profits ($m) |

9,310.8 |

8,940.9 |

9,316.3 |

9,744.8 |

| Average understatement per case ($m) |

4.8 |

4.7 |

5.0 |

5.2 |

| Back tax and penalties assessed ($m) |

2,154.8 |

2,101.5 |

2,052.5 |

2,059.2 |

| Back tax and penalties collected ($m) |

1,962.4 |

1,787.6 |

1,949.1 |

2,039.9 |

|

|

|

|

|

|

|

|

| |

Field

Audit

Field audit is conducted on both corporations and unincorporated

businesses. The work of field auditors entails site visits

to business premises and examination of accounting records

of taxpayers in order to ascertain whether correct returns

of profits have been made.

In 2003-04, there were 14 Field Audit sections.

Anti-Tax Avoidance

Two of the 14 Field Audit sections concentrate on

tackling tax avoidance schemes, whereas other investigation

officers and tax auditors handle avoidance cases on an operational

need basis. |

During 2003-04, the Field

Audit and Investigation Unit completed 196 tax avoidance cases

and assessed back tax and penalties of $636 million (Figure

33). |

|

| |

2000-01 |

2001-02 |

2002-03 |

2003-04 |

| Number of cases completed |

193 |

202 |

200 |

196 |

| Understated earnings and profits ($m) |

2,363.0 |

2,783.7 |

3,131.0 |

3,769.3 |

| Average understatement per case ($m) |

12.2 |

13.8 |

15.7 |

19.2 |

| Back tax and penalties assessed ($m) |

445.1 |

510.2 |

565.4 |

636.2 |

|

|

|

|

|

|

|

|

| |

Investigation

Investigation officers are responsible for conducting in-depth

investigations where tax evasion is suspected, and taking

penal action (including prosecution proceedings in appropriate

cases) to create a deterrent to tax evasion.

In 2003-04, there were 8 Investigation sections. |

| Prosecution

One of the 8 Investigation sections focuses on criminal investigation

of tax evasion.

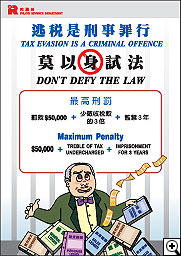

Tax evasion is a serious crime. If a person

is convicted of tax evasion, the Inland Revenue Ordinance

provides for a maximum custodial sentence of three years.

In 2003-04, the Unit successfully prosecuted

5 tax evasion cases. The most serious case involved the understatement

of business profits of some $50 million. The defendant was

convicted and was jailed for 18 months in addition to a fine

of $11 million. It was the first case that the Secretary for

Justice instituted prosecution under Common Law and the defendant

was punished under Criminal Procedure Ordinance. Another businessman

was imprisoned for 5 months and fined $1.5 million for concealing

his business sales. Two cases involved the understatement

of rental incomes. Monetary fines plus imprisonment of 2 to

6 months were imposed on each of the defendants. The last

case involved the understatement of salaries income. Fine

and suspended sentence were imposed on the defendant. |

|

| |

|

|

|

|

|

|

|