|

|

|

|

| |

IRD Homepage

www.ird.gov.hk

Through its homepage, the Department continues

to expand the scope of tax information and provide a wider

range of electronic service, so that any person interested

to know more about taxes in Hong Kong may do so any time,

anywhere.

More and more taxpayers rely on the homepage

to

- get information on how to complete tax

returns, fulfil tax obligations and find solutions to common

tax issues;

- download IRD software and tax forms;

and

- use the interactive application software

to compute their salaries tax liability.

New programmes introduced to the homepage

include a Tax Representatives' Corner, as well as e-Seminars

for employers, property owners and individual taxpayers.

To facilitate easy navigation, the homepage

was revamped in 2003-04 to adopt a common look and feel with

other government websites. |

|

|

|

|

|

|

|

|

| |

Telephone

and Counter Enquiry Services

The Department's Enquiry Service Centre handles telephone

and counter enquiries. The Centre, equipped with computer

network, aims at providing an immediate "one-stop" service

as far as possible. |

The Centre makes use of an

Interactive Telephone Enquiry System with 120 telephone lines.

Callers can, on a 24-hour basis, gain access to a wide range

of tax information by listening to recorded messages or obtaining

facsimile copies of the information and forms. A leave-and-call-back

facility is available. Callers are able to speak to enquiry

officers during office hours.

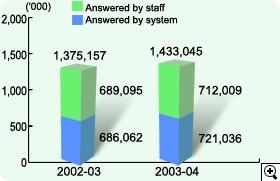

Over 1.43 million telephone calls were answered

by the Centre during the year (Figure 35).

The number of calls answered by staff was over 0.71 million.

This represented an increase of 3.3%, as compared with the

previous year (Figure 36). The increase was

attributable to the redeployment of staff to strengthen operator

services when required. |

|

| |

2002-03 |

2003-04 |

Increase/Decrease |

| No. of calls answered by staff |

689,095 |

712,009 |

+3.3% |

| No. of enquiries answered by staff |

789,163 |

831,093 |

+5.3% |

| No. of calls answered by system |

686,062 |

721,036 |

+5.1% |

| No. of leave-and-call back messages |

70,631 |

71,993 |

+1.9% |

| No. of fax supplied by the system |

12,757 |

16,613 |

+30.2% |

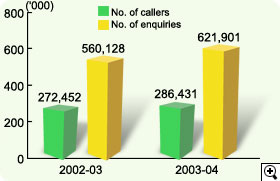

Counter staff of the Centre

are generally able to handle enquiries, collect mail and issue

forms without the need to refer to other officers in the Department.

To facilitate the provision of quality counter

enquiry service, the Centre has installed an electronic queuing

system to enable taxpayers to be served according to tag numbers

in sequence.

A taxpayer service team with professionally

qualified staff is also stationed in the Centre. The members

of this team handle more complex cases. As the demand for

services provided by the Kowloon and Tsuen Wan sub-offices

had dropped, to better use our resources, the two sub-offices

were closed on 1 August 2003. The number of counter enquiries

has increased accordingly by 11%, as compared with the previous

year (Figure 37).

To make it easier for taxpayers to obtain

tax information and forms, two form stands are installed;

one on the ground floor and the other on the first floor of

the Revenue Tower. |

|

|

|

|

|

|

|

|

|

| |

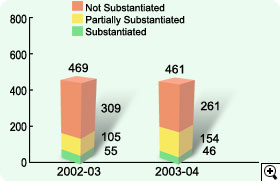

Complaints

If a taxpayer is dissatisfied with the services provided by

the Department or cannot solve his or her problem satisfactorily

through normal channels, the Complaints Officer may be approached

for assistance. The complaint channel provides taxpayers with

the means of having individual grievances dealt with independently

at a senior level. This ensures that such cases are properly

handled in a fair and unbiased manner. During 2003-04, 461

complaint cases were received (Figure 38).

This represents a decrease of 2%, as compared with the previous

year.

If a taxpayer is dissatisfied with any administrative

action taken by the Department, the person concerned may refer

the matter to the Ombudsman. During the year, the Ombudsman

sought written comments from the Department in respect of

14 cases. In the light of these cases, the Department has

reviewed relevant operations with a view to improving them.

There were 111 Letters of Compliments received

during the year. Two officers of the Department also won individual

awards from the Ombudsman. |

|

| |

|

|

|

|

|

|

|