Tax Deduction for Domestic Rent

The Inland Revenue (Amendment) (Tax Deductions for Domestic Rents) Ordinance 2022 was enacted on 30 June 2022 to provide for new deduction for domestic rent with effect from the year of assessment 2022/23. The implementation framework of the new deduction is as follows:

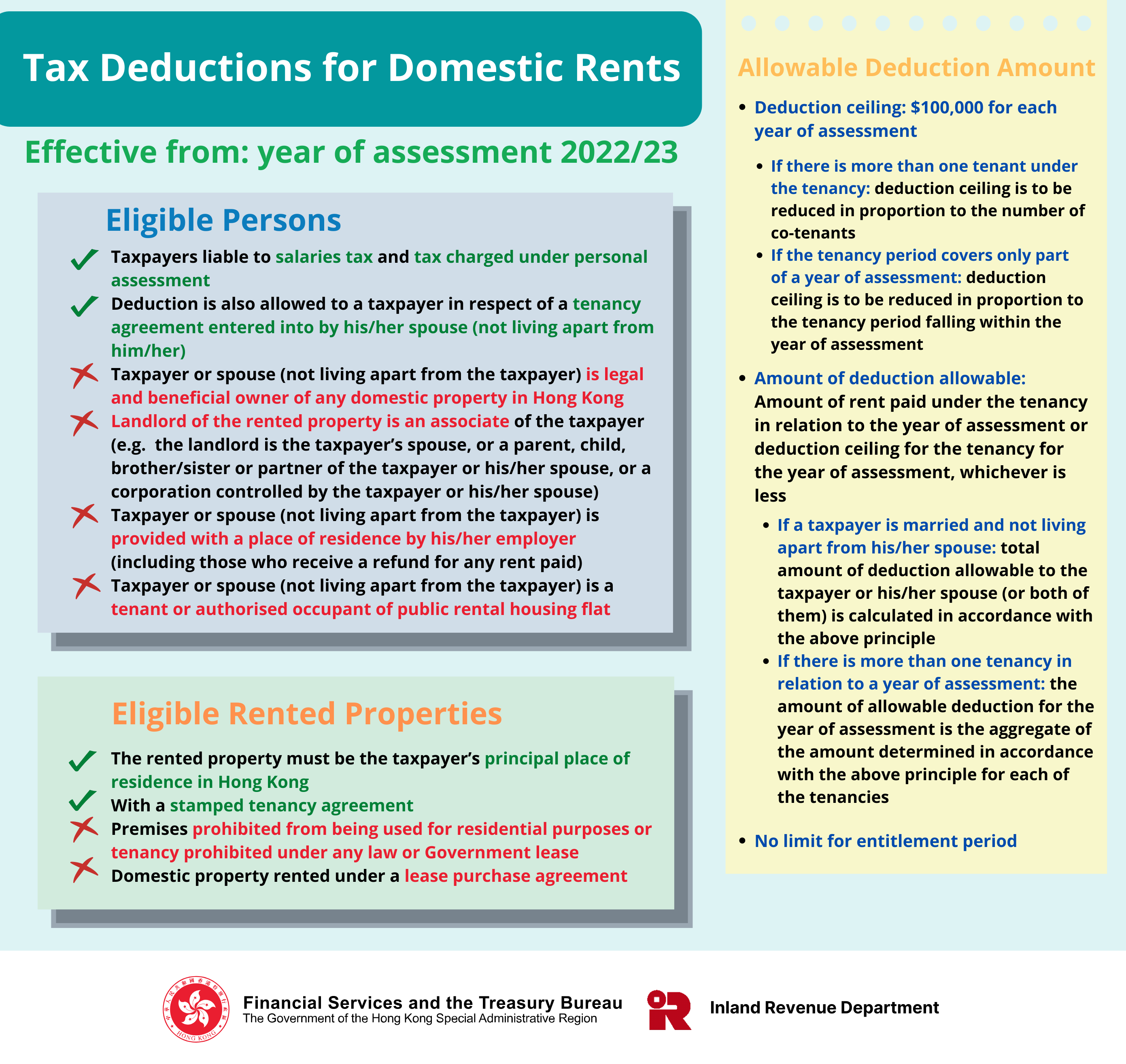

Eligible Persons

A taxpayer chargeable to salaries tax or tax charged under personal assessment is eligible to claim deduction of the rent paid by him / her as a tenant under a qualifying tenancy of domestic premises.

A taxpayer may be allowed deduction of rent paid by his / her spouse (who is not living apart from the taxpayer) as a tenant under a qualifying tenancy of domestic premises.

Eligible Premises

A deduction is only allowable in respect of rents paid under a qualifying tenancy of domestic premises used by the taxpayer as his / her place of residence. Domestic premises are a building or any part of such a building that is not prohibited by or pursuant to any law or any specified instrument (e.g. Government lease, occupation permit, etc.) from being used for residential purposes. If the taxpayer has more than one place of residence, the relevant premises must be his / her principal place of residence.

If a qualifying tenancy is procured in respect of any domestic premises and car parking space, and the car parking space is not sublet, the car parking space will be taken to be part and parcel of the domestic premises for the purposes of the deduction.

Qualifying Tenancy

To qualify for the deduction, a tenancy (or a sub-tenancy) in writing must be procured in respect of any domestic premises. The tenancy must be stamped within the meaning of the Stamp Duty Ordinance (Cap. 117) except one procured in respect of any domestic premises leased by the Government or the Financial Secretary Incorporated as an agent of the Government at a rent of a fair market value.

Amount of Allowable Deduction

In general, the maximum amount of deduction allowable to a taxpayer is $100,000 for each year of assessment.

The deduction ceiling for a tenancy is the maximum amount of deduction, to be reduced:

- if there is more than one tenant under the tenancy – in proportion to the number of co-tenants; or

- if the period of the tenancy for which the right to the exclusive use of the domestic premises is given under the tenancy covers only a part, but not the whole, of a year of assessment – in proportion to the period of the tenancy falling within the year of assessment.

The amount of deduction allowable to a taxpayer for a year of assessment is the amount of rents paid under a tenancy for the year of assessment, or the deduction ceiling for the tenancy for the year of assessment, whichever is less.

If the taxpayer is married and not living apart from his / her spouse, the total amount of deduction allowable to the taxpayer or the taxpayer’s spouse (or both of them) is the amount of rents paid under the tenancy for the year of assessment, or the deduction ceiling for the tenancy for the year of assessment, whichever is less.

If the taxpayer is married during part of a year of assessment, the above principle for determining the total amount of deduction allowable to the taxpayer or the taxpayer’s spouse (or both of them) will apply to that part of the year of assessment when the taxpayer is married.

If there is more than one qualifying tenancy in relation to a year of assessment, the amount of deduction allowable to the taxpayer, or the total amount allowable to the taxpayer or the taxpayer’s spouse (or both of them), for the year of assessment is the aggregate of the amount determined in accordance with the above principle for each of the tenancies.

If there is more than one tenant under a tenancy, the rent paid under the tenancy will be taken to have been paid by each of the co-tenants in equal shares.

If domestic premises are used partly as a place of residence and partly for other purposes (e.g. for business use as home office or front-shop back-home), the amount of rents paid under the tenancy allowable for deduction is such part of the amount that is reasonable in the circumstances of the case.

Circumstances in which Deduction is Not Allowed

A deduction for domestic rents will not be allowed in the following circumstances:

- the taxpayer or the taxpayer’s spouse (who is not living apart from the taxpayer) is a legal and beneficial owner of any domestic premises in Hong Kong;

- the landlord of the tenancy concerned (or the principal tenant in the case of sub-tenancy) is an associate of the taxpayer or the taxpayer’s spouse (e.g. the landlord is the taxpayer’s spouse, or a parent, child, sibling or partner of the taxpayer or the taxpayer’s spouse, or a corporation controlled by the taxpayer or the taxpayer’s spouse);

- the taxpayer or the taxpayer’s spouse (who is not living apart from the taxpayer) is provided with a place of residence by his / her employer or an associated corporation of the employer; or the rents payable or paid by the taxpayer or the taxpayer’s spouse in respect of a place of residence are wholly or partly paid or refunded by the employer or the associated corporation;

- the taxpayer or the taxpayer’s spouse (who is not living apart from the taxpayer) is a tenant or an authorised occupant of a public rental housing flat of the Hong Kong Housing Authority or the Hong Kong Housing Society;

- the tenancy concerned is prohibited by any law or a Government lease;

- the taxpayer or the taxpayer’s spouse has entered into a lease purchase agreement in respect of the premises concerned with the landlord;

- the rents are allowable as a deduction under any other provision of the Inland Revenue Ordinance (Cap. 112); or

- any rent paid in respect of any other domestic premises has been allowed to the taxpayer or the taxpayer’s spouse (who is not living apart from the taxpayer) as a deduction for the same period for which the rent is paid.

Further Information

More information on the tax deduction for domestic rent are available through the following links:

RSS

RSS  Share

Share Printer View

Printer View