Hotel Accommodation Tax

- Scope of the Charge

- Payment of HAT, Rate of Tax and Return

- General Guidelines for Determination of the Amount of Accommodation Charge for the Hotel Accommodation Tax ("HAT")

- Exemption

- Inspection

- Refund

- Frequently Ask Questions

- Enquiries

- Sample of HAT return

By virtue of the Hotel Accommodation Tax Ordinance, Cap 348 (“HATO”), Hotel Accommodation Tax (“HAT”) is imposed on all accommodation charges received by hotels or guesthouses.

"Hotel" means any establishment, the proprietor of which holds out to the extent of his accommodation that he will provide, accommodation to any person presenting himself who is able and willing to pay a reasonable sum for the services and facilities provided and is in a fit state to be received.

"Accommodation" means any furnished room or suite of rooms hired by the proprietor of the hotel to guests, or for the use of guests, for lodging and includes such furnishings, appliances and fittings as are normally provided therein.

"Accommodation charge" means the sum payable by or on behalf of guests for accommodation received.

Payment of HAT, Rate of Tax and Return

The Collector of Stamp Revenue is responsible for the collection of the HAT within fourteen days after the 30th day of September, the 31st day of December, the 31st day of March and the 30th day of June in each year, the proprietor of every hotel shall pay to the Collector the amount of the tax payable in respect of the three monthly periods ending on those dates; at the same time the manager of that hotel shall sign and send to the Collector a return setting out the total amount of accommodation charges made by the proprietor of the hotel during such period for which the tax has been paid.

Effective from 1 July 2008, the Government waives the charge of HAT. The rate of tax is reduced to 0% (the tax rate was at 3% for the period up to 30 June 2008) on all accommodation charges.

For the period during which the rate of HAT is 0%, hotels and guesthouses are not required to pay HAT on accommodations charges and they do not need to file the HAT return to the Collector.

If hotels and guesthouses have received HAT in advance from the guests for accommodations after 30 June 2008, they must refund the HAT to the guests.

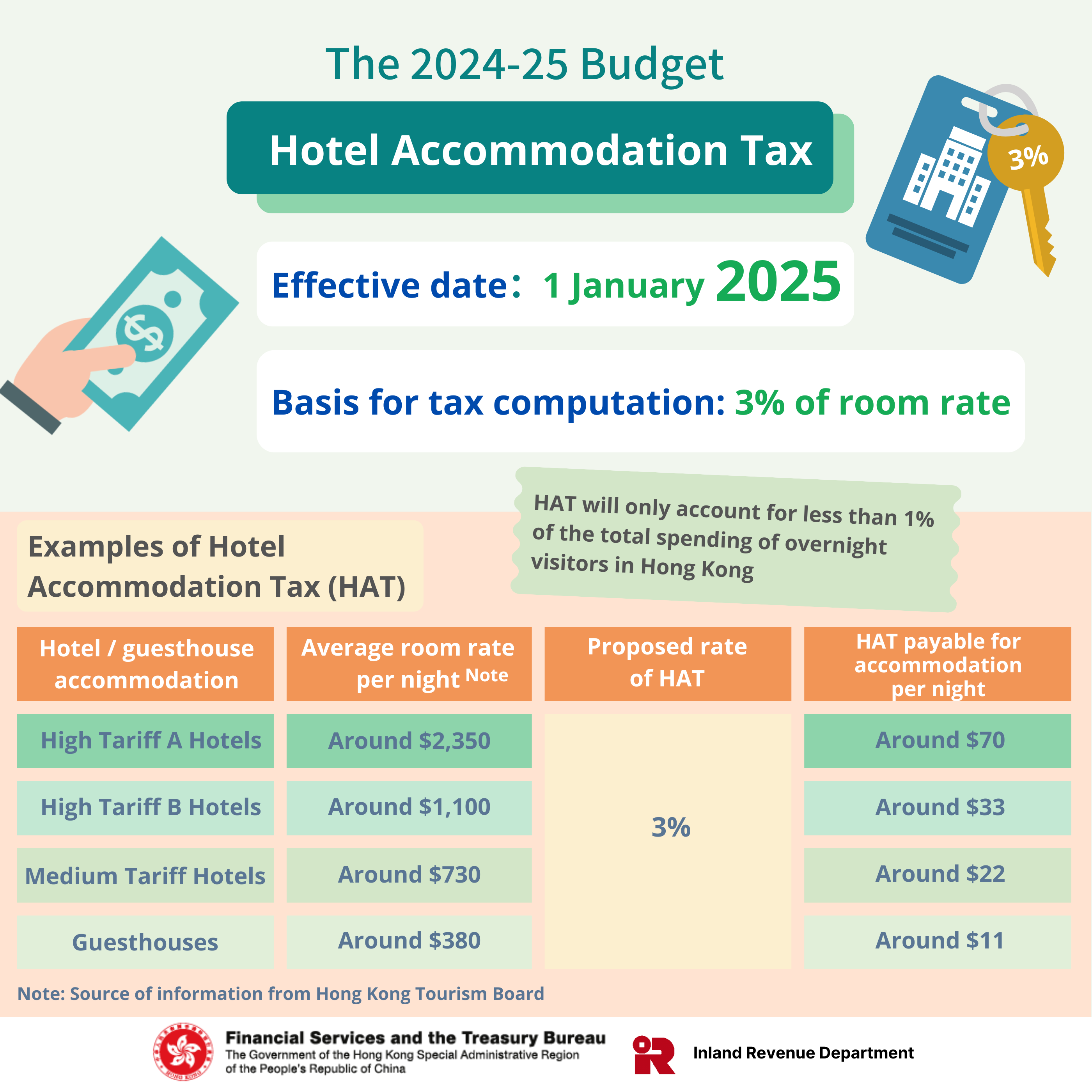

2024-25 Budget Proposal

In his 2024-25 Budget Speech, the Financial Secretary proposed to re-impose the HAT.

Under the proposal, the rate of HAT will be adjusted from the current rate of 0% to the rate of 3% (same as the one before waiver) with effect from 1 January 2025. The Government will move a resolution at the Legislative Council to give effect to the proposal in due course.

Starting from the effective date, hotels/guesthouses will be required to comply with the quarterly obligations to pay the HAT at the rate of 3% on all accommodation charges and file the HAT return to the Inland Revenue Department.

Hotels/guesthouses may need to perform preparatory work, including to enhance accounting and billing systems, separately disclosing accommodation charges and HAT payable thereon, and to update websites and room price lists, drawing guests’ attention to whether the room rates are inclusive of HAT. In addition to the above recommendations, hotels/guesthouses have to plan and get prepared for compliance with the quarterly obligations to pay the HAT and file the HAT return.

After the proposal has been enacted into law, a quarterly HAT return will be issued on the first working day of the quarter starting from the effective date. Hotels/guesthouses will be required to pay the HAT and file the duly completed return for that quarter within 14 days after the quarter-end date.

If the effective date of the re-imposition of HAT is 1 January 2025, hotels/guesthouses will need to pay the HAT and file the HAT return for the period from 1 January 2025 to 31 March 2025 on or before 14 April 2025. To answer enquiries on completion of HAT return, a dedicated helpdesk has been set up on 3/F (Inspection Section) of the Inland Revenue Centre.

General Guidelines for Determination of the Amount of Accommodation Charge for the Hotel Accommodation Tax ("HAT")

| The provisions | |

| (1) | Under the HATO, the HAT is levied at the rate of 0%, with effect from 1 July 2008, (the tax rate was at 3% for period up to 30 June 2008) on all accommodation charges. Accommodation charge is defined in the HATO as the sum payable by or on behalf of guests for accommodation received. Payment can be in the form of money or money's worth – including any credit, book entry, set off or any other act by which a debt due to the proprietor of a hotel for accommodation charges may be discharged. |

| Cases in general | |

| (2) | In most cases, the accommodation charge is the agreed price paid by or on behalf of the guest for the hotel room. |

| If the hotel room is provided to a person in return for a service | |

| (3) | If a contract has been signed by the hotel with a person for providing some services of a particular value (such as advertising, etc.) in exchange for the provision of a number of hotel room-nights as stated in the contract, the HAT is levied on the value as stated (commonly known as the barter rate). |

| (4) | If no value is stated in the contract, or if no contract is signed, the HAT is levied on the average room rate offered to other customers for the same type of hotel room on the day the hotel room is occupied by the service provider (or his agent). |

| Cash coupons | |

| (5) | If the guest has used cash coupon(s) issued by the hotel or other entities to settle the hotel room charge, or part of the hotel room charge, the value of the cash coupon(s) is subject to the HAT as it is money's worth. |

| Service charges | |

| (6) | The normal 10% service charges added to the room rate are exempt from the HAT. Any additional service charges (on top of 10%) for services incidental to the provision of the hotel room (such as newspaper services, etc.) are part of the accommodation charge for the calculation of the HAT. |

The provisions of the Hotel Accommodation Tax Ordinance shall not apply to accommodation charges where the Collector is satisfied that:-

| (1) | the rate of the accommodation charge is less than $15 per day; |

| (2) | the accommodation is provided by society (i.e. any club, company, school, institute, association or other body of persons by whatever name called) not established or conducted for profit; or |

| (3) | the hotel contains less than 10 rooms normally available for lodging guests. |

| Note : | For certain types of long term accommodation which have clear characteristics of not being accommodation provided to "guests", we generally accept that they are excluded from the charge of Hotel Accommodation Tax. However, each case has to be decided on its own merits. |

Tax Inspectors will periodically carry out inspections at hotels to check on the accommodation charges paid by guests to ensure that the appropriate amount of tax is paid by the hotel proprietors.

Where it can be shown to the satisfaction of the Collector that any accommodation charge has not been paid to the proprietor of a hotel, the Collector shall refund the tax paid in respect of that accommodation charge.

RSS

RSS  Share

Share Printer View

Printer View