General

1.

Q:

We close our accounts on 31 December. Can we file form IR56Bs in accordance with our accounting date?

A:

No. The basis period for Salaries Tax runs from 1 April of the current year to 31 March of the succeeding year. Hence, form IR56Bs must be completed for the relevant year ended 31 March.

2.

Q:

We have reported our new business address in the box provided in form BIR56A. Is it necessary for us to notify the Business Registration Office of our new business address as well?

A:

If you have provided a new business address in form BIR56A, there is no need to file a separate notice with the Business Registration Office. However, you should notify the Business Registration Office of any subsequent changes of address in accordance with the Business Registration Ordinance.

3.

Q:

We are a holding company. Should we include employees of our subsidiaries in our Employer's Return?

A:

No. The obligation to file employer's returns (form IR56Bs) rests with the employer shown in the respective employment contract. You and your subsidiaries should file separate employer's returns.

4.

Q:

Is it necessary to report the income paid to shareholders/directors of a limited company? How about the income paid to proprietor or partners of an unincorporated business?

A:

You need not report dividends paid to shareholders of a limited company because dividends are not taxable. On the other hand, salaries and directors' fees received by directors are chargeable to Salaries Tax and should therefore be reported by means of form IR56B.

It is not necessary to file form IR56B for the proprietor /any partner of an unincorporated business or his spouse. The remunerations paid to such person are not allowable deductions under the Inland Revenue Ordinance and have to be adjusted in computing the profits chargeable to Profits Tax.

5.

Q:

Can I print my own form IR56B, the format of which is the same as those issued by the Inland Revenue Department to the employers?

A:

No, you cannot print your own paper form IR56B. If you wish to submit paper form IR56B, you must use the form IR56B provided by the Inland Revenue Department (IRD). You can also download the form by click here; or obtain it from 'FAX-A-FORM' Service (2598 6001).

6.

Q:

I am the responsible person of a charitable organization. Do we need to make an employer's return for our part-time assistants?

A:

Yes, even when your organization is entitled to exemption from registration under the Business Registration Ordinance and/or payment of Profits Tax, your reporting requirements are the same as other employers. You have to report the remuneration paid to all part-time assistants, both single and married persons (regardless of the amount paid). If you have not received BIR56A and IR56B forms by mid April, you can contact us for the forms. You can inform us by completing the IR6163 and send the completed form to the IRD by mail or by fax. The forms will be sent to you once the Employer's file has been opened. IR6163 can also be obtained through the 24-hour Fax-A-Form Service (2598 6001).

7.

Q:

I work in the Personnel Department of a big company. Our company has employed 5 Country A citizens with permits to work in Hong Kong. They arrived last month and had gone to the Immigration Department to register for Hong Kong Identity Cards. They told me that a Hong Kong Identity Card number has been allotted to each person – but the physical Identity Card is pending issue. Should I report their HK Identity Card numbers or their passport numbers on the form IR56E?

A:

The purpose of the passport number and the HK Identity Card number is to help identify the taxpayer. To avoid the opening of double tax files for the same employee, you should supply the HK Identity Card number in Part 2 of form IR56E. However, if the employee does not have a Hong Kong Identity Card number when you prepare the IR56E, you can fill in his/her passport number and place of issue. You then have to follow up with the employee. You should, soonest possible, write in to inform the IRD to update his/her personal records when the Hong Kong Identity Card number of the employee is known.

8.

Q:

An employee resigned on 30 April 2025 without giving notice. My company has not yet filed any IR56B in respect of his remuneration. Which form should be used, should I file IR56B, or IR56F?

A:

In the circumstance described by you, you should file the following forms in respect of this employee, namely:

| (i) | an IR56B for year of assessment 2024/25 covering the period up to and including 31 March 2025; and |

| (ii) | an IR56F covering the period from 1 April 2025 to 30 April 2025. |

Income

9.

Q:

Under the terms of the employment contract, we refunded the full amount of rent paid by an employee. Should we report only the amount of "rent refunded to employee" in item 12 of the form IR56B?

A:

No. Apart from reporting the amount of "rent refunded to employee", the column for "rent paid to landlord by employee" must be completed. Even if the two amounts are the same, the column for "rent paid to landlord by employee" should not be left blank or inserted with an "X".

10.

Q:

We run a restaurant and we distributed tips received from customers to our employees on irregular basis. Is it necessary to report the amount of tips in form IR56Bs?

A:

Yes. Tips are subject to Salaries Tax as part and parcel of the income of the employees. The amounts distributed to them should therefore be reported in item 11(k) of the form IR56B.

Holiday Journey Benefits

11.

Q:

Employee A took a business trip to England for 8 days. Employer B paid his air ticket, accommodation and meal expenses. At the end of the business trip, he extended his stay for 3 days for sightseeing. Employer B also paid additional accommodation and meal expenses for these 3 days. Whether the additional accommodation and meal expenses were taxable as Employee A's income?

A:

Where a trip is taken partly for business and partly for holiday, the IRD will look at the immediate purpose of the trip and will refrain from taxing the benefit if the holiday element is merely incidental to a business trip. However, in cases where a clearly identifiable part of a journey is taken for holiday purpose, the expenses relating to that part of the journey will have to be ascertained and will be assessed as income of the employee. In the above scenario, the cost of additional accommodation and meal expenses for those 3 days should be taxable.

12.

Q:

Employer B offered a 3-days overseas brainstorming trip to her senior executives. Whether the trip expenses incurred were taxable?

A:

If brainstorming was the sole purpose of the trip, the trip expenses were not taxable. For record purpose, Employer B should retain details of the seminar itinerary, subsequent reporting on the topics discussed and participants' involvement, etc.

13.

Q:

Employer B organized a tour for her employees on a group basis. The group comprised employee A, his two family members and seven other employees. Whether the expenses incurred for the tour are taxable on the employees? If yes, how?

A:

The tour expenses would be taxable on the employees. Where the amount paid by the employer was not distinct and separable for individual employees, an apportionment on a head count basis might be adopted. As employee A joined the tour with his family members, his share of benefit should be greater than the seven other employees. In the absence of other more appropriate methods of apportionment, 3/10th of the tour cost should be allocated to employee A and 1/10th of the tour cost should be allocated to each of the seven other employees.

14.

Q:

Employer B purchased a package tour to be taken by Employee A for holiday. Employer B also paid for Employee A's visa fee and travel insurance premium. Apart from the package tour fee, should the visa fee and insurance premium be included as Employee A's taxable income?

A:

The amount paid by an employer in connection with a holiday journey is taxable income of the employee. The visa fee and insurance premium were paid in connection with Employee A's holiday journey. Thus they should also be reported.

15.

Q:

Employee A sent his son to Australia for studying in high school and got reimbursement from his employer for his son's airfare on the trip to Australia. Was the amount reimbursed taxable?

A:

As the trip was not for holiday purpose, the provisions on the taxation of holiday journey did not apply. However, the son's airfare was a private expense of Employee A. The reimbursement should be taxable as a perquisite.

For more information, please refer to Departmental Interpretation and Practice Notes No.41 - Salaries Tax - Taxation of Holiday Journey Benefits.

About Termination Payment

16.

Q:

I left my employment on 15 March 2025. My employer did not work out my entitlements to bonus and commission and did not pay them to me until 30 April 2025. Are these receipts taxable, and if they are, in which year of assessment should they be included as my assessable income?

A:

Yes, they are taxable. Although these bonus and commission were paid to you in year of assessment 2025/26, they are regarded as income for the last day of your employment (15 March 2025) and are your assessable income for the year of assessment 2024/25.

17.

Q:

I resigned on 1 March 2025. As I was required to pay one month´s salary in lieu of notice to my employer, I was not paid the salary for February 2025. For the year of assessment 2024/25, should I pay tax on my salaries for 10 months or 11 months?

A:

Your assessable income is salaries for 11 months. Furthermore, for tax purposes, you cannot claim to deduct the salary in lieu of notice paid by you as your expense. Hence, salaries for 11 months are assessable.

18.

Q:

On quitting my job my employer paid me a lump sum. I do not know how it was calculated. How would the Assessor assess me on this sum of money?

A:

You should report this sum of money in your Tax Return – Individuals. Then, on a separate sheet of paper, you could describe the circumstances under which it was paid to you. You should also supply a copy of all relevant documents (e.g. employment contract, notice of termination of employment and/or agreement to terminate service). The Assessor will examine the information supplied by you (and if necessary, will also ask your employer to furnish further information and computation) to determine if any part of the lump sum is non-taxable, such as the severance/long service payment that your employer is required to pay to you under the provisions of the Employment Ordinance.

19.

Q:

If I leave employment on 15 October 2025 and remain unemployed until 30 November 2025. May I be exempt from payment of Provisional Salaries Tax ("PST") for year of assessment 2025/26?

A:

If you have already received your Salaries Tax assessment, you may apply for the holding over of the whole or a part of the provisional tax for year of assessment 2025/26. To do so, you have to submit an application in writing, stating your actual income for the period from 1 April to 15 October 2025 and your estimated income from 16 October 2025 to 31 March 2026. Your application must be received by the IRD not later than 28 days before the due date for payment of tax.

In other situations, when you complete your Tax Return – Individuals, you should state in your return the period of unemployment. The Assessor will consider your statements and compute the tax demand appropriate to your situation.

Payments in lieu of notice

20.

Q:

Why payments in lieu of notice were not assessed to tax previously? Why does the department start to assess to salaries tax payments in lieu of notice accruing on or after 1 April 2012?

A:

In 2011, the Court of Final Appeal has clarified that payments in lieu of notice contractually agreed are income from employment and chargeable to tax under the Inland Revenue Ordinance. The department is obligated to follow the judgment of the Court of Final Appeal as from the year of assessment 2012-13 onwards and will charge to salaries tax payments in lieu of notice which accrue on or after 1 April 2012. Payments in lieu of notice contractually agreed include sums made by employers to employees under section 7 of the Employment Ordinance. Therefore, employees who receive such payments in lieu of notice as from 1 April 2012 onwards are chargeable to salaries tax.

21.

Q:

Has the department changed its assessing practice on payments in lieu of notice?

A:

The department administers the law as clarified by the Court of Final Appeal, i.e. contractual payments in lieu of notice are chargeable to salaries tax.

22.

Q:

On which date will payments in lieu of notice become assessable to salaries tax?

A:

Payments in lieu of notice which accrue on or after 1 April 2012 will be assessed to salaries tax.

23.

Q:

When does the sum accrue if the employer terminates the employment contract by agreeing to pay the employee a payment in lieu of notice but the payment is made sometime later?

A:

The sum accrues on the date when the employer's agreement to pay the payment in lieu of notice becomes unconditional or on the date the employment is terminated, whichever is the earlier.

24.

Q:

Is the employer required to report payments in lieu of notice in the employer´s return of remuneration and pensions for the year ended 31 March 2025?

A:

In the employer´s return of remuneration and pensions for the year ended 31 March 2025, the employer is required to report payments in lieu of notice.

25.

Q:

Is the employer required to report payment in lieu of notice in the notification of an employee who is about to cease to be employed, i.e. Form IR56F?

A:

In the notification, the employer is required to report payment in lieu of notice which accrues on or after 1 April 2012 to the employee who is about to cease to be employed.

26.

Q:

Is the employer required to report payment in lieu of notice in the notification of an employee who is about to depart from Hong Kong, i.e. Form IR56G?

A:

In the notification, the employer is required to report payment in lieu of notice which accrues on or after 1 April 2012 to the employee who is about to depart from Hong Kong.

27.

Q:

What actions the department will take to ensure that all payments in lieu of notice accruing on or after 1 April 2012 are assessed to salaries tax?

A:

The department will examine the facts and circumstances of each case carefully to determine the date on which the payment in lieu of notice accrued. If the date of accrual of the payment in lieu of notice was wrongly provided, the department will consider taking penalty actions in accordance with the provisions of the Inland Revenue Ordinance.

28.

Q:

Are payments in lieu of notice compensation not assessable to salaries tax?

A:

Payments in lieu of notice are income from employment, not being in the nature of compensation. Since they are income paid under the express or implied term of an employment contract, they are assessable to salaries tax.

29.

Q:

If the contract is regulated by foreign law, would the taxability of payments in lieu of notice differ?

A:

The department would examine carefully the foreign law which regulates the employment, including the right to payments in lieu of notice. The sum will be assessed to salaries tax if it is an income from employment, whether paid under the express or implied term of an employment contract.

30.

Q:

Can the Commissioner exercise his discretion not to charge to salaries tax payments in lieu of notice?

A:

The Commissioner does not have the discretion. The Commissioner administers the law as clarified by the Court of Final Appeal. Payments in lieu of notice are assessable to salaries tax since they are income from employment, whether paid under the express or implied term of an employment contract.

31.

Q:

If the employee needs an early termination of the employment and pays payment in lieu of notice to the employer, can he deduct the amount as outgoings and expenses under salaries tax?

A:

Generally, deductions under salaries tax are restricted to expenses wholly, exclusively and necessarily incurred in the production of assessable income. Payment in lieu of notice made by an employee for early termination of employment with the employer is not accepted as allowable deduction in computing his chargeable income and is not deductible for salaries tax purpose.

32.

Q:

Why should the Commissioner assess to salaries tax payments in lieu of notice but not severance payment even though the obligations to make the two kinds of payment are both regulated under the Employment Ordinance?

A:

Severance payment on redundancy is the means whereby an employee is compensated for loss of employment through no fault of his own while payment in lieu of notice is an income from employment. Since the natures are different, the tax treatments are also different.

33.

Q:

Why should the Commissioner assess to salaries tax payments in lieu of notice accruing on or after 1 April 2012 but not earlier?

A:

In July 2011, a tax appeal to the Court of Appeal having direct relevance to the taxation of payments in lieu of notice was formally withdrawn. Salaries tax assessments for 2011/12 raised prior to the withdrawal are not disturbed since they have become final and conclusive. It is considered more appropriate to assess to salaries tax payments in lieu of notice which accrues on or after 1 April 2012, i.e. in the year 2012/13 and thereafter.

Share Options

34.

Q:

Some of our former employees/directors had realized gains during the 12-months to 31 March Year X by the exercise of share options previously granted to them. Should we submit a form IR56B in respect of each person's realized gains?

A:

Yes, in respect of the gains realized, you should file a form IR56B for each person. You are required to --

- report the amount of gains in item 11(j) of the form IR56B;

- where there is only one exercise, assignment or release transaction, show the date of transaction as both the start date and the end date in item 10 (i.e., the space for inserting the period of employment); but

- where there were more than one transaction, show the date of the first transaction as the start date and the date of the last transaction as the end date in item 10; and

- append to the forms IR56B a control list showing, in respect of each former employee/director -

- name & HKIC/passport number with place of issue; and

- the sheet number of the relevant form IR56B.

N. B.

For any former employee who has ceased to earn income chargeable to Hong Kong Salaries Tax (such as by reason of retirement or departure from Hong Kong), you are required to file a form IR56B only when the gains realized during the year of assessment have exceeded the basic personal allowance for that year of assessment.

35.

Q:

If a new employee was conditionally granted a share option prior to commencement of his employment in Hong Kong and that option could only be exercised after rendering services in Hong Kong, is it necessary to report this information to the IRD? When to report? How to report?

A:

Yes, you are required to supply the information to the IRD. From the information given, it would appear that the employee concerned must be liable to Salaries Tax so that you would have to file a form IR56E for him within 3 months after employing him. You should confirm in item 13 of the form IR56E that this new employee has been conditionally granted a share option that can be exercised after rendering services in Hong Kong. In addition, you are also required to supply a list, as an attachment to the form IR56E, showing details of :

- the number and type of shares covered by the option;

- the consideration (if any) paid for the grant of the option;

- the consideration required to exercise the option; and

- the period within which the option must be exercised.

36.

Q:

If an employee is about to leave Hong Kong for good but he has not exercised all the share options granted to him by our company or other corporations, do we need to report this information to the IRD? When to report? How to report?

A:

Yes, you are required to supply the information to the IRD.

You are required to confirm in item 18 of the form IR56G (Notification by an employer of an employee who is about to depart from Hong Kong) that that employee has share options not yet exercised, assigned or released. In addition, you should also state

- the number of shares that can be exercised after termination of employment; and

- the date on which the relevant share options were granted to that employee.

Subsequently when that employee has realized gains from the exercise, assignment or release of the share options, you will be required to report the amount of gains in form IR56B. Please see answer to question 34 for details.

For more information, please refer to Departmental Interpretation and Practice Notes No.38 - Salaries Tax - Employee Share Option Benefits.

Please click here for more details on taxation of share awards and share options.

Filing of Computerized Employer's Return

37.

Q:

Our company has prepared electronic records of the annual Form IR56B through the IR56 Forms Preparation Tool or an approved self-developed software. How should I submit the electronic records to the Department?

A:

Employers can submit and upload the data file via the "Online Mode" (Login of the ITP/BTP Account of an Authorized Signer is required) or the "Mixed Mode" (Login of the ITP/BTP Account of the Authorized Signer is not required) of the Employer’s Return e-Filing Services.

When submitting the IR56B records in electronic format, employers can dispense with the filing of paper Forms IR56B. If the data file of IR56B records are uploaded via "Mixed Mode" of the Employer’s Return e-Filing Services, employers are also required to print and duly sign the cover page of the Control List (one page only) generated by the system. If for annual filing, the Control List must be submitted together with the paper Employer´s Return (Form BIR56A) and they should be signed by the same Authorized Signer.

Migrate employee's details from the data file prepared by “Direct Keying” to the IR56 Forms Preparation Tool

38.

Q:

Can I migrate the employee’s details from the DAT file or draft DAT file prepared by "Direct Keying" to the IR56 Forms Preparation Tool?

A:

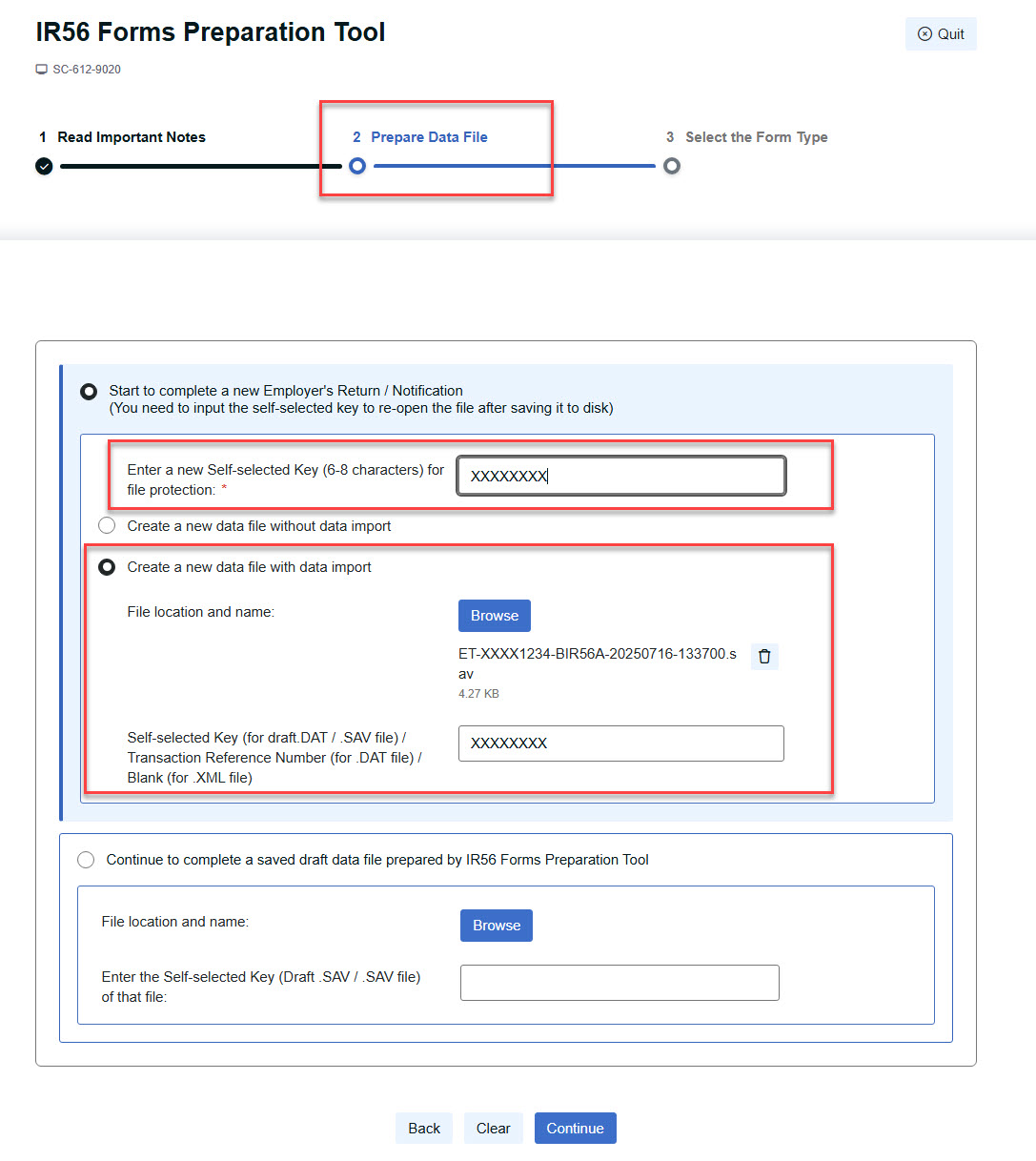

Yes, you can migrate the employee’s details from the data file to the IR56 Forms Preparation Tool through the option "Create a new data file with data import" in the IR56 Forms Preparation Tool with the input of the relevant Self-selected Key (for draft DAT file) / Transaction Reference Number (for DAT file).

For detailed steps, please refer to FAQ 40.

IR56 Forms Preparation Tool

39.

Q:

How to access the IR56 Forms Preparation Tool (“Preparation Tool’) under the New Tax Portals and are there any enhanced features?

A:

You can access the Preparation Tool through the following path:

Welcome Page of ITP/BTP > select “View All Services” > select “Employer’s Matters” > select “ IR56 Forms Preparation Tool”

Or you can click here for the direct access.

The Preparation Tool has been enhanced to cover the preparation of the forms IR56E, IR56G and IR56M. Thus, employers can now use the Preparation Tool to prepare all types of Forms IR56 data files for the submission via the Online Mode or Mixed Mode (except for form IR56G) of the Employer’s Return e-Filing Services.

A:

If you have previously prepared an annual IR56B data file by using the Preparation Tool (SAV file) / Pre-approved Self-developed Software (XML file) / "Direct Keying" of ER e-Filing Services (draft DAT file / DAT file ), you can import the employees’ details to prepare another data file for those employees by the following steps:

1) Choose "IR56 Forms Preparation Tool" under "Employer’s Matters".

2) After entering the Tool, input a new Self-selected Key for the data file to be created at "2. Prepare Data File" screen.

3) Choose "Create a new data file with data import".

4) Select the previously prepared data file from your own computer.

5) (i) If the imported data file is the SAV file prepared with IR56 Forms Preparation Tool / draft DAT file prepared by "Direct Keying" of ER e-Filing Services, the Self-selected Key of the previously prepared file is required to be input.

(ii) If the imported data file is the DAT file generated from the "Direct Keying" upon submission, the Transaction Reference Number of the relevant submission is required to be input.

6) Click "Continue" to proceed.

41.

Q:

I have prepared a new data file through the IR56 Forms Preparation Tool by importing the personal particulars of the employees from the DAT file of “Direct Keying”. When I clicked <Submit Later> or <Submit Now> after editing, an error message “ You are not allowed to submit a data file with no record or containing incomplete record.(612-E-0801)” is shown at the top of the screen. However, no record was marked with the triangle sign on the first page of the “Control List” page. How can I locate the incomplete records?

A:

You can click the sort button at the right-hand side of “No.” to arrange the Control List to show all the incomplete records first. The incomplete records would be listed starting from the first page of the “Control List” page and then followed by the completed records.

42.

Q:

Our company would like to use the IR56 Forms Preparation Tool to prepare a batch of additional Form IR56B, can I set the “Type of form” be defaulted as “Additional” so that it is not required to set the “Type of form” to “Additional” in every forms?

A:

When using the IR56 Forms Preparation Tool, you can make use of the pull-down menu “Default Type” in the section “Select the Employer’s Return/Notification to be completed” to pre-set the “Type of form” to “Additional”.

Completion of Form IR56M

43.

Q:

When completing the Form IR56M, if I do not know whether the recipient is a sole-proprietorship, partnership or unincorporated body of persons, should I fill in item 2 or item 3 of the form?

A:

If you do not know whether the recipient is a sole-proprietorship, partnership or unincorporated body of persons, please insert the name and business registration number of business in item 3(a) and skip item 2 and 3(b).

44.

Q:

When completing the Form IR56M, if the recipient is a sole-proprietorship and I only know the Business Registration Number of the recipient, but do not know the name and Hong Kong Identity Card Number of the sole-proprietor, can I just complete item 3(a) and skip item 3(b)?

A:

Yes, if you only know the Business Registration Number of the recipient, you can just complete item 3(a) and skip item 3(b) of the Form IR56M.

RSS

RSS  Share

Share Printer View

Printer View