Skip to main content

>

>

Download Forms

- Since built-in PDF viewer of some browsers may not be able to perform the functions embedded in the fillable PDF form properly, please download the fillable PDF form to local drive, open and complete the form by using the latest version of Adobe Acrobat Reader.

- Once you have installed Adobe Acrobat Reader, please ensure that it is set as the default PDF viewer (How to set).

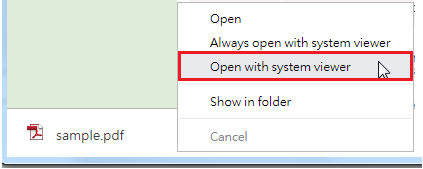

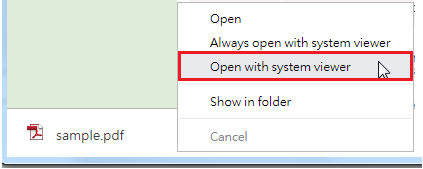

- For Chrome user, please right click on the downloaded PDF file in "download bar" at the bottom of the screen and select "Open with system viewer" (i.e. Adobe Acrobat Reader).

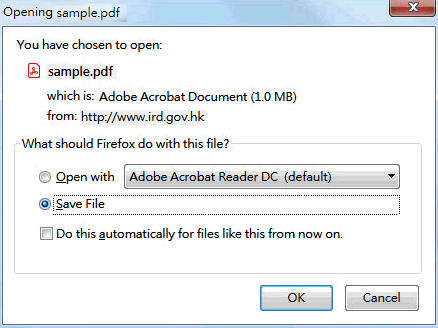

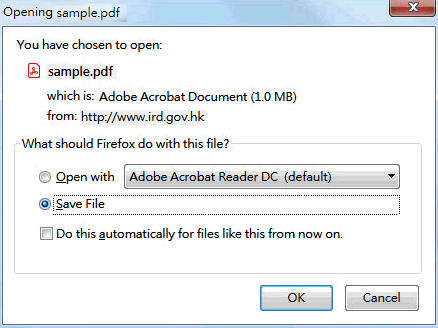

- For Firefox user (see below)

-

All supplementary forms must be submitted electronically through the electronic filing of Profits Tax Return services under the Business Tax Portal (BTP) or Tax Representative Portal (TRP), irrespective of the filing mode of Profits Tax Return for any year of assessment from 2019/20 to 2025/26 (both inclusive). Taxpayers must export the electronically completed form to XML file and upload the XML file via the electronic filing of Profits Tax Return services under the BTP or TRP for submission.

- Please refer to “Uploading of Data Files for Supplementary Forms and Supporting Documents to Profits Tax Return” for further details.

Download

RSS

RSS  Share

Share Printer View

Printer View