Housing Benefits

- How to calculate the taxable benefit of a place of residence

- Related Pamphlet

- How to calculate the taxable benefit of a place of residence

- If a flat is provided, a notional benefit, called "rental value" (RV), should be added to income.

- The RV is calculated at 4%, 8% or 10% of the net income after deducting outgoings and expenses (excluding self-education expenses), depending on the type of accommodation provided.

How to calculate the taxable benefit of a place of residence Type of AccommodationPercentageA residential unit / serviced apartment 10%2 rooms in a hotel, hostel or boarding house 8%1 room in a hotel, hostel or boarding house 4% - To ensure correct computation of the RV, you have to advise the Inland Revenue Department ("IRD") the type of accommodation provided and the relevant period very clearly.

- The employee may opt to substitute the "Rateable Value" of the property for the RV, if to do so can reduce the amount of ultimate amount of tax to be paid.

- If the employee is required to pay rent to the employer, that payment can be deducted to arrive at the RV. We call this "rent suffered".

- To know more about how item 12 of IR56B is to be completed, please study the following 3 examples (IR56E/F/G carries the same format):

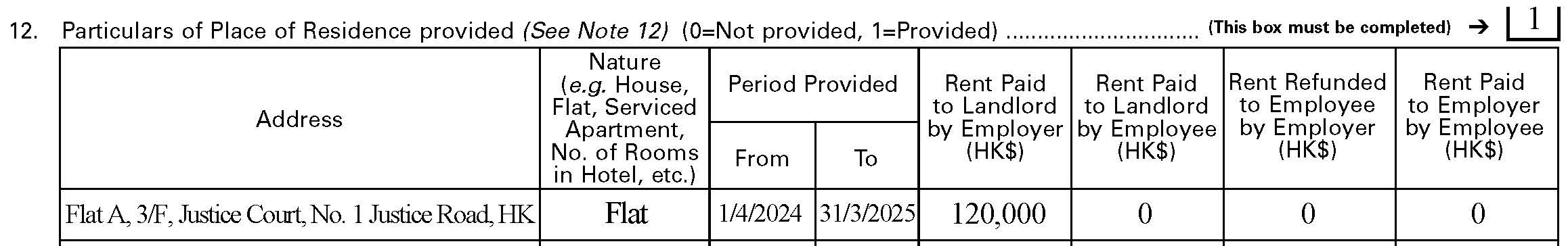

For 1 April 2024 to 31 March 2025, company X rented a flat at Flat A, 3/F Justice Court, No.1 Justice Road, Hong Kong and provided it to Ms Anna Chan (the employee) as her place of residence.

- Company X paid $120,000 to the landlord;

- Anna was not required to pay any rent, neither to the landlord nor to Company X

Company X should complete item 12 of IR56B for year of assessment 2024/25 in respect of Anna as follows:

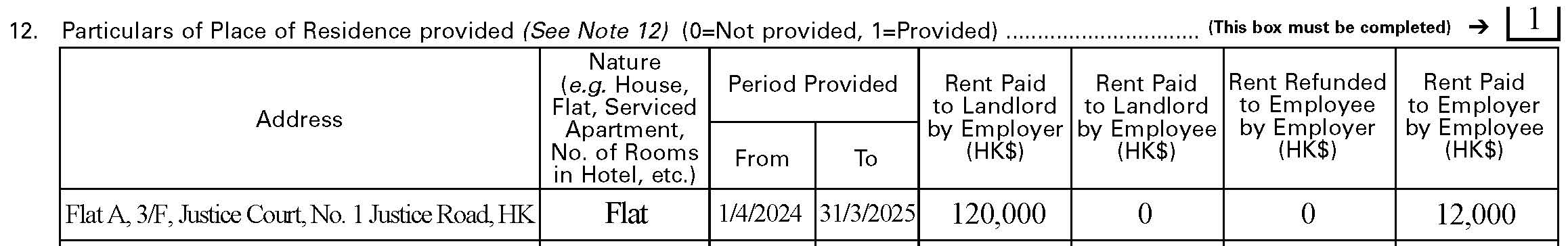

Example 2

Data same as Example 1 but this time Anna needed to pay $12,000 as rent to Company X.

Company X should complete item 12 of IR56B for year of assessment 2024/25 in respect of Anna as follows:

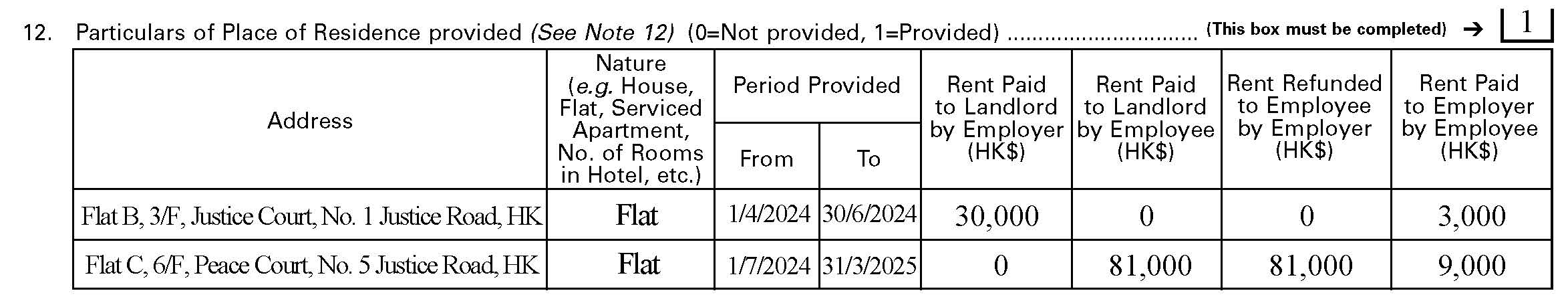

Example 3

For 1 April 2024 to 31 March 2025, Company Y provided a place of residence to its employee, Mr George Lau as follows:

From 1 April 2024 to 30 June 2024, Company Y rented a flat at Flat B 3/F Justice Court, No.1 Justice Road Hong Kong and provided it to Mr George Lau (the employee) as his place of residence.

- Rent paid by Company Y to landlord for the period was $30,000.

- Rent paid by George to Company Y was $3,000.

From 1 July 2024 to 31 March 2025, Company Y reimbursed the rent paid by George to the landlord in respect of his residence at Flat C 6/F Peace Court No.5 Justice Road Hong Kong.

- Rent paid by George to the landlord for the period was $81,000.

- Rent paid by George to Company Y was $9,000.

Company Y should complete item 12 of IR56B for year of assessment 2024/25 in respect of George as follows:

RSS

RSS  Share

Share Printer View

Printer View