General issues and rectification of returns

Receive a Tax Return but I have no income to report

1.

Q:

I have no income to report, but I have received a Tax Return - Individuals (BIR60) from the Inland Revenue Department. Do I have to complete it?

A:

Upon receipt of the Tax Return, you are required to complete and send it back to the Inland Revenue Department within the time limit specified in the return so that the Department can assess whether or not you are liable to tax for that year of assessment. The Department may issue a Tax Return - Individuals to you in the following situations:

| (i) | You had income from employment, rental income from solely owned property and /or business income from sole proprietorship business for the preceding year of assessment, and you have not given any notification to the Department regarding the permanent cessation of such income source(s).

|

| (ii) | You have elected "Personal Assessment", or "Joint Assessment" under Salaries Tax in your spouse's Tax Return and there is indication that you may have salaries income or other income chargeable to tax for that year of assessment. |

| (iii) | Tax Returns are issued once every few years to individuals previously found to be exempt from tax (e.g., property owners whose properties were self-occupied) so as to ascertain if their tax exemption status still stands. |

Whether notices will be issued for no tax liability cases

2.

Q:

I filed the Tax Return - Individuals to the Inland Revenue Department several months ago and I only have salaries income. Will the Department issue a notice of salaries tax assessment to me under the following situations?

| (a) | My salaries income is lower than the total amount of allowances and deductions entitled by me. |

| (b) | The salaries tax charged is less than the amount of tax reduction for the year. |

A:

If you have no salaries tax liability after deducting allowances and deductions, or the tax reduction, and your case does not involve tax refund of previously paid provisional salaries tax for the relevant year, no notice of salaries tax assessment will be issued to you. If necessary, you may request the Department for a written confirmation of your salaries tax position and tax computation.

3.

Q:

I hold a full-time employment as a manager of a trading company and concurrently have another part-time job. This year, I reported salaries income from my full-time employment when filing the Tax Return - Individuals but omitted to report my part-time income. In the notice of salaries tax assessment issued by the Department, only the income from my full-time employment was assessed as assessable income. I needed not pay tax for the year because of the tax reduction and I had already received the tax refund of previously paid provisional salaries tax. Subsequently, I informed the Department my omission in reporting the part-time income. That said, I did not receive any notice from the Department. In this regard, I was informed that I was still not liable to salaries tax for the year due to the tax reduction after assessing my part-time income. Can I apply for confirmation regarding my tax position?

A:

If, after adjustment of your assessable income, there is still no salaries tax payable or no change in salaries tax liability where no refund of tax is involved, no notice will be generated to you. If necessary, you may request the Department for a written confirmation of your salaries tax position and tax computation.

"Married Person's Allowance", "Joint Assessment" , "Personal Assessment", or nominate my spouse to claim deduction of "Home Loan Interest"

4.

Q:

I am married. How should I claim "Married Person's Allowance", elect "Joint Assessment" or "Personal Assessment", or nominate my spouse to claim deduction of "Home Loan Interest"?

(ii) If we have elected "Joint Assessment" or "Personal Assessment" but such election proves disadvantageous, will the Inland Revenue Department inform us? Do we have to withdraw the election?

A:

| (i) | (a) |

Claim for "Married Person´s Allowance"

|

| (b) |

Election for "Joint Assessment"? Generally speaking, if both married person and the person´s spouse have salaries income and one of them has assessable income lower than his/her entitlements to allowances and concessionary deductions, election for Joint Assessment will be advantageous. To make an election for Joint Assessment, both of them have to complete their own tax returns. Please see Example. If only one spouse has salaries income and the other does not and that spouse has not elected for Personal Assessment separately, there is no need to elect "Joint Assessment". Under Salaries Tax, so long as the salary-earning spouse has completed Part 12.1 of the Tax Return properly, "Married Person´s Allowance" will be granted. |

|

| (c) |

Election for "Personal Assessment"? There is no need to elect "Personal Assessment" if you only have salaries income. You may claim allowances and deductions under Salaries Tax. However, if you earn rental income or have business profits, you should consider if the election for "Personal Assessment" can reduce your overall tax liability. For instance, if you have borrowed money to purchase a property for letting, deduction of mortgage interest from your rental income can only be claimed when you elect "Personal Assessment". From the year of assessment 2018/19 onwards, eligible married taxpayers can elect for "Personal Assessment" separately from their spouse or jointly with their spouse. However, they are only entitled to "Married Person Allowance" if they have elected for "Personal Assessment" jointly with their spouse. The spouse of married taxpayers must sign in Part 13 of the Tax Return to confirm their agreement to elect "Joint Assessment" or "Personal Assessment" jointly with their spouse. |

|

| (d) | Nomination of spouse to claim deduction of "Home Loan Interest" is applicable only if your spouse has no income chargeable to tax (including rental income, salaries income and business profits). If your spouse has income chargeable to tax, the law does not permit nomination. Each spouse has to claim the deduction in his / her own tax return. However, you may seek the full deduction of "Home Loan Interest" through the election for "Joint Assessment" or "Personal Assessment" jointly with your spouse. (Please refer to Question 32) |

|

| (ii) |

Yes, you will be informed if your election proves disadvantageous. Basically, both "Joint Assessment" and "Personal Assessment" are tax relief, and the election for one or the other depends on which of them will give you the appropriate tax relief. In practice, the Inland Revenue Department will only assess you under "Joint Assessment", "Personal Assessment" elected separately or jointly with your spouse if it gives you tax advantage. Normally, if you have made an election that is proven disadvantageous, you will be informed by way of an ´Assessor Note´ in the relevant notice of assessment. As explained above, you / your spouse are not required to tender a notice of withdrawal. |

|

Documentary evidence in respect of my claim for exemption of income and deduction for expenses

5.

Q:

I want to claim exemption of income and deduction for expenses. Should I submit documentary evidence with the Tax Return - Individuals?

A:

If you claim exemption of salaries income under section 8(1A)(c) of the Inland Revenue Ordinance or relief under Double Taxation Arrangements between Hong Kong and other jurisdictions, you should submit the supporting documents with the return (Please refer to Question 21). However, please do not submit any documentary evidence in support of other deduction claims. They should be retained for a period of 6 years after the expiration of the relevant year of assessment. You should be able to present them to the Assessor for verification when required.

Settled the tax prior to departure, returned to Hong Kong and became employed again

6.

Q:

I ceased to be employed on 31 July 2024 and departed Hong Kong for good on 1 August 2024. I had already settled all my tax liabilities prior to departure. I returned to Hong Kong on 30 September 2024 and became employed again on 16 October 2024. How should I report my employment income after my returning to Hong Kong?

A:

Salaries Tax is assessed on the basis of actual income of the year of assessment (i.e. 1 April to 31 March of the following year). Since you had settled your tax liabilities in respect of the income for the period 1 April 2024 to 31 July 2024 before you departed Hong Kong on 1 August 2024 you will only be required to inform the Assessor in writing within 4 months after the end of the year of assessment (i.e. before 31 July 2025), of details of your employment income for the period 16 October 2024 to 31 March 2025, including the name of the employer, the capacity employed, the employment period and the amount of income. Upon receipt of this information, the Assessor will issue another Tax Return - Individuals for 2024/25 for you to report your income after you returned to Hong Kong.

Errors / omissions discovered in tax return after submission

7.

Q:

I have discovered errors / omissions in a tax return submitted to the Inland Revenue Department and have not yet received the notice of assessment. How should I correct the errors?

A:

If you filed your tax return by eTAX – Individual Tax Portal (ITP), you can correct the errors / omissions via "Make a Request / Reply" after you have logged in your ITP Account. For details, please see Amendment or Supplement to Return already submitted through the Internet.

If you wish to amend the information in a paper tax return already submitted, you have to write to the Assessor. Please furnish the amended information according to the required format of the tax return; or, you may use the IR Forms for making the relevant claims. The following table illustrates the amended information to be furnished / the appropriate IR Form to be completed:

| Errors / omissions discovered in tax return already submitted and notice of assessment not yet received | Amendment/ correction required | ||

| (a) | Income omitted / understated | Furnish particulars of the income - | |

| (i) |

Salaries income details including:

|

||

| (ii) |

Solely-owned properties income details: Report according to the format of Part 3 - ´Property Tax´ of the tax return. |

||

| (iii) |

Sole Proprietorship business details: Report according to the format of Part 5 -´Profits Tax´ of the tax return. |

||

| (b) | Deduction / allowance over-claimed

|

Give particulars of the over-claimed deduction / allowance. |

|

| (c) | Having income chargeable to Salaries Tax but forgot to elect "Joint Assessment" | If you do not elect for Personal Assessment separately from your spouse and Joint Assessment is advantageous to the couple, Form BIR50E will be issued inviting the couple to elect for "Joint Assessment". |

|

| (d) | Having property income or business assessable profits but forgot to elect "Personal Assessment" |

Complete Form IR76C if eligible. | |

| (e) | Forgot to claim deduction for "Home Loan Interest" or "Interest payments to produce rental income from properties" |

Complete Form IR6072. | |

| (f) | Forgot to claim deduction for Domestic Rents |

Complete Form IR6823. | |

| (g) | Forgot to claim deduction for "Qualifying Premiums paid under Voluntary Health Insurance Scheme Policy" |

Complete Form IR6173. | |

| (h) | Forgot to claim deduction for Assisted Reproductive Service Expenses |

Complete Form IR831. | |

| (i) | Forgot to claim deduction for Qualifying Annuity Premiums and Tax Deductible MPF Voluntary Contributions |

Complete Form IR831. | |

| (j) | Forgot to claim deduction for "Dependent Parent / Grandparent Allowance" or "Elderly Residential Care Expenses" |

Complete Form IR6071. | |

| (k) | Forgot to claim deduction for "Child Allowance" and "Dependent Brother or Dependent Sister Allowance" |

Complete Form IR6044. | |

| (l) | Forgot to notify Change of Address

|

Complete Form IR1249. | |

8.

Q:

I have received my notice of assessment and discovered that it is incorrect. What should I do?

A:

If you wish to dispute the assessment, you must lodge a notice of objection in writing stating precisely the grounds of objection within one month after the issue date of the notice of assessment.

If the incorrectness is due to errors or omissions in the return already submitted, and you wish to amend the information in the tax return, you have to write to the Assessor. The following table illustrates the amended information to be furnished / the appropriate IR Form to be completed:

| Errors / omissions discovered in tax return already submitted and notice of assessment has been received | Amendment / correction required | |||

| (a) | Error or omission in the tax return previously submitted and the tax is excessively charged. | Lodge a written application for revision of assessment within 6 years after the end of the relevant year of assessment or within 6 months after the date on which the relevant notice of assessment was served, whichever is the later. State details of the error or omission and submit sufficient evidence to substantiate the claim. Take notice that the application for revision of assessment is not an alternate way to extend the time limit for lodging objection against a notice of assessment. If the time limit for lodging objection (i.e. within one month after the issue date of the notice of assessment) is missed, state the reasons preventing from lodging an objection within the specified time. See Objection and Appeals for details. Complete the relevant parts of the Form IR831 for the application for revision of assessment. If an eTAX – Individual Tax Portal (ITP) Account has been opened, apply for revision of assessment via the ITP account. If the claim is accepted, revised notice of assessment will be issued and the relevant tax will be refunded (if the tax has been paid) or discharged (if the tax has not yet been paid).

|

||

| (b) | Income omitted / understated | Furnish particulars of the income - |

||

| (i) | Salaries income details including:

|

|||

| (ii) | Solely-owned properties income details: Report according to the format of Part 3 - ´Property Tax´ of the tax return. |

|||

| (iii) | Sole Proprietorship business details: Report according to the format of Part 5 - ´Profits Tax´ of the tax return. |

|||

| (c) | Deduction / allowance over-claimed | Give particulars of the over-claimed deduction / allowance. |

||

Notes :

- You may obtain the relevant forms through our "Fax-A-Form Service" by dialing 2598 6001. Alternatively, you may download them under "Public Forms and Pamphlets" in the IRD Web site, www.ird.gov.hk.

- You have to quote your name, file reference number and the relevant year of assessment in all correspondence to the IRD.

Salaries drawn from my own business

9.

Q:

I have drawn salaries from my business. How should I report this income in the Tax Return - Individuals?

A:

If your business is a sole-proprietorship business or partnership business, salary paid to you should be included as part of your business profits and is chargeable to "Profits Tax" and not "Salaries Tax". For sole-proprietorship business, the salary paid should be declared as part of the business profits in item (7) [Assessable Profit] in Part 5 [Profits Tax] of the Tax Return - Individuals (please refer to the answer (ii) for Question 24) and should not be reported again under Part 4 [Salaries Tax] of the Tax Return. As for partnership business, the salary paid should be declared as part of the business profits and reported in Profits Tax Return (BIR52) for that business and should not be reported again under Part 4 [Salaries Tax] of the Tax Return - Individuals.

Note :

Do not file Employer´s Return of Remuneration and Pensions (IR56B) in respect of the amount of salaries drawn by you and / or your spouse from your sole-proprietorship / partnership business.

Requested by the employer to change my working status to self-employed.

10.

Q:

I work in the service industry and have been requested by my employer to change my working status from an employee to that of a self-employed so as to release my employer from the obligation in making Mandatory Provident Fund contributions for me. Should I report my income as business profits in the Part for Profits Tax in the Tax Return?

A:

Whether an income should be assessed to "Salaries Tax" or "Profits Tax" depends on its nature. If an employer-employee relationship exists between the payer and the taxpayer, the income will be regarded as salary income and should be reported by the taxpayer in Part 4 (Salaries Tax) of the Tax Return - Individuals. The fact that you were accepted as a self-employed person for the purposes of Mandatory Provident Fund contributions will not alter the nature of your income. The Inland Revenue Department will consider the facts of the case and decide whether you should pay "Profits Tax" or "Salaries Tax".

Property Tax

Solely / jointly owned or co-owned property

11.

Q:

I have let my property and received rent. How should I report this income? If the property is only jointly owned or co-owned by me, where should I report the income?

A:

If you are the sole owner of the property, please give details of the rent and other particulars in Part 3 [Property Tax] of the Tax Return - Individuals.

If you only own part of the property, please do not report the rental income in Part 3 of your tax return. This is because the rent received from a jointly owned or co-owned property should be reported separately in a Property Tax Return (BIR57). (Please refer to Question 33 for "Personal Assessment" and "Interest Deductions")

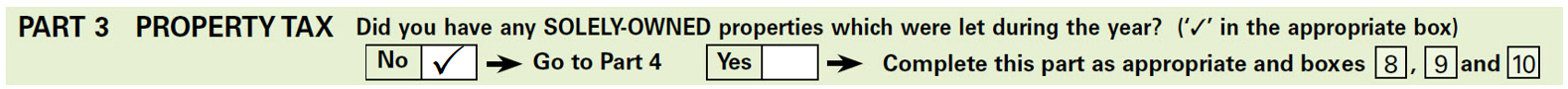

[Example]

In year of assessment 2024/25, Mr Lee had earned rental income from three properties, one of which was jointly owned or co-owned with another person. The particulars of these properties are as follows :-

| Property 1 | Property 2 | Property 3 | |

| Location | 3/F, 88 Yan Chee Street, Hong Kong | 5/F, 40 Chung On Street, Hong Kong | 8/F, 268 Luen Ming Street, Hong Kong |

| Share of Ownership | 100% | 100% | 25% |

| Rental Income | $120,000 | $300,000 | $180,000 |

| Rates paid by owner | $0 | $8,500 | $2,800 |

| Irrecoverable Rent | - | $35,000 | - |

| How to complete |

Mr Lee should give the details in respect of the solely-owned properties (i.e. Properties 1 and 2) in Part 3, and put down the relevant total figures in Boxes no. 8 to 10 on the right : |

Mr. Lee should not report the rental income from the jointly owned or co-owned property (i.e. Property 3). If Mr. Lee has not yet received his property tax return (BIR57), he should notify the department in writing.

Vacant or self-occupied property

12.

Q:

My property was vacant or occupied as my residence for the full year. How should I complete the Tax Return? Are the rates paid for the property deductible?

A:

You do not have to pay Property Tax if your property was vacant or occupied as your residence for the full year. There is no need for you to report such property in Part 3 of your tax return. However, you still have to complete Part 3 as follows :-

| (a) |

If you did not have any other solely-owned property which was let during the year, please put a"

|

|

| (b) | If you had other solely-owned properties which were let during the year, please put a " |

|

| Note: | You should put down the total number of properties let in Box no. 8. Please do not include in this number the properties that were vacant or occupied as your residence for the full year. | |

Rates paid on properties that were vacant or wholly used as your residence are not deductible. Please do not include such in item (4) of Part 3 (or Box no. 9).

Decoration expenses, management fees and government rent

13.

Q:

I have decorated my property before renting it out. I have also paid management fees and government rent for my property. Are these decoration expenses, management fees and government rent deductible from my rental income?

A:

| Under the provisions of the Inland Revenue Ordinance, only the following items are deductible under Property Tax: | |

| 1. | rates (net of rates concession) agreed to be paid and actually paid by the owner; |

| 2. | 20% allowance for repairs and outgoings; and |

| 3. | irrecoverable rent. |

Thus, the management fees, government rent and decoration expenses incurred by you are not deductible and they should not be included in Box no. 9 of Part 3 of the Tax Return - Individuals.

Salaries Tax

Bonus, allowance and commission

14.

Q:

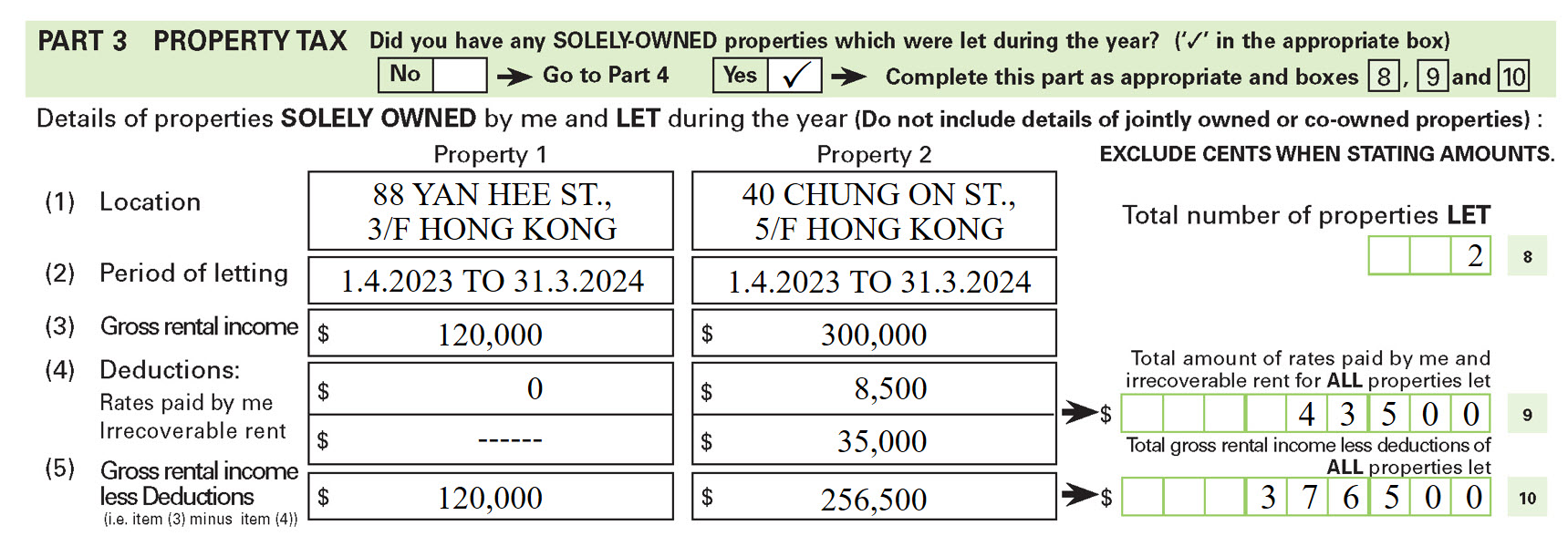

My salaries income includes bonus, allowance and commission. How should I report such income?

A:

You should add up all of these income and fill in Part 4.1 of your tax return by entering the total amount in item (1). You should also fill in Box no. 30 the grand total of all income from all of your employers (see example below). Besides, you should report the total amount of commission income in Box no. 33.

| [Example] | $ | $ | |

| Details of income from Company A | |||

| Salary | 80,000 | ||

| Commission | 5,000 | ||

| Bonus | 5,000 | 90,000 | |

| Details of income from Company B | |||

| Salary | 180,000 | ||

| Commission | 5,000 | ||

| Cash allowance | 5,000 | 190,000 | |

| 280,000 | |||

How to complete

Right to acquire shares

15.

Q:

My employer had granted me certain right to acquire shares in the year 2020. I exercised this right and acquired the shares on 1 August 2024. I have not sold any of these shares yet. Do I have to report these shares in this year´s tax return? If I have to pay tax, how is this computed?

A:

As you had exercised the right to acquire shares on 1 August 2024, you must report the relevant gain in the Tax Return - Individuals for the year of assessment 2024/25, and whether the shares have been sold is not a relevant consideration. For tax purposes, the relevant gain is to be quantified and taxed as follows:

open market value of shares at time of exercise

Less : amount of consideration given for the shares

Long service payment, severance payment and payment in lieu of notice

16.

Q:

Do I have to report in my tax return the long service payment, severance payment and payment in lieu of notice received upon termination of my employment?

A:

Sums paid to you as severance payments or long service payments strictly in accordance with the provisions of the Employment Ordinance are not assessable to salaries tax. The amount not assessable to salaries tax should be computed after the deduction of :

| (a) | contract gratuities based on length of service; |

| (b) | benefits attributable to employer's contributions paid under an occupational retirement scheme; and |

| (c) | accrued benefits attributable to employer's contributions held in a mandatory provident fund scheme or which have been paid. |

You need not report the sums computed as above in your tax return. However, you have to report sums that were paid in excess of your statutory entitlement. If you are not sure whether or not the long service or severance payment was made under the Employment Ordinace, you should report the total amount received by you and also supply full details.

Payment in lieu of notice accrued to you up to 31 March 2012 is not assessable to salaries tax. From 1 April 2012 and onwards, payment in lieu of notice, whether paid under an express or implied term of an employment contract (e.g. section 7 of the Employment Ordinance) will be assessed to salaries tax.

Pension

17.

Q:

Upon retirement, I received a lump sum and commenced to receive a monthly pension under a recognized occupational retirement scheme ("ROR scheme"). Should I report in my tax return the lump sum and monthly pension received?

A:

Any sum received by way of commutation of pension under a ROR scheme upon retirement is not taxable and you are not required to report the sum in your tax return. However, the exemption does not apply to monthly pension which is fully taxable and should be reported in your tax return.

18.

Q:

I am a pensionable civil servant. Upon retirement, I received a lump sum and commenced to receive a monthly pension. Should I report in my tax return the lump sum and monthly pension received?

A:

Any sum received by way of commutation of pension under the Pensions Ordinance, Pension Benefits Ordinance and Pension Benefits (Judicial Officers) Ordinance is not taxable and you are not required to report the sum in the tax return. However, the exemption does not apply to monthly pension which is fully taxable. You should report the monthly pension received in your tax return.

Contract gratuity

19.

Q:

I had completed my two years' contract of employment and received a lump sum contract gratuity. Then I renewed my contract with my employer for another two years, do I have to report the entire sum of contract gratuity in this year's tax return? Can I apply to spread it evenly as my income over the two years covered by the first contract?

A:

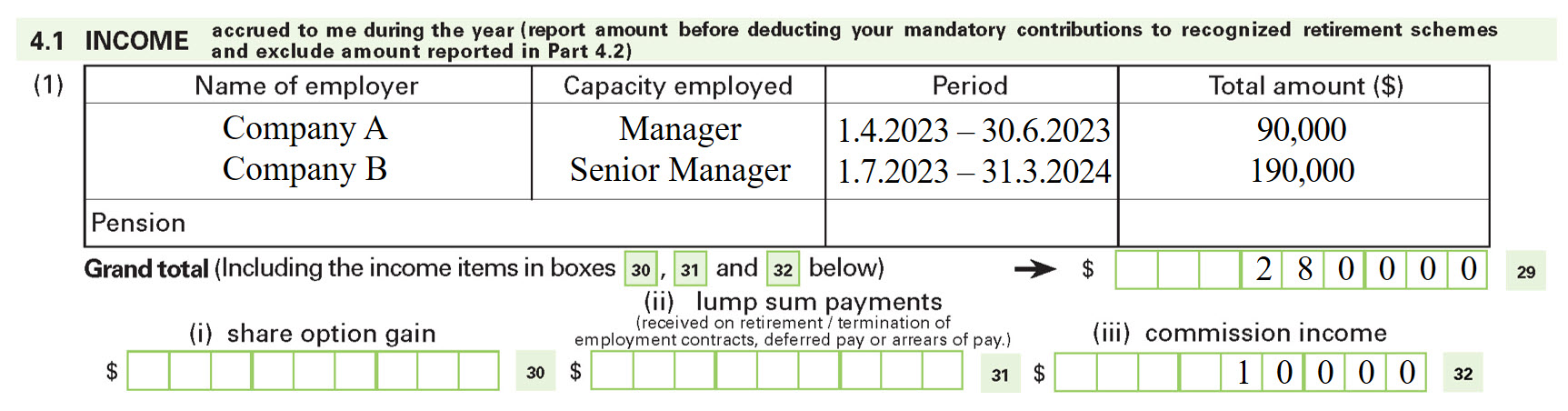

You must report this lump sum gratuity payment in this year´s tax return. Please include the amount of contract gratuity in "Total amount" of item (1), Part 4.1 of the tax return. You may apply to have the lump sum related back to the period in respect of which the payment was made.

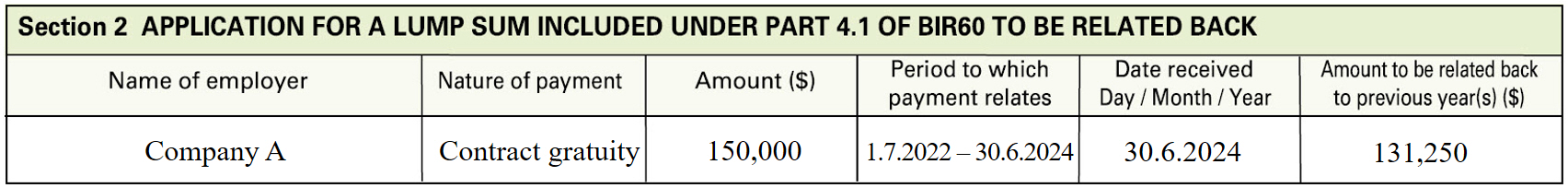

| [Example] | $ |

| Details of income from Company A during the year 2024/25 | |

| Salary | 372,000 |

| Contract gratuity (period : 1.7.2022 - 30.6.2024) | 150,000 |

| 522,000 |

Contract gratuity may be related back to relevant years as follows:

| 1.7.2022 - 31.3.2024 | $150,000 / 24 months x 21 months = $131,250 -- as income related back evenly to the years of assessment 2022/23 and 2023/24 |

| 1.4.2024 - 30.6.2024 | $150,000 / 24 months x 3 months = $18,750 -- as income for the year of assessment 2024/25 |

How to complete

Section 2 of Appendix to BIR60 should be completed as follows:

20.

Q:

I received a lump sum contract gratuity on 30 September 2024. Since no similar sum will be received in 2025/26, can I make a holdover request to exclude the lump sum from the computation of 2025/26 provisional salaries tax?

A:

Please refer to Answer 4 of the Frequently Asked Questions on Application for Holdover of Provisional Tax.

Seconded by my employer to work in the Chinese Mainland

21.

Q:

I am seconded by my employer to work in the Chinese Mainland. I always stay there. However, my salaries are paid into my bank account in Hong Kong. Do I have to pay Hong Kong Salaries Tax? If I have already paid tax in the Mainland, can I apply for exemption of Hong Kong Salaries Tax?

A:

If your employer is a Hong Kong company but you only rendered services in Hong Kong during visits not exceeding a total of 60 days during the year of assessment, your salaries income for that year will be wholly exempt from tax. However, if you were present in Hong Kong for more than 60 days and had rendered services in Hong Kong during the relevant year of assessment, your income is wholly taxable. If you have paid Individual Income Tax in the Mainland on the income derived from services rendered in Mainland, you can claim relief by way of tax credit in respect of tax paid in Mainland under section 50 of the Inland Revenue Ordinance.

If you wish to claim the above relief, you are required to put a "![]() " in Box no. 6 of Part 2, then enter the gross amount of your income in Box no. 30 of Part 4.1 of the Tax Return - Individuals. Do not forget to provide details and supporting evidence (such as the tax receipts issued by the Mainland tax authorities, and detailed computation of amounts for which relief is sought) in Section 3 of the Appendix of the Tax Return - Individuals.

" in Box no. 6 of Part 2, then enter the gross amount of your income in Box no. 30 of Part 4.1 of the Tax Return - Individuals. Do not forget to provide details and supporting evidence (such as the tax receipts issued by the Mainland tax authorities, and detailed computation of amounts for which relief is sought) in Section 3 of the Appendix of the Tax Return - Individuals.

My employer provides me with a place of residence

22.

Q:

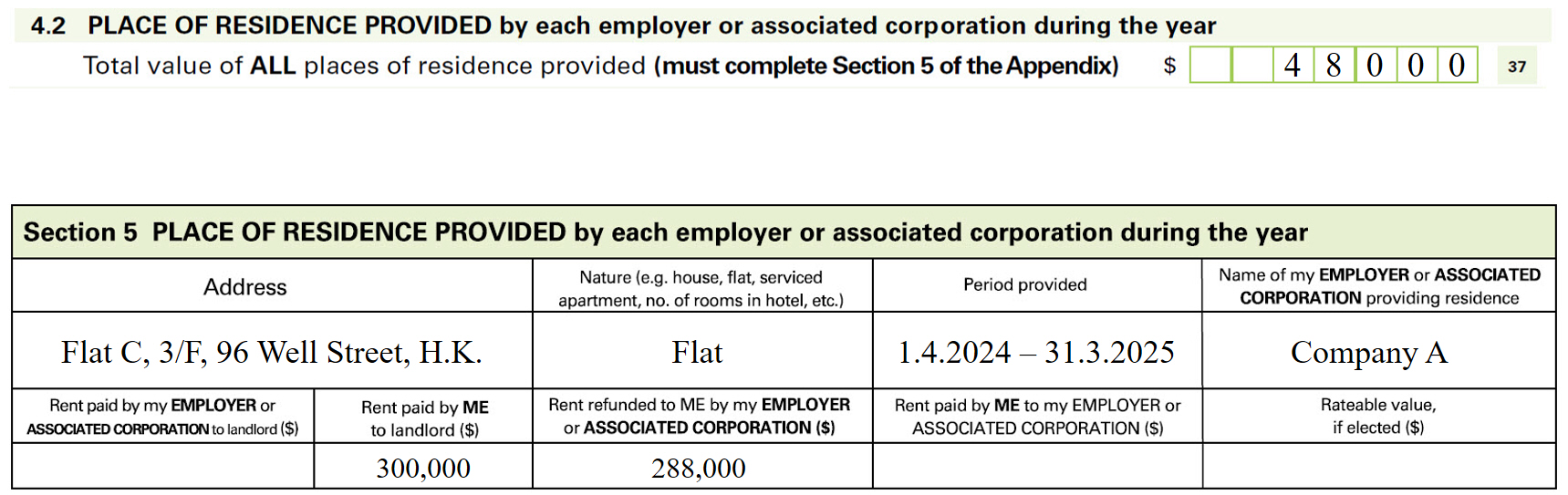

My employer provides me with a place of residence. How should I report "Total value of ALL places of residence provided" (Box no. 37) in Part 4.2 of Tax Return - Individuals and complete Section 5 of the Appendix?

A:

The "Total value of ALL places of residence provided" is the "rental value" less the rent, if any, suffered by you. The "rental value" is a certain percentage of the total income from the employer or associated corporation less outgoings and expenses (excluding charitable donations and self-education expenses). For a flat, that percentage is 10%. For accommodation in a hotel, hostel or boarding house, it is 8% for two rooms and 4% for one room. If this "rental value" is greater than the rateable value of the accommodation provided, you may elect to substitute it by the rateable value. If you share a flat with other employees, the rental value will be calculated as 4% if one room is provided to you and 8% for two.

If under the tenancy agreement you are responsible for the payment of rates and management fees, and your employer has accepted these as part of the costs of providing the accommodation for the purpose of making refund of rent to you, you may also include such rates and management fees in the column for "Rent paid by ME to landlord".

[Example]

Mr Wong´s income from Company A -- $600,000

Rent paid by him to landlord -- $300,000

Rent refunded to him by employer -- $288,000

Total value of ALL places of residence provided (Box no. 37)

=$600,000 x 10% - $(300,000 - 288,000)

=$48,000

How to complete

Deduction for "self-education expenses"

23.

Q:

How can I claim deduction for "self-education expenses"("SEE")?

A:

Deduction for SEE can be claimed if it is paid for a prescribed course of education. You are required to enter the amount of expenses paid during the relevant year of assessment in Box no. 39 of item (2), Part 4.3 of the Tax Return - Individuals.

However, if the expenses are reimbursed or reimbursable by your employer or other persons (such as the Government), they are not deductible and should not be claimed.

You need not attach any supporting documents to your completed tax return. You should retain them for future inspection, upon request by the Department. (Please refer to Question 5)

Profits Tax

"Gross income", "Turnover", "Gross profit" and "Assessable Profits"

24.

Q:

| (i) | Explain the difference of "Gross income", "Turnover" and "Gross profit" in Part 5 of the Tax Return - Individuals? |

| (ii) | How should I compute the "Assessable Profits"? |

A:

| (i) | "Gross income" comprises all income. It includes ordinary business income, proceeds from the sale of capital assets and any other non-taxable receipts whether or not derived from the principal activities of your business. | |

| "Turnover" is the income from your ordinary business. It is the income received/receivable from the sale of goods or services rendered. | ||

|

||

| [Example] | ||||||||||||||

|

||||||||||||||

| Income | ||||||||||||||

| $ | $ | |||||||||||||

| Turnover | 400,000 | 400,000 | ||||||||||||

| Less: Cost of goods sold | 250,000 | |||||||||||||

| Gross profit | 150,000 | |||||||||||||

| Proceeds from sale of machineries | 300,000 | |||||||||||||

| Gross income | 700,000 | |||||||||||||

| How to complete | ||||||||||||||

| Part 5 | Profits Tax | $ | ||||

| Item (3) | Gross income (including turnover and other income) | 700,000 | ||||

| Item (4) | Turnover | 400,000 | ||||

| Item (5) | Gross profit/(loss) | 150,000 | ||||

| (ii) | The "Assessable Profits" are the net profits for the basis period, arising in or derived from Hong Kong and calculated in accordance with the Inland Revenue Ordinance. You may make use of the proforma tax computation form to make the necessary adjustments to the amount of net profits per accounts to arrive at the amount of assessable profits. |

Took out a Business Registration Certificate but the business has no activity during the whole year

25.

Q:

If my sole-proprietorship business has ceased already and there was no business activity during the whole year, how should this be reported in the Tax Return?

A:

Cessation of business must be reported in writing to the Business Registration Office. To do so you may complete Form IRC3113 obtainable from the Business Registration Office. If you have a fax machine, you may dial 2598 6001 for our Fax-A-Form Service. You may also download the form under "Public Forms and Pamphlets" in the IRD Website, www.ird.gov.hk.

Even though there was no business activity, you still have to complete the business name and business registration number of the business in Part 5 and enter "0" for items (3) to (9) in this year´s tax return. After you have cancelled the business registration of your business, you need not report it in your tax returns for the years following.

Sole-proprietorship business changed to a partnership, or vice versa

26.

Q:

If my sole-proprietorship business has changed to a partnership during the year of assessment, or vice versa, do I need to report such a business in the Tax Return - Individuals?

A:

The point to remember is that you only need to furnish information in Part 5 of the Tax Return - Individuals in respect of businesses which were operated as sole proprietorships throughout the relevant year of assessment.

For a business that was partly operated as a sole-proprietorship and partly operated as a partnership during the year, the profits should be reported on a Profits Tax Return (BIR52). You are not required to report such a business in the Tax Return - Individuals.

Gross income of my sole-proprietorship business during the year was below $2,000,000

27.

Q:

The gross income of my sole-proprietorship business during the year was below $2,000,000. Do I need to retain this year's business records, and if so, for how long?

A:

Yes.

As the gross income of your sole-proprietorship business did not exceed $2,000,000, you are not required to submit the Balance Sheet, the Profits and Loss Accounts and the supporting schedules with your tax return.

However, according to Section 51C of the Inland Revenue Ordinance, any person carrying on a business in Hong Kong must keep sufficient business records of income, expenditure, assets and liabilities, in English or in Chinese, to enable his/her assessable profits to be readily ascertained. Records relating to any business transaction must be retained for at least 7 years. This period of 7 years should be counted from the date of completion of the transaction.

Can the proprietor of a business entitle to the basic or other tax allowances

28.

Q:

I am the proprietor of a business. Am I entitled to the basic or other tax allowances (such as child, single parent, dependent parent, dependent grandparent or dependent brother/sister allowances), and Home Loan Interest deduction?

A:

Profits from sole proprietorship/partnership businesses are taxed at the standard rate (15% for year of assessment 2024/25) under "Profits Tax". However, if you are eligible to elect "Personal Assessment", by doing so you may claim the following deductions and the tax on your income will be computed at the progressive rates applicable to "Salaries Tax":

| (a) | interest incurred on money borrowed for the purpose of producing property income (the amount deductible should not exceed the net assessable value of each individual property); |

| (b) | approved charitable donations; |

| (c) | elderly residential care expenses; |

| (d) | home loan interest; |

| (e) | qualifying premiums paid under Voluntary Health Insurance Scheme (VHIS) Policy; |

| (f) | qualifying annuity premiums and tax deductible MPF voluntary contributions; |

| (g) | domestic rents; |

| (h) | assisted reproductive service expenses; |

| (i) | business losses incurred in the year of assessment; |

| (j) | losses brought forward from previous years under Personal Assessment; and |

| (k) | personal allowances. |

If you are married and your spouse has assessable income, you can elect for "Personal Assessment" separately from your spouse or jointly with your spouse in Part 7 of the tax return. If you have elected "Personal Assessment" jointly with your spouse, the election must be made by both of you in Part 7 of the tax returns and each of you must sign in Part 13 of the other´s Tax Return - Individuals to confirm the election. Your total income (including salaries, rental income and business profits), net of the appropriate deductions, will be aggregated with that of your spouse to arrive at the joint total income of the couple for the purpose of computing your tax liabilities under "Personal Assessment". Normally, the tax payable on the joint assessment will be proportionately allocated to you and your spouse on the basis of your respective reduced total incomes. Notices of assessment will be issued to you and your spouse separately.

Interest Deduction

Interest deduction in respect of rented, vacant or self-occupied properties

29.

Q:

I owned several properties and they were put to different use - let, vacant or occupied as my residence. I wish to claim interest deduction for the purchase of my properties. Which parts of the Tax Return should be completed?

A:

It all depends on the type of properties (solely-owned or jointly owned or co-owned) and the usage (let, vacant or used as residence).

For solely-owned properties, details of rent should be provided in Part 3 of your tax return. Rental income from jointly owned or co-owned properties should not be reported in the Tax Return - Individuals. (Please refer to Question 11)

For properties that were vacant or occupied by you as residence for the full year, you need not report such properties in Part 3 of your tax return. (Please refer to Question 12)

If you wish to claim interest deduction, you should complete Part 8 of your tax return. However, interest paid for vacant property is non-deductible. (Please refer to Question 33)

The table below summarizes those parts of the Tax Return - Individuals that should be completed under different scenarios:

| Scenario 1 Property solely-owned & let out |

Scenario 2 Property jointly owned or co-owned & let out |

Scenario 3 Property used as own residence |

Scenario 4 Property vacant or for other use |

|

| Rental Income from the property | Complete Part 3 | Not applicable (To be reported in Property Tax Return) | Not applicable | Not applicable |

| Election for Personal Assessment | Complete Part 7 | Complete Part 7 | Complete Part 7 | Complete Part 7 |

| Total Number of Properties | Enter in Box no. 8 under Part 3 | Not applicable | Not applicable | Not applicable |

| Interest Deduction | Complete Part 8.1 to 8.3** [Note (1)] | Complete Part 8.1 to 8.3** [Note (1)] | Complete Part 8.1, 8.2 and 8.4** [Note (2)] | Not applicable |

| (**For re-mortgaged loan, also complete Section 10 of the Appendix) | ||||

| Note: | (1) | "Personal Assessment" must be elected in Part 7 if you wish to claim interest deduction for letting properties. |

| (2) | "Home Loan Interest" is only deductible from a person´s assessable income under "Salaries Tax" or from a person´s total income under "Personal Assessment". |

Nominate the spouse to claim deduction for the full amount of "Home Loan Interest" paid

30.

Q:

My spouse and I live in a property jointly owned by us. Can we nominate one of us to claim deduction for the full amount of "Home Loan Interest" paid?

A:

The amount of Home Loan Interest paid by each of you is computed according to your respective share of ownership in the dwelling. In the case of a joint tenancy, it is regarded as in equal shares.

If your spouse has no income chargeable to tax for the relevant year of assessment, he /she can nominate you to claim deduction in respect of the "Home Loan Interest" paid by him /her. To do so, please insert "![]() " in item (2)(a) under Part 8.4 (i.e. Box no. 75, 89 or 103). You should also complete Part 12.1 and invite your spouse to sign the declaration in Part 13 to indicate his/her agreement. Do not forget to complete the relevant boxes in Part 8 of your Tax Return - Individuals. (Please refer to Example 2 in Question 33) Your spouse would then be regarded as having been allowed the Home Loan Interest deduction for a year of assessment.

" in item (2)(a) under Part 8.4 (i.e. Box no. 75, 89 or 103). You should also complete Part 12.1 and invite your spouse to sign the declaration in Part 13 to indicate his/her agreement. Do not forget to complete the relevant boxes in Part 8 of your Tax Return - Individuals. (Please refer to Example 2 in Question 33) Your spouse would then be regarded as having been allowed the Home Loan Interest deduction for a year of assessment.

If your spouse has income chargeable to tax, nomination is not permitted under the law. He/she has to claim the deduction in his/her own Tax Return. However, you may consider election for "Joint Assessment" or "Personal Assessment" jointly with your spouse, so as to claim deduction of the full amount of Home Loan Interest paid. (Please refer to Question 32)

Deduction for the "Home Loan Interest" in jointly owned or co-owned property

31.

Q:

My spouse and I live in a jointly owned or co-owned by us. The mortgage interest is paid by me only. What amount can I claim as "Home Loan Interest" deduction?

A:

Since you own the dwelling as one of the joint owners or tenants in common, the amount of interest deductible is restricted to that portion of the total interest proportional to the number of joint tenants/share of your ownership. The amount allowable for deduction should not exceed the ceiling prescribed in the Inland Revenue Ordinance as proportionately reduced.

You should complete Part 8.1, 8.2 and 8.4. In Part 8.4, you should fill in your share of interest as mentioned above.

My spouse's income is below the personal allowance. Can he/she nominate me to claim deduction for the "Home Loan Interest" paid by him / her

32.

Q:

My spouse need not pay tax as he/she only had meagre income below the personal allowance. Can he/she nominate me to claim deduction for the "Home Loan Interest" paid by him/her?

A:

No.

Your spouse has to claim deduction for the "Home Loan Interest" in his/her own Tax Return. You may consider election for "Joint Assessment" or "Personal Assessment" jointly with your spouse under which you can claim the full amount of the relevant "Home Loan Interest" paid by you and your spouse.

| (i) |

If both you and your spouse have salaries income and your spouse has income less than the total of allowable "Home Loan Interest" and Personal Allowance, you and your spouse may elect "Joint Assessment" under Salaries Tax in Part 4.4 so that the relevant "Home Loan Interest" would be deductible from your aggregate assessable income (Please refer to the example below). |

| (ii) |

If you and/or your spouse has/have income other than salaries, and if you are eligible and have elected "Personal Assessment" jointly in Part 7, the allowable "Home Loan Interest" paid will be first deducted from your spouse´s income. Any part of the interest deduction not so utilized would be set off against your total income. |

However, any excess could not be carried forward to the following year.

[Example]

Year of assessment 2024/25:

Husband´s salary $500,000, Wife´s salary $150,000, Basic Allowance $132,000 each, Wife paid Home Loan Interest $80,000 for a property solely owned by her.

| Under Separate Assessment: | |

| Husband: | Net Chargeable Income = $500,000 - $132,000 = $368,000 Salaries Tax payable after the 100% tax reduction (capped at $1,500)* = $43,060 |

| Wife: | Net Chargeable Income = $150,000 - $132,000 - $80,000 = 0 Salaries Tax payable = 0 Balance of interest deduction $62,000 cannot be transferred to husband, nor carried forward to next year. |

Under Joint Assessment:

The interest paid by the wife will be deductible from their aggregate assessable income. In other words, the whole amount of $80,000 can be deducted in this example.

The aggregate Net Chargeable Income

= $500,000 + $150,000 - $264,000 - $80,000

= $306,000

Salaries Tax payable after the 100% tax reduction (capped at $1,500)* = $32,520

| *Note: | For 2024/25, 100% of the final tax payable under profits tax, salaries tax and tax under personal assessment would be waived, subject to a ceiling of $1,500 per case. |

The interest paid for acquisition of properties

33.

Q:

How can I claim interest deduction for the purchase of property? How should I complete the Tax Return to claim deduction if the property is only jointly owned or co-owned by me?

A:

For properties that were used as own residence or for letting purpose, no matter solely-owned or jointly owned or co-owned by you, you may claim interest deduction under "Salaries Tax" or "Personal Assessment" by completing Part 8 of the Tax Return.

Firstly, you have to provide details of the properties in Part 8.1 and 8.2. Secondly, depending on the usage of the properties, you have to complete Part 8.3 or 8.4. If a re-mortgaged loan is involved, you must also complete Section 10 of the Appendix.

| (1) | Complete Part 8.3 for the deduction of interest in respect of a loan obtained for the acquisition of a property for letting purpose. For jointly owned or co-owned properties, you should enter your share of interest payments in Part 8.3 (i.e. Box no. 73, 87 or 101) in accordance with your share of ownership (please refer to Example 1 below). | |

| Note: | You may claim such interest deduction only under Personal Assessment. Please complete Part 7 of the Tax Return to make a valid election for Personal Assessment. | |

| (2) | Complete Part 8.4 for deduction of Home Loan Interest. For jointly owned or co-owned properties, you should enter your share of interest payments in item (1) of Part 8.4 (i.e. Box no. 74, 88 or 102) according to your share of ownership (please refer to Example 2 below). | |

| Note: | Home Loan Interest Deduction is only allowable under "Salaries Tax" or "Personal Assessment". If you had only rental income or business income, you should elect "Personal Assessment" in order to obtain such interest deduction. |

|

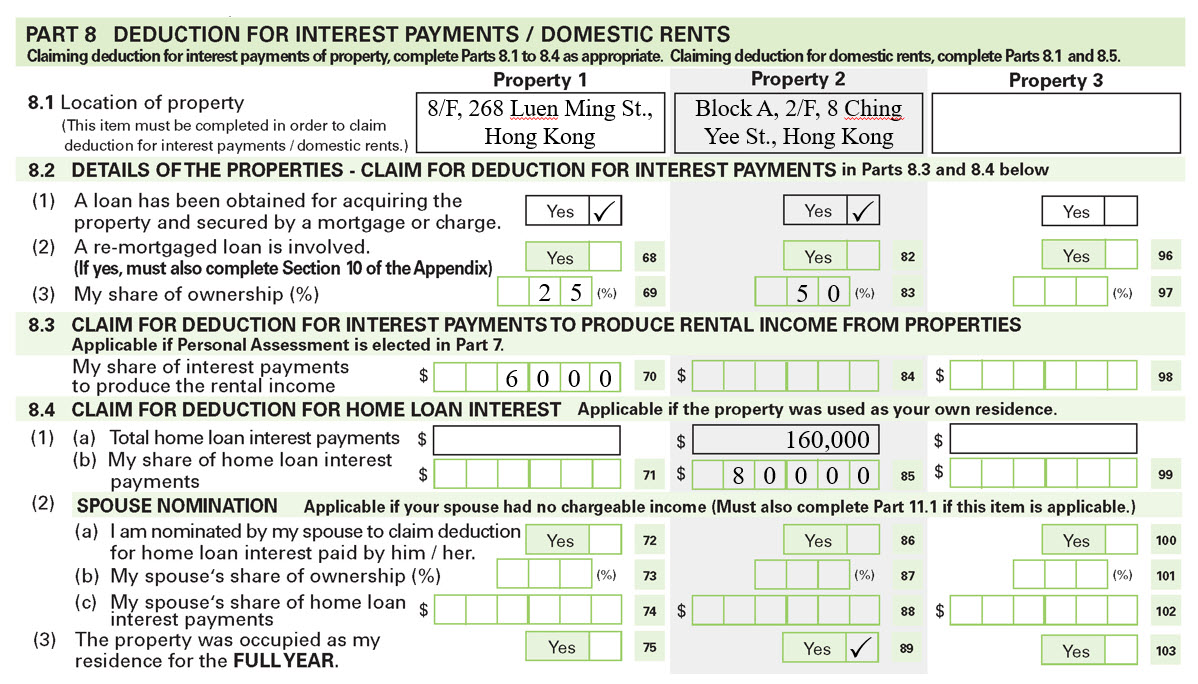

[Example]

Two examples of jointly owned or co-owned properties (year of assessment 2024/25):-

| Example 1 | Example 2 | |

| Location | 8/F, 268 Luen Ming Street, Hong Kong | Block A, 2/F, 8 Ching Yee Street, Hong Kong |

| Share of ownership | 25% | 50% |

| Usage | Letting | Own residence |

| Total Interest Paid | $24,000 | $160,000 |

| Share of interest payments: | $24,000 x 25% | $160,000 x 50% |

| = $6,000 | = $80,000 |

(Home Loan Interest will be apportioned according to the share of ownership, maximum amount allowable $100,000)

$100,000 x 50% = $50,000

How to Complete

Re-mortgaged property

34.

Q:

My property was initially mortgaged to Bank A and now re-mortgaged to Bank B. Is the total interest paid deductible? How should I complete the Tax Return?

A:

Whether you may claim interest deductions in the Tax Return depends on the usage of your property and the purpose for which the loan was borrowed:

| (i) |

If the loan was made for the purchase of your residence, you can claim deduction of "Home Loan Interest" under "Salaries Tax" or "Personal Assessment" by completing Parts 8.1, 8.2 and 8.4 of the Tax Return - Individuals and Section 10 of the Appendix. |

| (ii) |

If interest payments were incurred to purchase properties for letting, you have to elect "Personal Assessment" to claim interest deductions. For making election for "Personal Assessment", you should complete Part 7 and also provide further details in Parts 8.1 to 8.3 of the Tax Return - Individuals and Section 10 of the Appendix. |

If you re-mortgaged the property before the original mortgaged loan was fully repaid and you used the money borrowed under the re-mortgaged loan to repay the original loan (e.g., you re-mortgaged in order to enjoy a lower rate of interest offered by another lending institution), the Assessor must be informed of the amount of the re-mortgaged loan as well as the balance of the original loan that was repaid. You will not get full deduction of the interest paid under the re-mortgaged loan, if only part of it was applied for repayment of the original loan.

For example, you still owed Bank A $1,000,000 and you obtained a re-mortgaged loan of $1,500,000 from Bank B. Interest will be prorated on the basis of 1/1.5. In other words, only 2/3 of the interest paid by you to Bank B will be considered for deduction. If the re-mortgaged loan was obtained after the initial loan had been fully repaid, the whole of the interest paid to Bank B is non-deductible.

If you wish to claim interest deductions for your re-mortgaged loan, you have to furnish full details in respect of your re-mortgaged loan and the previous mortgaged loan in Section 10 of the Appendix.

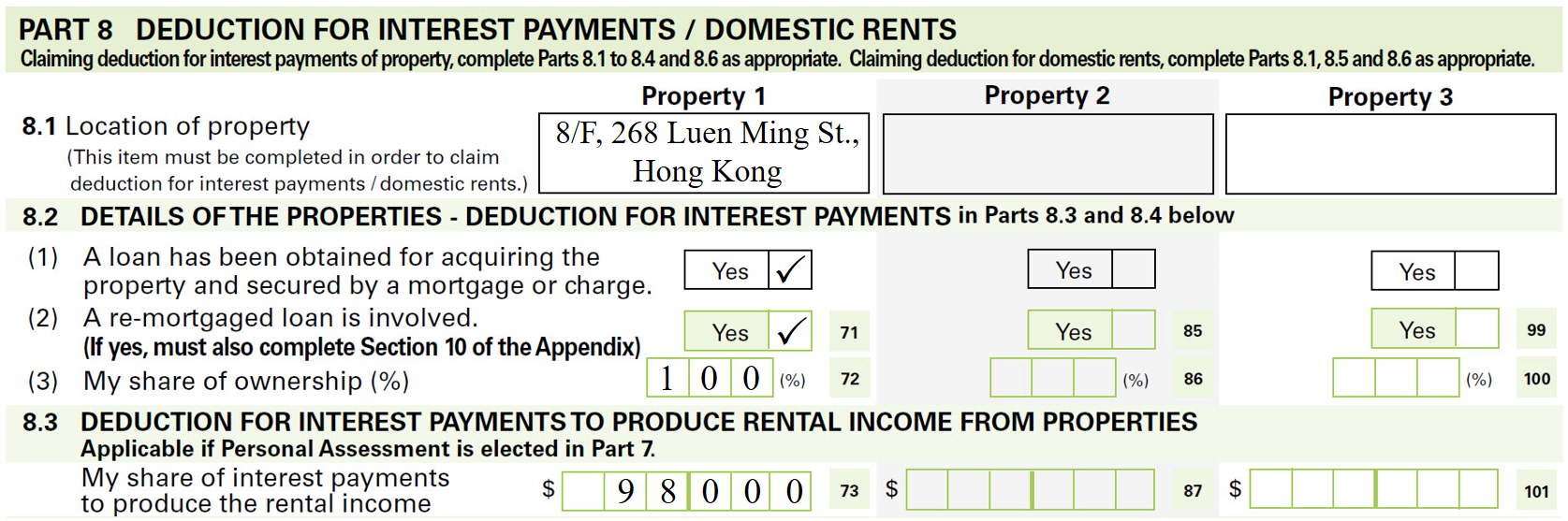

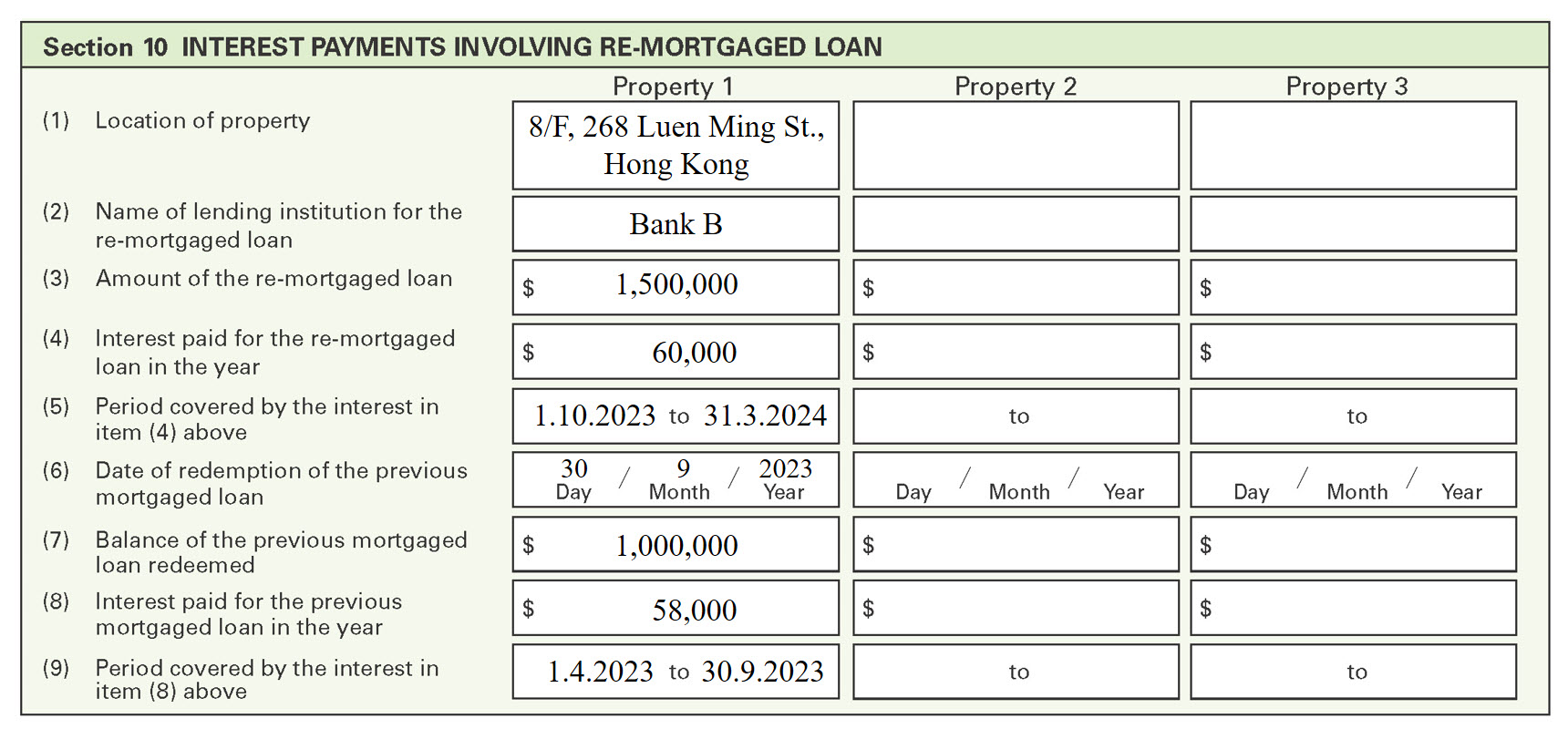

[Example]

A few years ago Mr. Lee obtained a loan from Bank A to purchase a property for letting. On 1.10.2024, that property was re-mortgaged to Bank B for a loan of $1,500,000. On the same day the loan from Bank A was redeemed and the amount of principal redeemed was $1,000,000. Mr. A incurred the following interest payments for the year of assessment 2024/25:-

| (1) | 1.4.2024 to 30.9.2024, interest to Bank A $58,000 |

| (2) | 1.10.2024 to 31.3.2025, interest to Bank B $60,000 |

Computation of deductible interests

| (1) |

1.4.2024 to 30.9.2024 : $58,000 (wholly deductible). |

| (2) | 1.10.2024 to 31.3.2025 : $60,000 x 1,000,000/1,500,000 = $40,000. |

The total deductible amount is $(58,000 + 40,000) = $98,000.

This amount should be entered in Part 8.3 (If the property concerned was used as residence and "Home Loan Interest" Deduction is claimed, the amount should be entered in Part 8.4).

Part 8 of the Tax Return and Section 10 of the Appendix should be completed as follows:

RSS

RSS  Share

Share Printer View

Printer View