Business Tax Portal (BTP)

- Overview

- Getting Started with BTP

- Users under BTP

- Account Registration and Management under BTP

- Online Services Available under BTP

- Frequently Asked Questions

- More Information on Other Portals under eTAX

back to New Tax Portals under eTAX

BTP is a multi-user platform dedicated for Businesses to handle tax and/or business affairs in a more convenient and efficient way. After registered with BTP, Businesses can submit their tax returns online, view their e-filed tax returns and tax assessments issued, request to amend an assessment, and communicate with the IRD on other tax related matters. Additionally, the BTP also provides a channel for e-filing of Employers’ returns, and conducts matters relating to stamp duty, certificate of resident status and business registration.

Login / Register to enjoy the benefits brought forth by BTP.

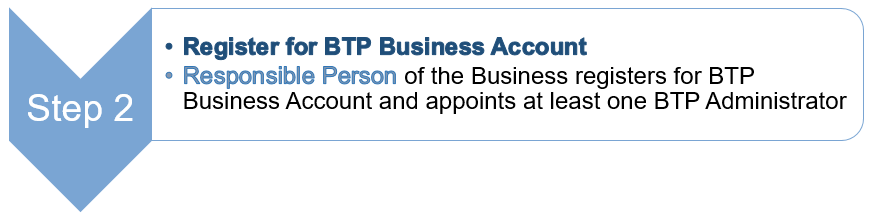

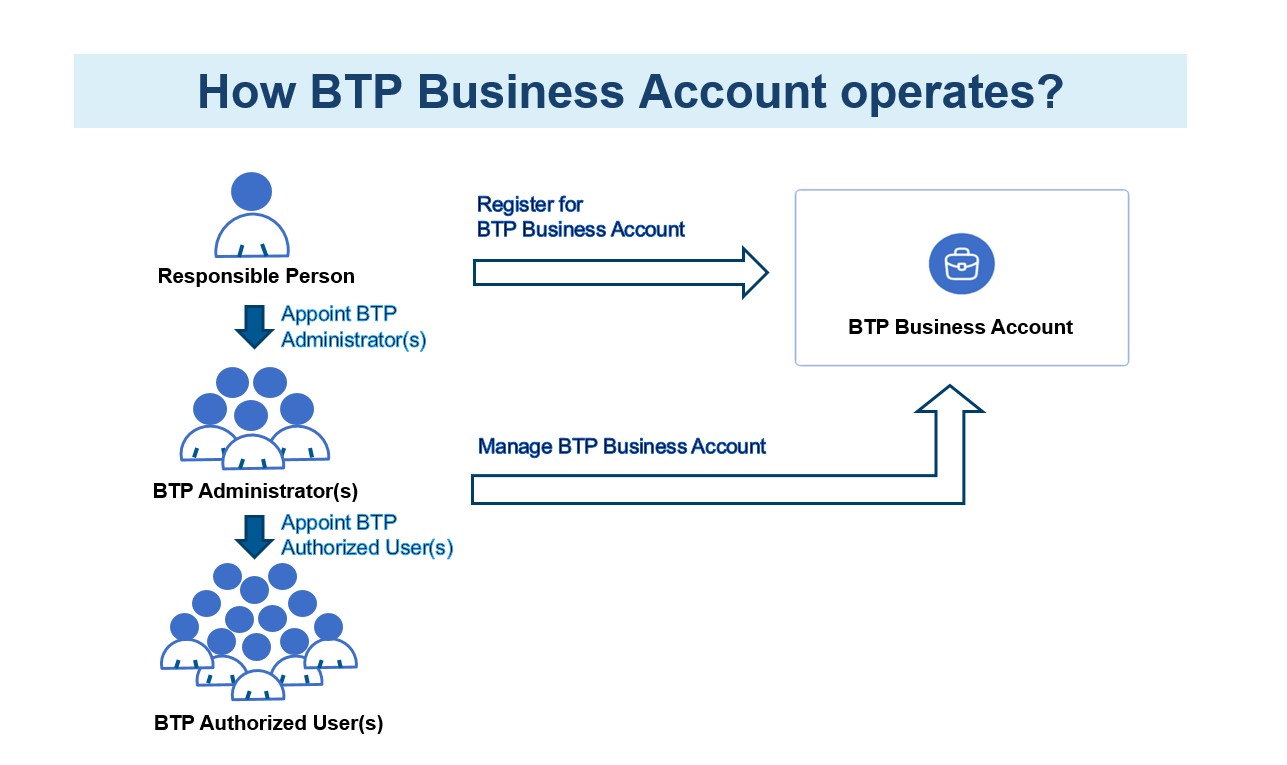

To access the online services available under BTP, the Responsible Person of the Business needs to first open a BTP Business Account, then appoint BTP Administrator(s), who are responsible for managing the BTP Business Account and in turn appoint other BTP Authorized User(s) for the Business. Only those BTP Administrator(s) and BTP Authorized User(s) appointed by the Business can handle tax and/or business affairs of the Business under BTP.

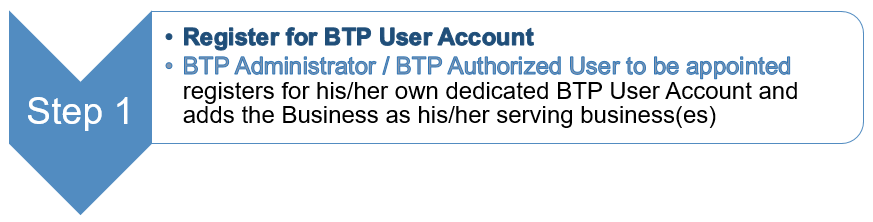

Quick Steps

| BTP Administrators / BTP Authorized Users are ready to use the BTP Online Services! |

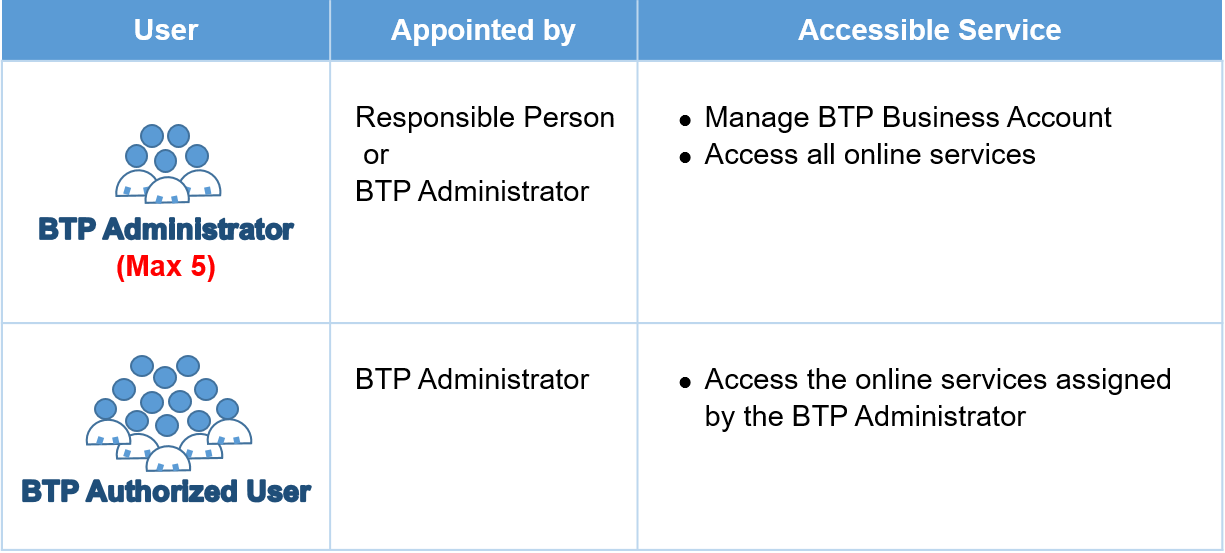

The Responsible Person of the Business can appoint BTP Administrators, who are responsible for managing the BTP Business Account and in turn appoint other BTP Administrator(s) and BTP Authorized User(s) for the Business. BTP Administrators are also given right to access all online services available under BTP while BTP Authorized Users' right of access to the online services is assigned by the BTP Administrators. Each BTP Business Account can have no more than five BTP Administrators while the number of BTP Authorized Users is unlimited.

Account Registration and Management under BTP

1. BTP Business Account Registration

To access the online services available under BTP, a Business needs to open a BTP Business Account. Only the Responsible Person (RP) of the Business can register for a BTP Business Account.

Depending on the legal form or arrangement of the Business, the RP must be a natural person* in one of the following capacities:

| (a) | director or company secretary of a corporation; | ||

| (b) | partner in a partnership; | ||

| (c) | general partner in a limited partnership fund; | ||

| (d) | principal officer of a body of persons; or | ||

| (e) | sole proprietor of a sole proprietorship business. | ||

* For a Partnership without natural person partner, the Corporate Partner can register the BTP Business Account for the Business as RP.

Just a few steps to register for BTP Business Account: -

| 1 | Read Terms and Conditions | ||

| 2 | Authenticate Your Identity | ||

| 3 | Provide Details of BTP Business | ||

| 4 | Appoint BTP Administrator | ||

| 5 | Provide Your Contact Details | ||

| 6 | Confirmation | ||

| 7 | Acknowledgement | ||

Ways to open BTP Business Account

There are two ways to open BTP Business Account:

- Register account one by one

- Register accounts by Bulk Upload

Register for BTP Business Accounts by Bulk Upload NEW

The Bulk Upload function is available for Corporations only. The common Director or Company Secretary (i.e. the RP) of a group of companies can use this function to register up to 500 BTP Business Accounts for the Group in one go.

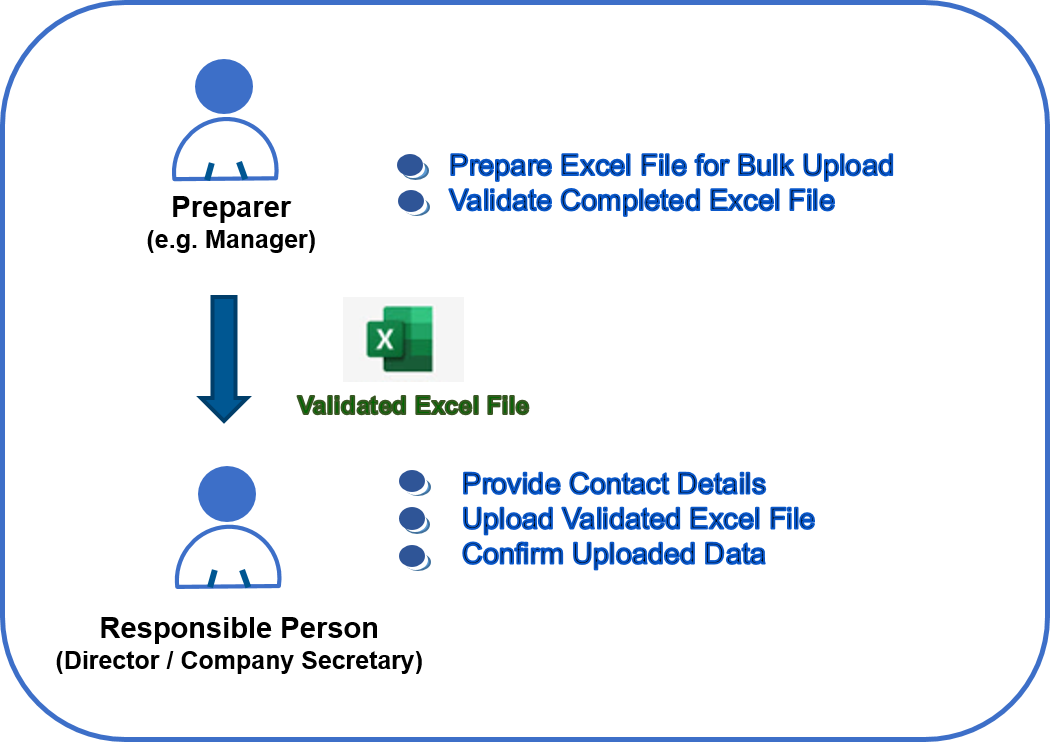

The RP may assign other individuals within the Group to prepare the Excel file for Bulk Upload. This person (i.e. the Preparer) can make use of the “Validate completed Excel file” feature provided in the “BTP Business Account Registration” function to check and rectify the records in the file based on the rejection reasons given in the Results Report until all records in the file are accepted for batch processing. The RP can then register for BTP Business Accounts in bulk by uploading the validated Excel file.

Excel Template

You can download the Excel Template here directly by clicking the icon below. The Template provides a user guide on how to prepare the Excel file and some points to note.

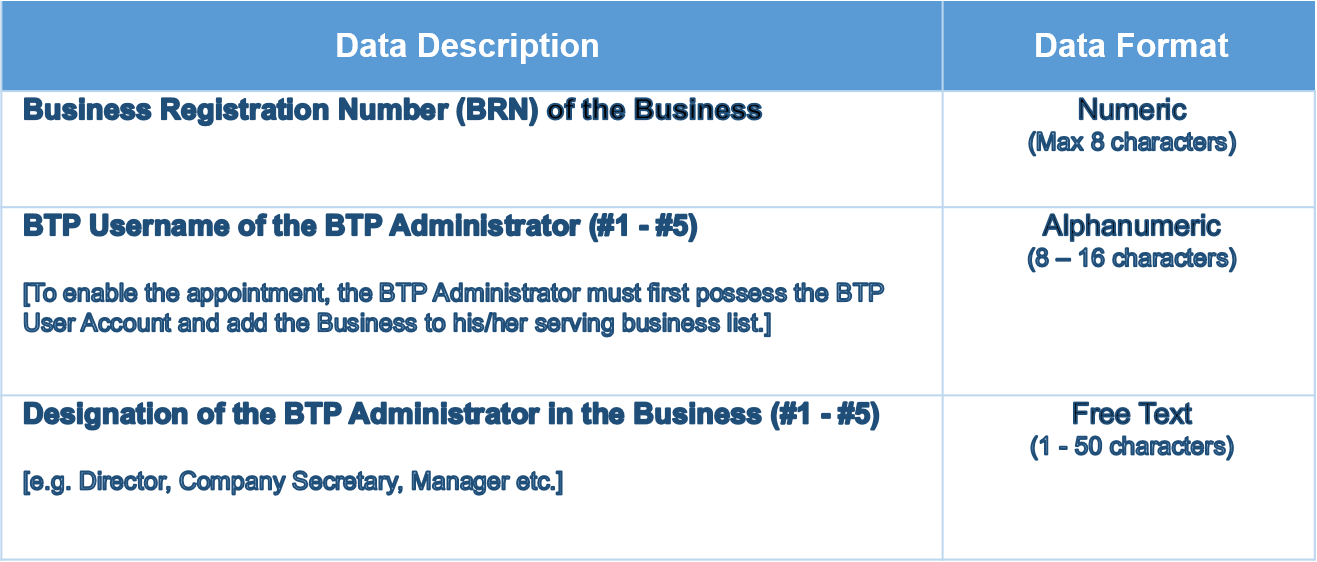

You are required to fill in the following details for each Business in the Excel file.

| Points to Note: | |||

| 1. | The RP will need to verify his/her identity by using one of the three digital authentication mechanisms available: | ||

| (i) | iAM Smart | ||

| (ii) | Individual Tax Portal (ITP) TIN & Password* | ||

| (iii) | Personal Digital Certificate | ||

| * If the RP chooses to verify his/her identity through ITP, he/she will be redirected to the login page of ITP. The RP should ensure that he/she can log into the ITP before starting the registration. | |||

| 2. | The RP is required to appoint BTP Administrator(s) who is/are responsible for managing the BTP Business Account. The RP can appoint himself/herself and/or others as BTP Administrators and each BTP Business Account can have no more than five BTP Administrators. The BTP Administrator to be appointed must register for his/her own BTP User Account first and add the Business to the serving business list kept in his/her account profile in order to activate the appointment. | ||

| 3. | In case of Corporation, registration is subject to approval as the RP’s identity will be verified against the record kept by the Companies Registry. | ||

| 4. | Both RP and appointed BTP Administrator(s) will receive notifications when the BTP Business Account is ready for use. For bulk registration, only the RP will be informed of the registration result. | ||

For e-Demos and User Guides about BTP Business Account Registration (including Register for BTP Business Accounts by Bulk Upload NEW), please visit the Learning Resources Centre Page.

2. BTP User Account Registration

The Responsible Person (RP) and the BTP Administrator(s) may designate and appoint other individuals within the Business as BTP Administrator(s) or BTP Authorized User(s). To activate their appointments, these individuals need to register for their own dedicated BTP User Account first and add the Business to their serving business list kept under their account profile.

Before registering for a BTP User Account, an individual must possess an Individual Tax Portal (ITP) Account. The BTP User Account is for business-use and is distinct from the ITP Account that is designated for handling individual tax affairs.

Access to the Online Services under BTP shall only take effect after the BTP User Account registration is complete and that individual is appointed as a BTP Administrator or BTP Authorized User.

Just a few steps to register for BTP User Account: -

| 1 | Read Terms and Conditions | ||

| 2 | Authenticate your identity with ITP | ||

| 3 | Create BTP Username & Password | ||

| 4 | Set up BTP User Account Profile | ||

| 5 | Provide Details of BTP Business(es) You Serve | ||

| 6 | Confirmation | ||

| 7 | Acknowledgement | ||

| Points to Note: | |

| 1. | You must possess an ITP Account for verifying your identity during the registration of a BTP User Account. You will be redirected to the login page of ITP for authentication. Please ensure that you can log into the ITP before starting the registration. |

| 2. | BTP User Account is your own dedicated account for business use. You will have to provide your BTP Username to your serving business(es) for appointing you as the BTP Administrator or BTP Authorized User. As the BTP Username cannot be changed once the registration is completed, please select your BTP Username carefully. |

| 3. | To allow your serving business(es) to appoint you as its BTP Administrator or BTP Authorized User, you have to add the Business Registration Number of such business(es) to your Serving Business List. |

| 4. | You can opt in your account profile to receive an e-alert email whenever an e-message is sent to the Business under BTP. |

For e-Demos and User Guides about BTP User Account Registration, please visit the Learning Resources Centre Page.

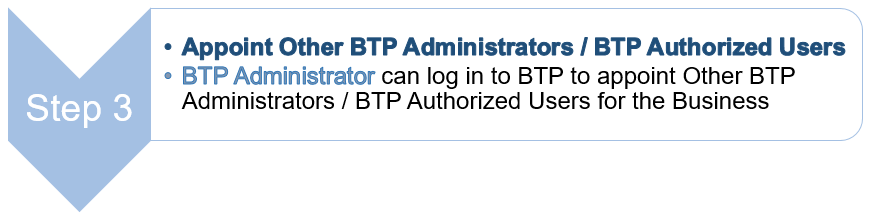

3. Manage BTP Administrator / Authorized User

This function enables the BTP Administrator(s) to:

- view the BTP Administrator(s) and BTP Authorized User(s) currently appointed by the Business;

- add/remove the BTP Administrator(s) / Authorized User(s); and

- update the designation of BTP Administrator(s) / Authorized User(s) in the Business and change the scope of their appointed services.

Appointed Services include:

- Profits Tax Matters

- Property Tax Matters

- Employer's Matters

- Business Registration Matters

- Certificate of Resident Status

- Stamp Duty

- Pillar Two Matters NEW

- Manage TRP Team NEW

BTP Authorized User, who is appointed with “Manage TRP Team” service, will be able to access TRP and use the “Manage TRP Teams” function just like a BTP Administrator, while TRP Business Account still needs to be opened by BTP Administrator.

For e-Demos and User Guides about Manage BTP Administrator / Authorized User, please visit the Learning Resources Centre Page.

This function enables BTP Administrator(s) to view the currently appointed Service Agent(s) of the Business; add/remove Service Agent(s) or update their appointed role(s) and service(s). Then through Tax Representative Portal, the appointed Service Agent can view the Business’s tax information and access online services as assigned by the Business.

The type of Service Agents and the scope of services that BTP Administrator can appoint/update are shown as follows:

| Tax Representative | Profits Tax Matters Certificate of Resident Status Pillar Two Matters NEW |

||

| Service Provider | Filing of Profits Tax Return Filing of Top-up Tax Notification/Top-up Tax Return NEW |

||

| Company Secretary | Business Registration Matters Certificate of Resident Status |

||

| Person managing the non-corporate Part 4AA Entity (for handling Pillar Two Matters only) | Pillar Two Matters NEW | ||

For e-Demos and User Guides about Manage Service Agent, please visit the Learning Resources Centre Page.

Online Services Available under BTP

The BTP offers a wide range of online services to enable Businesses to manage their tax and/or business matters in a more convenient and efficient manner, including services related to: -

- Profits Tax Matters

- Property Tax Matters

- Business Registration Matters

- Employer's Matters

- Stamp Duty

- Certificate of Resident Status

- Purchase of Tax Reserve Certificate

- Make a Request / Reply

To know more about BTP Online Services, please click here.

Click here to read the frequently asked questions about BTP.

More Information on Other Portals under eTAX

RSS

RSS  Share

Share Printer View

Printer View