Tax Representative Portal (TRP)

- Overview

- Getting Started with TRP

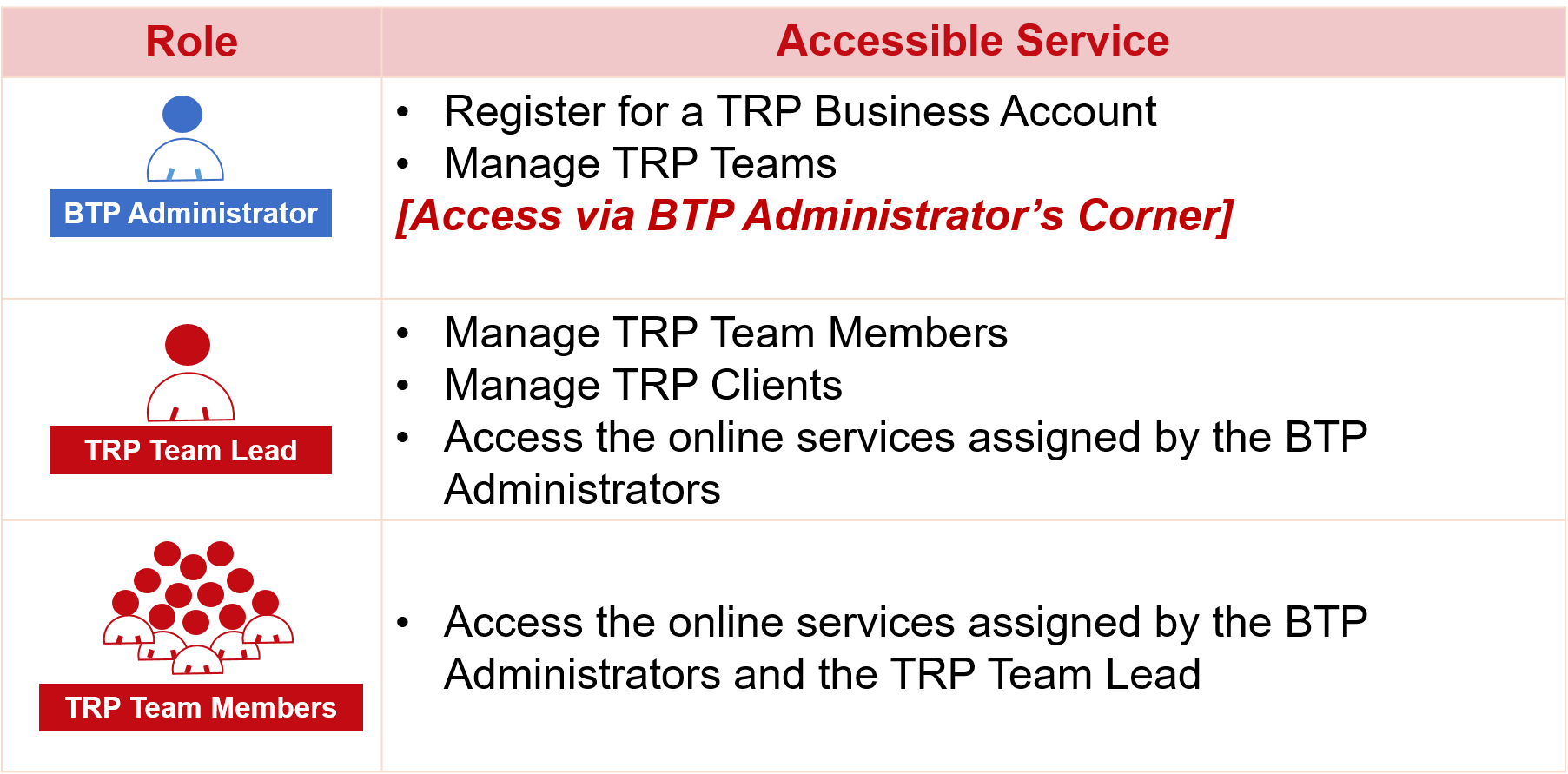

- Users under TRP

- Account Registration and Management under TRP

- Online Services Available under TRP

- Frequently Asked Questions

- More Information on Other Portals under eTAX

NEW BTP Authorized User being appointed with “Manage TRP Team” service will be able to access the same TRP services as BTP Administrator except for the “TRP Business Account Registration” service.

back to New Tax Portals under eTAX

TRP is a new electronic platform designed specifically for Service Agent (including Tax Representative, Company Secretary and Service Provider) enabling them to conduct tax and/or business related electronic transactions on behalf of their clients (both individuals and businesses). It will provide Service Agent with tools to manage clients and TRP Teams efficiently.

Login / Register to enjoy the benefits brought forth by TRP.

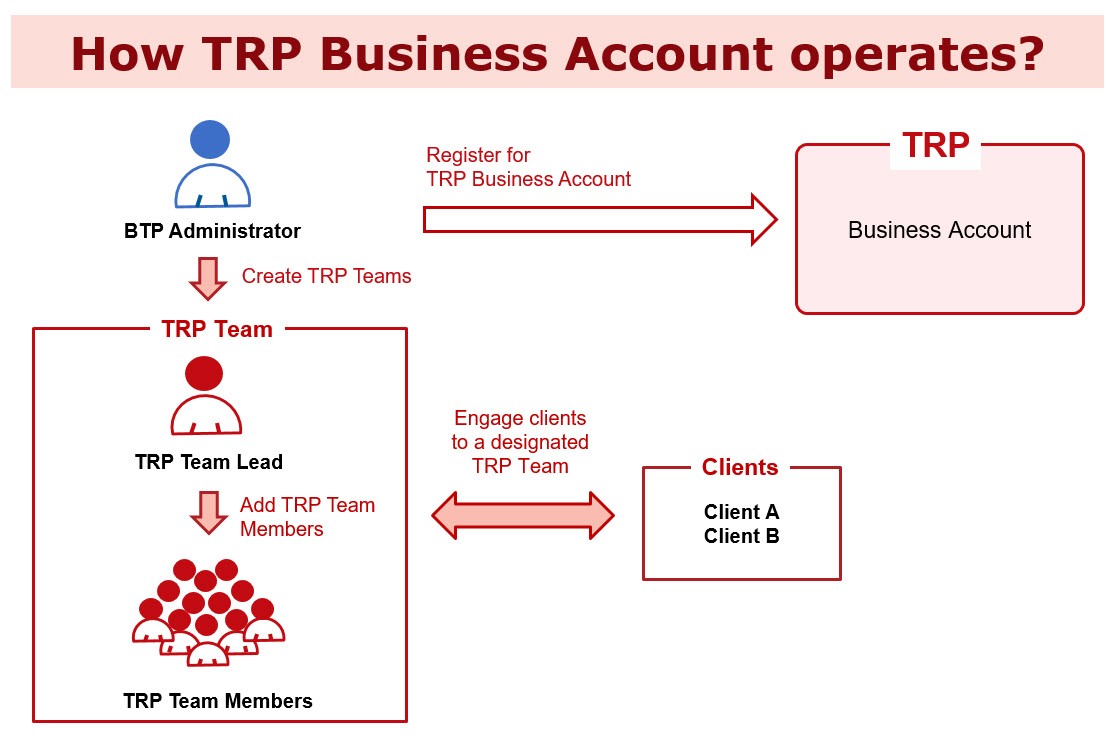

To view clients’ tax information and access online services available through TRP, a Service Agent needs to first open a TRP Business Account. Only the appointed Business Tax Portal (BTP) Administrator can register for a TRP Business Account. After the TRP Business Account is opened, BTP Administrator(s) / BTP Authorized User(s) being appointed to manage TRP Team can set up TRP Team(s), appoint TRP Team Lead and define the scope of services for each TRP Team. They and TRP Team Lead are given rights to add Team Member(s) and engage Client(s) to the TRP Team. After successful engagement of Clients to the designated TRP Teams, the respective TRP Team Lead(s) and TRP Team Member(s) can access the online services for or on behalf of clients via TRP.

Quick Steps

| TRP Team Leads / TRP Team Members are ready to use Online Services for or on behalf of their clients via TRP! |

BTP Administrator is appointed by the Responsible Person of the Business or other appointed BTP Administrator. Through BTP Administrator / Authorized User’s Corner under TRP, BTP Administrator can register for TRP Business Account.

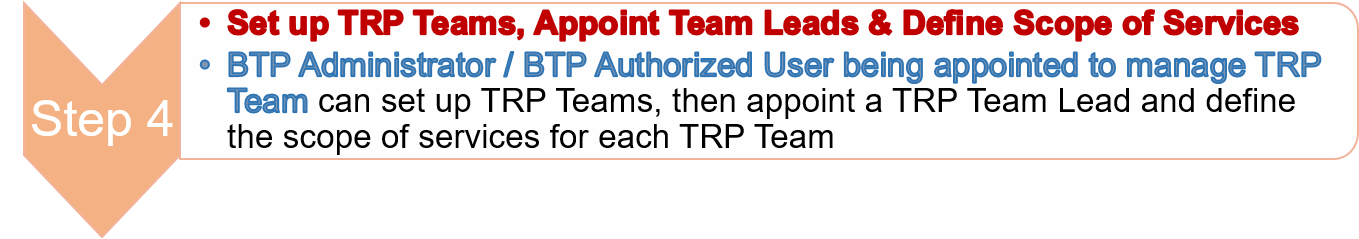

After TRP Business Account is opened, BTP Administrator / BTP Authorized User being appointed to manage TRP Team can manage TRP Teams by setting up TRP Teams (unlimited), appointing TRP Team Leads (one for each TRP Team), defining the TRP Team’s scope of services and engaging the Clients to designated TRP Team(s).

TRP Team Lead is appointed by BTP Administrator / BTP Authorized User being appointed to manage TRP Team. The same individual can be assigned as the TRP Team Lead of more than one TRP Team while each TRP Team can have only one TRP Team Lead. He/She is also given right to access the online services, which depend on the Team’s scope of services and type of services appointed by Clients.

TRP Team Member is appointed by BTP Administrator / BTP Authorized User being appointed to manage TRP Team / TRP Team Lead of the designated TRP Team. He/ She is given right to access the online services which are determined by the Team’s scope of services and type of services appointed by Clients.

Account Registration and Management under TRP

1. TRP Business Account Registration

To view clients’ tax information and access online services available through TRP, a Service Agent needs to open a TRP Business Account.

Before registering for a TRP Business Account, the Service Agent must have a registered BTP Business Account with BTP Administrator(s) appointed. Only the appointed BTP Administrator can register for a TRP Business Account under which he/she can set up TRP Team(s), appoint TRP Team Lead(s) and define the scope of services for each TRP Team.

Just a few steps to register for TRP Business Account:

| 1 | Read Terms and Conditions | ||

| 2 | Authenticate Your Identity | ||

| 3 | Select Business | ||

| 4 | Declaration | ||

| 5 | Acknowledgement | ||

| Points to Note: | |||

| 1. | The BTP Administrator will be redirected to BTP to verify his/her identity during the registration of a TRP Business Account by using one of the two digital authentication mechanisms available: | ||

| (i) | iAM Smart | ||

| (ii) | Business Tax Portal (BTP) Username & Password | ||

For e-Demos and User Guides about TRP Business Account Registration, please visit the Learning Resources Centre Page.

2. TRP User Account Registration

The BTP Administrator(s) / the BTP Authorized User(s) being appointed to manage TRP Team are responsible for appointing TRP Team Leads (one for each TRP Team). After that, they and the appointed Team Leads may designate and appoint other individuals as TRP Team Members. To activate the appointment as TRP Team Lead or TRP Team Member, these individuals need to register for their own dedicated TRP User Account first and add the Business to their serving business list kept under their account profile.

TRP User Account is also the BTP User Account. If the individual has already been a BTP User Account holder, he/she can directly log in TRP by using BTP authentication means without the need to do the registration.

Before registering for a TRP User Account, an individual must possess an Individual Tax Portal (ITP) Account. The TRP User Account is for business-use and is distinct from the ITP Account that is designated for handling individual tax affairs.

Access to the Online Services for or on behalf of clients via TRP shall only take effect after the TRP User Account registration is complete and that individual is appointed as a TRP Team Lead or TRP Team Member, as well as successful engagement of clients to the designated TRP Team.

Just a few steps to register for TRP User Account: -

| 1 | Read Terms and Conditions | ||

| 2 | Authenticate Your identity with ITP | ||

| 3 | Create TRP Username & Password | ||

| 4 | Set up TRP User Account Profile | ||

| 5 | Provide Details of TRP Business(es) You Serve | ||

| 6 | Confirmation | ||

| 7 | Acknowledgement | ||

| Points to Note: | |||

| 1. | You must possess an ITP Account for verifying your identity during the registration of a TRP User Account. You will be redirected to the login page of ITP for authentication. Please ensure that you can log into the ITP before starting the registration. | ||

| 2. | TRP User Account is your own dedicated account for business use. You will have to provide your TRP Username to your serving business(es) for appointing you as the TRP Team Lead or TRP Team Member. As the TRP Username cannot be changed once the registration is completed, please select your TRP Username carefully. | ||

| 3. | To allow your serving business(es) to appoint you as its TRP Team Lead or TRP Team Member, you have to enter its Business Registration Number to your serving business list. | ||

For e-Demos and User Guides about TRP User Account Registration, please visit the Learning Resources Centre Page.

This function enables the appointed BTP Administrator(s) / BTP Authorized Users to manage TRP Team, such as:

- Set up TRP Teams

- Appoint Team Leads

- Define Team’s scope of services, which may include

- Individual Tax Matters

- Profits Tax Matters

- Business Registration Matters

- Certificate of Resident Status

- Pillar Two Matters – Tax Representative NEW

- Pillar Two Matters – Service Provider NEW

- Pillar Two Matters – Person managing the non-corporate Part 4AA Entity NEW

- Manage Team Members

- Manage Clients

It is accessible through BTP Administrator / Authorized User’s Corner of TRP.

In order for a BTP Authorized User to access this function, he/she must first be appointed with “Manage TRP Team” Service by BTP Administrator. BTP Authorized User being appointed to manage TRP Team will be allowed to access the same TRP services as BTP Administrators except for the “TRP Business Account Registration” service.

For e-Demos and User Guides about Manage TRP Teams, please visit the Learning Resources Centre Page.

This function enables the appointed BTP Administrator(s) / BTP Authorized User(s) / Team Lead(s) to designate and appoint other individuals as TRP Team Members. For BTP Administrator(s) / BTP Authorized User(s), they should access “Manage Team Members” through “Manage TRP Teams” function.

BTP Administrator(s) / BTP Authorized User(s) can manage Team Members for all TRP Teams while TRP Team Lead is given right to manage Team Members of his/her own TRP Team(s) only.

The appointed BTP Administrator and BTP Authorized Users of the Service Agent can manage clients for all TRP Teams, including engagement of new clients, removal of existing clients from the assigned TRP Team and disengagement of clients (if Client's appointment of the Service Agent has been terminated). They should access “Manage Clients” through “Manage TRP Teams” function.

The TRP Team Lead is given right to manage clients of his/her TRP Team(s) only.

| Points to Note: | |||

| 1. | To engage your client(s) successfully, your client(s) is/are required to appoint you as Service Agent for the relevant tax matters through ITP or BTP; or inform the Department of your appointment as tax representative. | ||

| 2. | You can engage your client(s): | ||

| (i) | by Bulk Upload Function You have to prepare a valid file in common separated value format (“.csv”) with the information of Client Identification Number (such as your client’s Business Registration Number or Hong Kong Identity Card Number) and the Team Name of the designated TRP Team. You can upload records up to 5,000 clients each time. |

||

| (ii) | by Online Input You have to enter Client Identification Number and select the Team Name of the designated TRP Team. If you are the Team Lead of one TRP Team only, you are not required to select the Team Name. |

||

| 3. | For the same client, the same type of service can only be provided by one TRP Team of the TRP Business. | ||

| 4. | If you need to remove the client from current assigned TRP Team, you can select “Remove Client from the Team”. If you have terminated the appointed service(s) with your client, you can select “Disengagement of Client”. You are reminded that once the disengagement has been updated, you cannot engage this client again, unless the client has re-appointed you as the Service Agent. | ||

For e-Demos and User Guides about Manage Clients, please visit the Learning Resources Centre Page.

Online Services Available under TRP

Through TRP, the appointed Service Agent can view his/her client’s tax information and access online services as appointed by his/her client, such as services related to: -

- Profits Tax Matters

- Individual Tax Matters

- Business Registration Matters

- Certificate of Resident Status

- Make a Request / Reply

Bulk services and other services are also available under TRP to facilitate the work of Service Agent, including: -

- Block Extension Scheme for Lodgement of Tax Returns for the Current Year by Tax Representatives

- Change of Business Address

- View / Download Business Registration Demand Note

- View / Download Business Registration Certificate

- Purchase of Tax Reserve Certificate

To know more about TRP Online Services, please click here.

Click here to read the frequently asked questions about TRP.

More Information on Other Portals under eTAX

RSS

RSS  Share

Share Printer View

Printer View